M&G is set to expand its residential portfolio to more than £3bn across three specialist living funds.

It will make it the first major institution to target the spread of affordable, private, student and retirement assets in the UK and Europe in dedicated vehicles.

The move will see M&G Real Estate bolster funds dedicated to UK build-to-rent, UK affordable housing and wider European living assets.

The funds should more than triple the group’s residential portfolio value in the coming years, with M&G established as a Registered Provider to deliver shared-ownership affordable homes in the UK as well as targeting student and retirement assets in Europe.

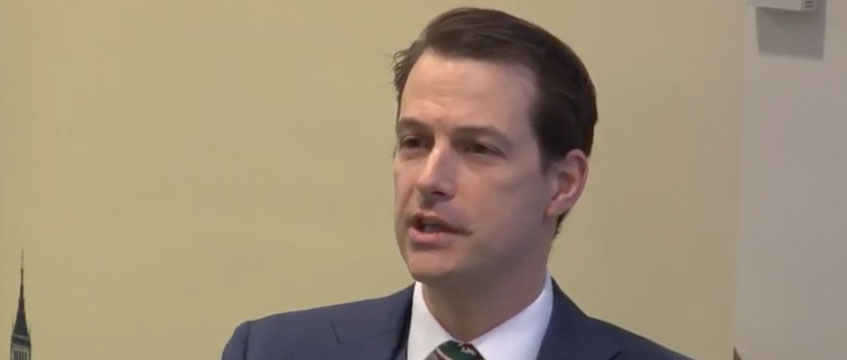

The group’s UK Residential Property Fund, launched in 2013 by Alex Greaves (pictured), is expected to hit £1bn in NAV and more than 3,000 homes this year. The open-ended fund targets core and core-plus investments with a long-term annual net return of 6-8% and an annual 3-4% distribution yield. At 31 June 2019, it had a NAV of £701.9m, with 28 schemes and 2,912 homes, and a pipeline of around £800m in assets.

The fund focuses on London and the South East, but its managers have also identified Manchester and Edinburgh for growth. A second fund targeting shared ownership assets is expected to reach a similar level in NAV. M&G has a seed portfolio under offer and this fund is likely to launch in the first half of the year, under the leadership of a newly appointed team.

M&G is also in the early steps of building a European residential fund, with existing internal capital expected to partner with new money in a multi-billion drive across student, BTR and retirement living.

The group is increasing its exposure to residential assets within the open-ended core M&G European Property Fund, which had a NAV of £2.5bn as of June 2019, with 72 investments weighted to Germany (23%), France (17%) and Spain (12%).

According to JLL’s European Multifamily report, there was €55bn (£48bn) of investment in rental assets across the continent last year. The most popular markets were Germany at €20bn, Sweden at €7.3bn and the UK with €6bn in deals.

M&G has been a high-profile casualty of investors’ uneasiness around real estate investments during economic uncertainties over recent months. Trading in its Property Portfolio Fund, which has a notable retail property focus, was suspended in December following heightened redemptions. The fund remained gated as of M&G’s full-year results announced this week.

To send feedback, e-mail emma.rosser@egi.co.uk or tweet @EmmaARosser or @estatesgazette