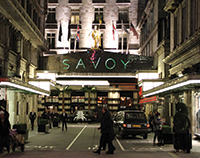

FINANCE: The owners of the Savoy hotel have started searching for £300m of fresh finance just one year after completing an extensive debt-and-equity restructure.

Prince Alwaleed bin Talal and Lloyds Banking Group’s joint venture has mandated Eastdil Secured to run the process, which will streamline the central London hotel’s £458m multi-tranched capital stack and lower the cost of debt.

The partners’ vehicle, Breezeroad, is looking to refinance a five-year, £200m senior facility provided equally by Credit Agricole and DekaBank. It has a margin of between 380 and 400 basis points over three-month Libor.

An equivalent loan on a prime central London hotel asset could now attract a margin of 250 to 275 basis points.

The £300m refinancing will also replace £100m of debt that is included in seven junior debt-and-equity positions. This is split between £143m provided by Lloyds and £115m by the Saudi billionaire’s Kingdom Holdings Investments. All eight facilities mature in March 2018.

The new £300m whole loan – which reflects a loan-to-value ratio of around 70% – could be divided into a circa £200m senior tranche with an LTV of up to 55% and a circa £100m mezzanine slice by potential lenders.

US investment banks are expected to compete for the facility, while the existing lenders might also be keen to maintain their position. Alternatively, a new clearing bank syndicate could emerge.

Lloyds and Prince Alwaleed’s KHI each have a 50:50 joint stake in Breezeroad, which bought the hotel in 2005.

In October last year accounts for the company revealed that Breezeroad made a £53m loss and was at risk of breaching the terms of its loans if trading conditions did not improve.

All parties declined to comment.

bridget.oconnell@estatesgazette.com