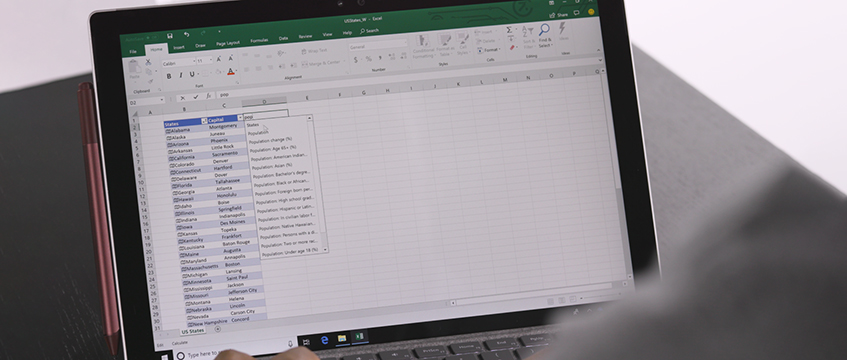

The spreadsheet should be allowed to die, real estate debt professionals admit – despite half of them acknowledging they are still reliant on the software to do their jobs.

More than half of the senior real estate debt executives in the UK and Europe quizzed by advisory firm Oxane Partners rated themselves as five or lower on a scale of one to 10 for “technology maturity”. Roughly half said they were still using Microsoft Excel for “almost all” work processes, despite a realisation that it has diminishing uses.

But with new technology being used more frequently in some important areas of business – most notably risk management – Oxane co-founder Vishal Soni said the property debt industry “is approaching an inflexion point”, adding that his team expects “significant digital maturation over the coming 24-36 months” as lenders grow to appreciate that new technology can help them to save time and money.

The survey explored respondents’ awareness and use of products including software for customer relationship management, data warehousing and investor reporting.

Most cited artificial intelligence, machine learning and business process automation as likely to have the greatest effect on their business, with far fewer highlighting blockchain technology.

Sixty per cent of respondents said that over-reliance on manual processes and spreadsheets was the biggest operational challenge their firms face.

Oxane’s analysts said in a report on the survey that the increasingly varied sources of real estate debt meant that lenders “are under even greater pressure” as the cycle matures, which will encourage the use of digitisation.

“On one hand, the increased competition calls for efficiencies in evaluating opportunities, deploying capital and managing investments,” they said. “On the other, the increasing demand for transparency by both regulators and investors requires them to increase the sophistication of all core processes, from risk controls to deal monitoring, due diligence and investor reporting.”

Oxane questioned 75 senior industry professionals, including executives working for investment banks, private debt funds, institutional asset managers and pension funds.

To send feedback, e-mail tim.burke@egi.co.uk or tweet @_tim_burke or @estatesgazette