Two years ago, Fitness First creditors voted through a company voluntary arrangement (CVA) and completed a financial restructuring that permitted the gym chain to eliminate half of its UK-leased sites, reduce its debt to a fraction of the pre-restructuring amount, and commence a substantial programme of rebranding and capital expenditure. Fitness First UK was the first group of companies to combine a financial restructuring – a debt reduction and debt- for-equity swap – with a successful lease rationalisation by way of a CVA, and in this case resulting in an EBITDA-positive business.

Since then, other household names have followed: Travelodge (2012), LA Fitness (2014) and, most recently, Tragus (2014). All have adopted the method of combining a financial restructuring with a CVA. There have been a number of CVAs that have not resulted in a sustainable business, and a few that have failed in court. What are the most commonly asked questions and answers in relation to the process? What are the advantages, disadvantages, issues and risks?

Background to the CVA process

A CVA is a statutory process that allows a company to reach agreement with its unsecured creditors by way of a proposal and vote. For a CVA to succeed, two voting thresholds need to be attained, both by value: first, 75% of all unsecured creditors need to vote for the CVA, and second, 50% of all unconnected unsecured creditors need also to vote for the CVA.

Unconnected is a control-based test, so any claim within the group would not be considered unconnected. In practice this means that if a company has a large intercompany creditor, it only needs 50% of landlords by value to vote for the CVA. This means that if the relevant vote thresholds are reached, all other affected unsecured creditors are bound by the CVA.

If the CVA is passed in respect of lease obligations, it operates as a parallel but overriding contract in which the underlying lease obligations remain, but are superseded and overridden by the CVA. The CVA operates as a contract between a company and its unsecured creditors, enforceable by law and the courts.

Timeline and proposal formulation

Six to eight weeks preparation is needed for the CVA element. Once the CVA is proposed, the vote can occur as soon as 14 days later, with a 28-day appeal period. In total, the combined CVA and financial restructuring process takes three to four months and, usually, the best time to undertake the process is before the next rent quarter date. For the financial restructuring element, the optimum plan is to run it in parallel but slightly ahead of the CVA in order to reach agreement with lenders before the CVA is proposed in order that they work seamlessly together.

Where a financial restructuring has been combined with a CVA to rationalise the company’s lease portfolio, the following is a typical timeline of how the two processes would run in parallel.

To formulate the CVA, a company and its advisers need to undertake a comprehensive analysis of the performance of the sites, then categorise those sites based on fairness, conservative voting assumptions and profitability maximisation. While most companies and sophisticated property advisers can undertake the first part of the analysis, the second part is more complex and requires experience with CVAs and concepts of fairness.

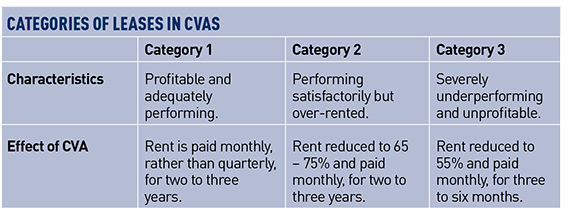

Not all landlords need to be treated the same in formation of the proposal: different landlords can be put into different categories. For instance, a company can categorise landlords in three ways: those whose lease payments will not be affected but will have some other variation to their lease; those whose lease payments will be cut by, for instance, 30%; and those who will be eliminated from the lease portfolio within, say, six months.

Important technical considerations need to be addressed as part of the CVA proposal, but the key is to treat landlords fairly based on a peer comparison and what they would get in an alternative. In most cases, the relevant company is distressed, making an insolvency – typically an administration – a real danger. Recoveries in an administration would be the alternative comparison.

There are a number of benefits that CVAs can offer to landlords, particularly of category 2 and 3 properties. These include sharing of upside by way of a “compromised lease fund” based on targets, offering category 3 landlords the marketing of their properties, and the payment of rates until a new tenant is found.

Contrary to what most market participants believe, landlords should not be negotiated with ahead of a CVA. Usually the proposal is formulated based on experience and analysis, and previewed to the six to ten largest landlords and the British Property Federation before launch. With the correct advisers, the proposal should be well-considered and fair.

Risks

The most obvious procedural risks are that the CVA fails, or an appeal is successful. Both circumstances lead to insolvency, usually an administration.

