India has long been on the ‘one to watch’ list for global investors. It is one of the world’s fastest growing economies with one of the youngest and largest populations at 1.3bn people. It has all the ingredients to challenge developed world economies with a considerable and increasingly well-educated labour force, entrepreneurial tradition and a strong base in leading industries such as tech. In fact, foreign investment in India has surged in recent years and one of the sectors that has found particular favour has been its real estate market.

Last year, around 78% of all investment in the sector was from overseas. Private equity alone invested $5bn which was coupled with considerable activity from global pension and sovereign wealth funds. But for many in the industry, the successful listing of India’s first real estate investment trust last year was a major indicator of a sector starting to hit its stride and compete with its international peers. And with potentially three more REITs reported to be listing in 2020, this could be a decisive point for India’s real estate market and a boon to its economy, arguably at a time when it’s needed.

While parts of India’s real estate market, particularly commercial property, were reporting a record year, the economy was hitting a bump in the road. In line with a global economic slowdown, India’s GDP growth dropped to 4.5% in its September quarter, its lowest in six years. It was hit by a slowdown in all three of its main economic pillars: consumer consumption, exports and investment, which has since fallen to a 19-quarter low of 1%. The Reserve Bank of India has lowered India’s projected growth to 5% for 2020, the lowest since the financial crisis in 2009.

India is also grappling with a credit crunch, the result of defaults in its non-banking financial companies which started in 2018. These were providing cheap loans across the economy including in real estate. But since the crisis NBFC lending has been slashed by over a third leading to liquidity constraints. The government and the RBI have introduced a number of reforms to ease the crunch including a $10bn recapitalisation of public sector banks and a partial credit guarantee scheme for NBFCs. Shishir Baijal, chairman and managing director of Knight Frank India, says the reforms are yet to “bear fruit” and while the credit crunch hasn’t impacted on the performance of the commercial property sector it could impact on office supply.

“We’ll have to see how it pans out. You do need to leverage yourself to continue development,” he adds.

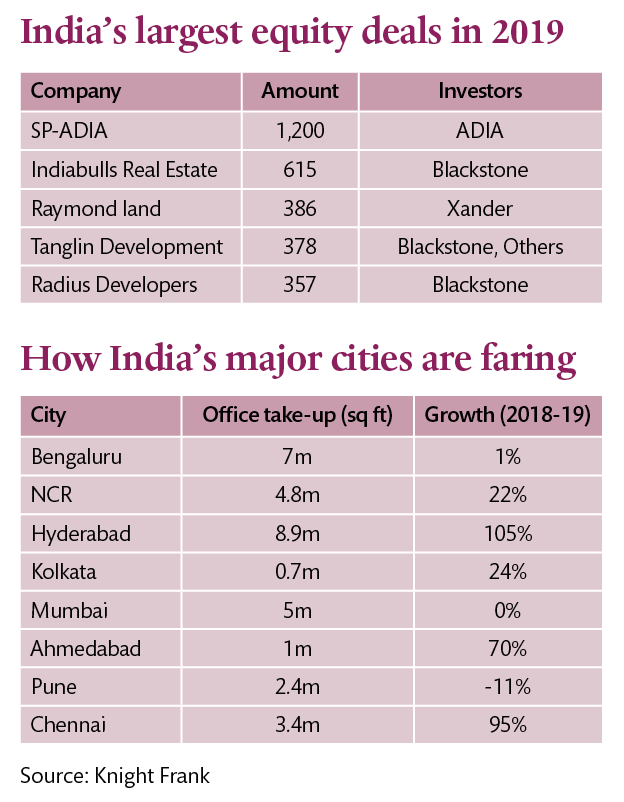

Significantly, one of the biggest private equity deals last year was global asset manager Blackstone buying the remaining 50% stake of IndiaBulls Real Estate for $615m. The deal was thought to be one of India’s largest property portfolio transactions with NBFC IndiaBulls keen to sell off its real estate division to pay down debts.

India’s other major private equity player Brookfield has entered the NBFC market taking a 40% stake in IndoStar Capital Finance earlier this year. A source close to the deal played down the NBFC crisis. “There will be new formats from the non-banking financial sector that emerge. Other markets have had bigger, deeper crises of confidence. In developed markets, it is part of the cycle and India is having its own.”

Knight Frank’s Baijal remains bullish about the economy and sees the GDP slowdown as short term, expecting growth to re-hit the 6.5% mark by 2021. He’s not alone. Ankur Gupta, head of Brookfield’s real estate business in India says: “We have long-term assets and we don’t want to put short-term pressures on the economy. We do have to be careful that these pressures don’t continue, but I don’t think they will.”

