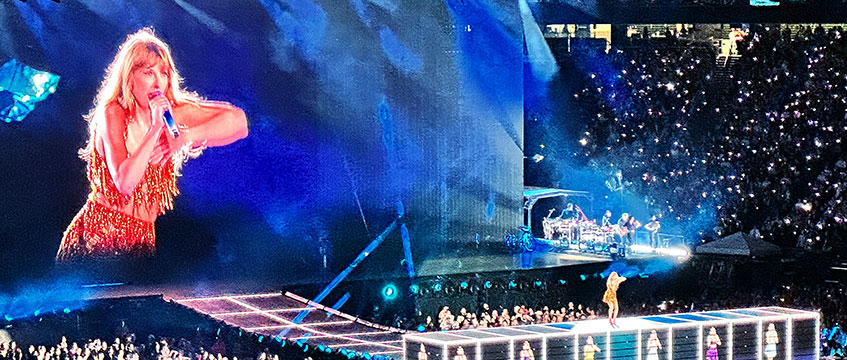

A booming London market and a string of major events, including the Taylor Swift tour, have helped European hotel investments reach their highest level since the pre-pandemic era, according to research from Cushman & Wakefield.

Transactions across Europe in the first half of 2024 reached €11.6bn (£9.8bn), which is the highest six-month total since 2019.

H1 volumes in London were up by 215% on the same period last year to €2.6bn. The next highest city in Europe was Paris, where volumes stood at €1.1bn. Dublin, Barcelona and Rome made up the remainder of the top five.

Major deals in the period included the Six Senses London hotel and spa in Bayswater as well as the Pullman Paris Tour Eiffel, the Hilton Paris Opera, the Shelbourne Dublin and the Park Hyatt Zurich. High-end hotels accounted for almost half of H1 volumes.

Jon Hubbard, Cushman’s EMEA head of hospitality, said, “The trading performance of European hotels experienced a ‘Taylor Swift bounce’ in the first half of this year, with high customer demand partly linked to the major events that took place across the continent, such as the Euro 2024 tournament and Swift’s Eras tour.

“On investment, the sharp pick-up in activity has been long-awaited and reflects not only clear confidence in the hotel sector but, more importantly, an alignment of pricing between vendors and purchasers. With the recent reduction in base rates, now is the time for investors to step back into the market to take advantage of expected performance and capital growth.”

Cushman & Wakefield expects full-year hotel investments across Europe to top the €20bn mark, with strong hotel performance met with increasing debt liquidity.

Photo © Stephen Mease/Unsplash

Send feedback to Jim Larkin

Follow Estates Gazette