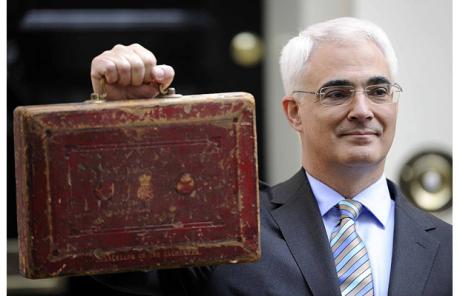

Fears are mounting that Chancellor of the Exchequer Alistair Darling will be more Ebenezer Scrooge than Father Christmas when he announces his pre-Budget report next week.

With the need to cut public spending looming large, and core public services high among Darling’s priorities, experts claim spending on regeneration could be neglected.

Nevertheless, the chancellor’s red box may offer Christmas cheer for some industry campaigns, as he aims to safeguard jobs, encourage housebuilding and boost the country’s economic recovery.

Crucially for the property industry, an announcement on tax increment financing is expected, something high on the Christmas wish lists delivered to Number 11 Downing Street by the British Property Federation, the RICS and the British Council for Shopping Centres.

An investigation into TIFs was launched in April’s Budget and there are hopes that a framework, setting out how the schemes could work, will be announced on 9 December.

Earlier promise

“Public spending will be massively cut, and we know that infrastructure funding isn’t going to come out of thin air,” says Liz Peace, chief executive of the BPF. “It is vital that the chancellor listen to city leaders and other experts and make good on his earlier promise to explore how TIFs could help build us out of recession.”

There is also cautious optimism around REIT reform. The BPF has called for REITs to be allowed to offer shares in lieu of cash, as part of the 90% of their annual income that they must return to shareholders.

Francis Salway, chief executive of the

Insiders now believe that the Treasury has accepted that this will be cost-neutral and will not damage shareholders’ interests.

Phil Nicklin, a REIT expert at accountant Deloitte, says that it would be a “win, win, win situation” where “the REIT conserves cash, shareholders can choose to receive shares, and the government still gets its tax”.

An announcement on the regulatory burden faced by housebuilders is also expected. Darling pledged in April to look into the cost of environmental and social policy on new homes, something that the Home Builders Federation has estimated could reach £80,000 per home by 2016. The Treasury is expected to report its findings next week.

The HBF has also called for the housing stimulus, including HomeBuy Direct and KickStart, to be continued and for a mortgage indemnity guarantee to be introduced that would insure lenders against the threat of falling property values.

Elsewhere, observers predict that the property industry’s campaign to scrap business rates on empty properties will be stymied by budgetary constraints, despite calls from the BPF, BCSC, RICS, the Institution of Commercial and Business Agents and the British Council for Offices.

Exemptions extended

However, it is thought that a desire to help small businesses may see exemptions for properties with a rateable value of less than £15,000 extended for a further 12 months, and increased in line with the 2010 rating revaluation.

Efforts to reform stamp duty land tax so as not to penalise bulk purchasers of residential property – seen as crucial to encouraging an institutionally backed private-rented sector – have also been proposed. But at a projected cost of £200m, reform is considered unlikely, despite lobbying by Homes and Communities Agency chief executive Sir Bob Kerslake.

One source said: “Spending will be dominated by health and education. I don’t think the commercial property industry is going to see a great Christmas. Santa is going to be a bit of a Scrooge as we are not at the top of the political list right now.”

Budget wish list

1 A resolution to proceed with tax increment financing

In o Out o

2 An end to empty rates, or an extension of the exemption for small properties

In o Out o

3 Temporary relief for businesses most affected by non-domestic rate increases

In o Out o

4 Reform of REIT rules to allow dividends to be paid in new shares

In o Out o

5 SDLT reform to end the “slab” system and encourage bulk residential purchases

In o Out o

6 Reduced VAT for the renovation of older homes

In o Out o

7 Landlords to be classed as secured or preferential creditors in prepacks

In o Out o

8 An extension of HomeBuy Direct and KickStart for housebuilders

In o Out o

9 A mortgage indemnity guarantee for lenders and more support for first-time buyers

In o Out o

10 A flexible voucher scheme giving free rent to small businesses

In o Out o

11 The extension of land remediation relief

In o Out o

12 Ability for residential landlords to roll over CGT

relief

In o Out o