Baijal adds that the growth in real estate should “maintain momentum” with 2020 on course to match 2019.

Indeed, parts of the commercial property sector had a record year in 2019. According to Knight Frank, the office sector saw historic take-up of 61m sq ft of space across its top eight cities, a 27% year-on-year increase. This was prompted in part by a leap in leasing from tech companies. Office supply, which had been constrained, surged in the second half of 2019 (67% year-on-year growth) and was the first time since 2013 that supply exceeded demand.

“Our commercial business continued to do well,” says Baijal. “It is backed by a strong tech sector backed by a robust US economy. Many companies are high-end AI, R&D and tech engineers for Apple, Google or Yahoo. It [the industry] has changed and now we are exporting our tech to the US.” The tech sector share of take-up rose from 31% to 41% in 2019, while manufacturing and banking & financial saw minor falls.

Ross Criddle, partner at Knight Frank’s International Occupier Team, says with India moving up the “value chain” in the tech industry it’s had a major impact on its office stock. “Occupiers want to retain talent, so they want grade-A new supply,” he says. “There’s been a big increase in prelets and in clusterings by developers.”

He adds that tech firms are also keen to access India’s vast consumer market and, with it being more accessible than China, India is becoming a major destination for tech. He says the likes of Amazon and Facebook which located there years ago are now reaping the benefits. Criddle also points to Japanese company NTT, which last year merged six of its data centre businesses under one $11bn company in four regions across the globe. It chose India as one of its regional headquarters.

India’s warehousing sector is also on the up, with the value of deals rising from $300m in 2014 to a high of $2.2bn in 2018. Baijal says the sector has had a “spectacular run” in the last few years largely as a result of the government’s move to GST, one nation, one tax, ensuring businesses no longer have to pay separate taxes in each city. “This has attracted a huge amount of funds and warehousing has really improved.”

The co-working office segment also saw an increase in take-up from 8% in 2018 to 12%. The only sector that has seen a significant slowdown is residential, which still recorded a 1% year-on-year growth in sales.

Baijal links some of this performance with government reforms which have been filtering through since 2016, including demonetisation, the Real Estate Act and simplifying the rules around REITs. These have made investing in India more transparent, he says, “and have helped to put the industry on a par with international peers”.

India’s much-anticipated first REIT launched in March last year. The Embassy Parks REIT, a joint venture with Blackstone, is believed to be the largest REIT in Asia by area. The original 25m sq ft portfolio included seven office parks, which are becoming increasingly prevalent in India, and four city centre office buildings across Mumbai, Pune and Bengaluru. It also has 500,000 sq ft of development pipeline.

On listing, the REIT was two and a half times oversubscribed which Baijal says shows the investment demand for high-quality offices in India. The REIT is currently priced at 40% over its listing price. He adds that the REIT was “really long awaited”. “REITs will bring in a lot of professionalism and institutional ownership into the real estate market,” he says. “It will help development and prompt larger borrowing to invest.”

The Embassy REIT is unlikely to be alone for long. Blackstone is reportedly working with Indian developer K Raheja Group to prepare for an initial public offering of its 20m sq ft joint commercial property portfolio, and Brookfield is also reportedly set to enter the market with a £1bn listing. Sources said one REIT is currently undergoing stock market approval, a second is close in progress, while a third retail REIT could also be on the table for 2020.

A source close to the talks says: “The total investment real estate market is 500m sq ft. It’s a sizeable market for REITs to own a slice of that. As that block grows it’s good for public capital to own a part of the market alongside private capital.”

With current liquidity constraints it seems another stream of funding is set to launch that could inject another level of capital into the Indian market.

Emerging markets in India: community living

Around 35% of India’s population are classed as millennials and, according to Knight Frank, many now prefer to rent rather than buy property. The rental market is in its infancy in India and the government has issued the Draft Model Tenancy Act to regulate the rental market. Community living, or the co-living model, is shared rental housing to suit students and young professionals. It’s very much an emerging market and the legislation is yet to be ratified but investors can expect yields of between 10-15% with it seen as a long-term stable investment. The market currently has around 120,000 beds, which have emerged over the last 15-20 months and it is anticipated that this will increase to 600,000 by 2023. Since 2016 around $750m has been invested in the sector including from operators such as OYO and investors including Goldman Sachs and Airbnb.