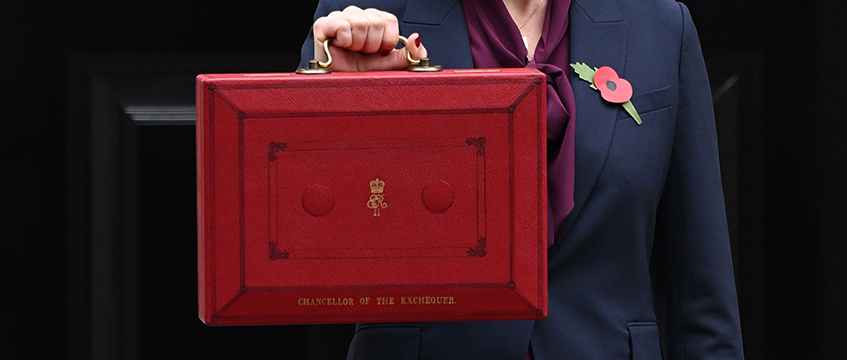

Real estate industry professionals have found Rachel Reeves’s Budget lacking, saying that if the government is to deliver on its 1.5m homes pledge it needs to go “much bolder and much further”.

The Budget included a £5bn allocation to housing delivery, a hike in stamp duty for second homeowners from 3% to 5%, and the much-awaited reform of business rates for leisure, hospitality and retail businesses.

The government’s investment in the housing sector included adding £500m to the Affordable Homes Programme, £3bn of additional support for SMEs and the build-to-rent sector, and £46m of additional funding to support the recruitment and training of 300 graduates and apprentices in local planning authorities.

It has approved £56m to unlock over 2,000 homes at Liverpool Central Docks, and a £25m investment into a joint venture to deliver 3,000 homes across the country, with a target of 100% of these being affordable. The Budget also confirmed £47m of funding to support the delivery of up to 28,000 homes that would otherwise have been stalled as a result of nutrient neutrality in affected catchments.

Industry responses

Melanie Leech, chief executive of the British Property Federation, said: “The promised housing strategy needs to be much bolder and go much further. This includes unlocking the billions of pounds of investment into the build-to-rent sector, so it is particularly disappointing that Rachel Reeves did not take the opportunity to reverse the previous government’s decision to abolish multiple dwellings relief announced in the spring.”

Brendan Geraghty, chief executive of the Association for Rental Living, said: “The Budget provided the government with the perfect opportunity to demonstrate its commitment to ‘fixing the foundations’ by putting housing front and centre of its plans, yet it did not go far enough today.

“The £3bn of additional support for SMEs and the BTR sector, in the form of housing guarantee schemes, is welcome although greater detail is needed. Reeves promised to ‘turbocharge the delivery of 1.5m homes’ in her maiden Budget. This will be very challenging with current low levels of construction starts and the contraction of PRS. To achieve this objective, the government needs to smooth the road to institutional investment in BTR and implement the recommendations of the recently published Radix Big Tent Housing Commission Report.”

Affordable Homes Programme offers ray of light

The sector largely welcomed the government’s £500m investment into the Affordable Homes Programme, but Olivia Harris, chief executive of Dolphin Living, said “long-term commitment is essential”.

“The previous government’s inconsistency in adhering to rent settlements has created uncertainty, making it crucial for the current government to establish a stable framework that will support housing associations in their mission to build and maintain homes for the long term,” she said.

“A commitment to consistent support in the form of grants and a clear rent settlement will empower us to meet the pressing needs of essential workers and ensure the sustainability of our communities. With high living costs placing substantial pressure on essential workers and median earners – many of whom cannot afford market rent yet do not qualify for social housing – it’s vital that affordable, quality homes for rent in accessible locations are central to the government’s housing agenda.”

Linda Thiel, director at White Arkitekter, said: “The government has been vocal about delivering a significant increase in affordable housing, and it is encouraging to see a commitment to the government’s Affordable Homes Programme. While we support the £500m pledge for the AHP, the government needs to use multiple levers to deliver not just any housing but homes that are affordable and sustainably designed.

“Taking example from the Renovation Wave in Europe, we would encourage Labour to create a fund that ties housing and energy together. In the midst of a housing and environmental crisis, as architects, we urge for subsidies that support design in addition to engineering, to deliver social and climate-centric homes for communities across the UK.”

Omer Fazal, managing director and head of real estate at Centrus, said: “Significant challenges over the past few years have stunted growth despite strong demand, leading to a tight lending landscape and stretched housing associations. For-profit registered housing providers are going to have a larger part to play in providing affordable housing, which will offer opportunities for both investors and housing providers.

“However, private capital cannot solely plug any subsidy gap that currently exists, so investors will have to assess appetite and identify areas in the market where partnerships as well as long-term rent settlement policy can bring worthwhile benefits for themselves, housing associations and local authorities, which could be key to unlocking housebuilding potential.”

Landlords slighted by stamp duty increase

Emma Cox, managing director of real estate at Shawbrook, said landlords in the private rented sector “feel like they are once again bearing the brunt of punitive measures” with a further increase in the stamp duty surcharge.

She said: “PRS has a key role to play in the UK housing market and will be a crucial component to providing adequate stock. Demand still far outweighs the supply of quality homes and tackling this will be extremely difficult if landlords are disincentivised by government measures. Our research shows that landlords have confidence in the market, with a third planning to add to their portfolios in the next 12 months, so the government should be incentivising, not deterring.

“Providing sufficient stock and meeting Labour’s ambitious housebuilding plans is going to require a multi-pronged approach, and landlords are an important piece to the puzzle. The government must consider how to support landlords if we are to see real progress in the market.”

Steve Griffiths, chief commercial officer at The Mortgage Lender, agreed with Cox: “With strong demand for rental properties, the need for a healthy private rented sector and the professional landlords that facilitate this is clear. We cannot keep asking landlords to bear the brunt of increased taxation, particularly at a time when there is a shortage of affordable homes available to buy and significant affordability challenges for first-time buyers.

“It is likely that we will see some landlords re-evaluate any additions to their portfolios in light of the increase to 5% on higher rates stamp duty for additional properties, effective immediately, with some smaller landlords weighing up whether it makes commercial sense to continue to operate.

“Not everyone is ready to or wants to buy a home. The private rented sector provides flexibility and security to millions across the country. If we want to encourage professional landlords to provide quality, energy efficient rental properties, we cannot afford to be punitive.”

Image © James Veysey/Shutterstock

Send feedback to Akanksha Soni

Follow Estates Gazette