With leveraged companies, a danger is that the CVA is undertaken without an accompanying financial restructuring to reduce the underlying over-leverage of the business. A CVA in isolation may not be enough to restore the company to sustainability. Even without leverage, owing to the necessity to obtain a successful vote, there are groups for which a CVA will not have enough impact on profitability, leading to an eventual administration. This underlines the necessity for detailed analysis including on alternative options.

From a landlord hold-out perspective, certain leases will have provisions allowing them to forfeit a property on either “proposal” or “approval” of a CVA. However, if rent has been paid, a company can apply, usually successfully, for relief from forfeiture on the basis that rent has been paid up to a certain date. Landlords can also appeal on certain criteria including material irregularity of unfair prejudice after the vote and within 28 days of the vote.

There are CVAs that have failed in court. The leading examples are Powerhouse (Prudential assurance Co Ltd v PRG Powerhouse Ltd [2007] EWHC 1002 (Ch); [2007] 3 EGLR 131) and Miss Sixty (2010), which were successfully challenged in court because they unfairly prejudiced the landlords by not assigning appropriate value to guarantees that the landlords benefitted from. A failure on this basis is avoidable and both cases provide clear guidance on this issue.

Alternatives

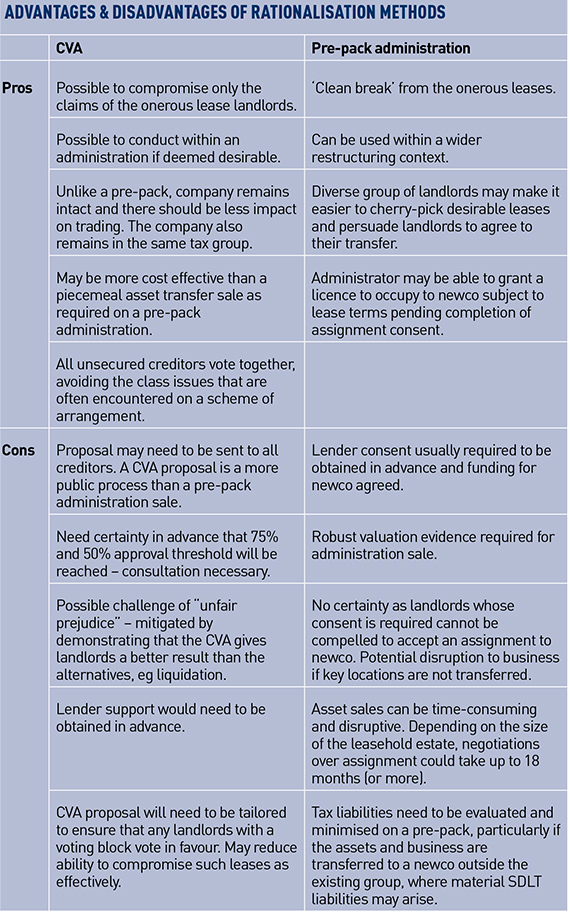

Aside from direct negotiation with landlords, the typical alternative is a prepackaged administration sale (“pre-pack”). This is where a buyer – connected with the existing owner or not – purchases the assets of the business, seeks consent to landlords of certain properties to assign the properties to the buyer, and leaves the unwanted properties behind in the insolvent estate. There are many benefits to structuring a transaction in this way and most purchases of distressed high street chains are conducted similarly.

In every case, advisers undertake a bottom-up lease and structure analysis to determine the optimum lease rationalisation method. There are advantages and disadvantages of both.

Practical steps for success

There are several practical steps that a company can undertake to materially increase the likelihood of success of the CVA:

• Advisors: seek out experienced advisors to assist with the options analysis and, if a CVA is selected, to help formulate the CVA proposal.

• Communicate the benefits: the 14-day period between the launch of the CVA and the creditors’ meeting gives the company an opportunity to set out to creditors the benefits of its proposal. Management should seek to leverage existing relationships.

• Anticipate and prepare for creditor action: even if the proposals are well-received, individual creditors may still use the CVA as an opportunity to improve their personal position (some leases may allow pre-emptive action by landlords to recover properties on launch of a CVA). Having lawyers and security on standby is critical.

• Encourage voting: all creditors should be encouraged to vote, with dedicated e-mail addresses and telephone lines being an easy way for proxies to be lodged if they cannot attend in person.

Kon Asimacopoulos and Elaine Nolan are partners in the restructuring group at Kirkland & Ellis International LLP.