The heady optimism, which hand-in-hand with rising values has buoyed the UK property market’s post-crisis bull run, seems to have run its course.

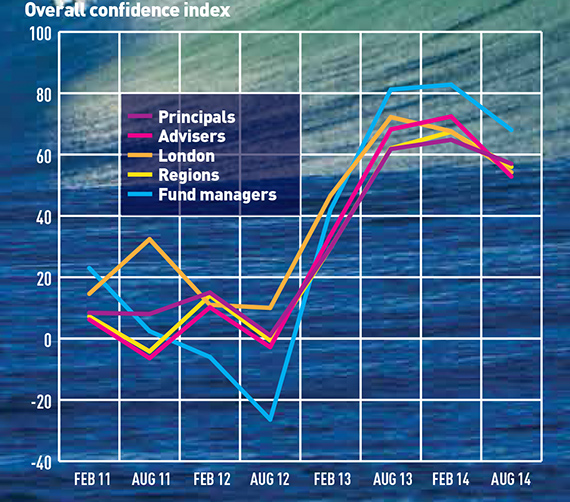

According to the latest Lloyds Bank Commercial Banking and Investment Property Forum Commercial Property Confidence Monitor, the 27-month run of rising confidence that kicked off in August 2012 has come to an end.

The upward trend has not come to a crashing halt, instead an increasing minority no longer expect the market to improve, leading to a reduction in overall confidence.

The flagging sentiment was found across all groups represented in the 540 real estate professionals polled. More than a third of fund managers expected no increase or a decrease in UK property market activity over the next three to six months, followed by a quarter of SMEs and 23% of major businesses.

This easing or tempering has been interpreted as a predictor of greater stability in the real estate sector rather than a decline.

Lloyds’ global head of corporate real estate, John Feeney, says: “This suggests we are moving into a stable phase in which some of this heavy run-up on to capital values is ended. Real estate operators are going to have to get back to good old asset management and creating value. They’re not just going to be able to sit passively on a portfolio and get returns through capital appreciation, so it’s more of a normal operating environment.”

However, while the 550-odd respondents feel slightly more pessimistic about the market and sector, the same cannot be said about their business performance optimism.

Some 80% of major businesses expect an upturn in their portfolio performance, followed by 69% of SMEs.

This disconnect is also being seen in the market, according to Feeney.

“People are relatively optimistic about their own businesses but are taking a slightly more cautious view of the broader market. Of course, everybody’s business can’t outperform the market, so there may be a slight disconnect there.”

He adds, however, that the key theme is the relatively modest “although quite meaningful” softening of sentiment. “We are over the crest, so to speak, and back into a normal environment that’s broadly healthy.”

Institutional optimism still tops the charts

With strong inflows keeping their coffers lined, fund managers remain the most confident group, polling 68 on the confidence index, closely followed by major businesses at 66. However, both of these measures are lower than a year ago when they were 81 and 75 respectively, and again from three months ago when fund managers weighed in at 83 – a record high for the monitor’s four-year life span.

Fund managers also lead in terms of expectations for continued growth in values. Some 90% still expect to see a rise, ahead of medium to large businesses in London on 76%.

The monitor found a greater consensus on investment intentions than has been seen since the index began, with most groups planning to maintain or scale down investment.

Not so for fund managers, where high levels of cash reserves and a sunny outlook on capital values give a singular result when it comes to investment intentions.

Some 72% of investment managers expect to invest in the immediate future. As one fund manager says: “We are reliant on investment inflows of cash from our investor and if money comes in, we will spend it.”

Capital cooling

The gap between confidence in London and in the rest of the country closed in February and both are now tracking downwards. London SME confidence is now 55; the UK SME average is 54.

The role of debt in the sharp recovery seen in recent years has been quite significant, particularly the return of liquidity to the regional and secondary markets. However, Feeney does not see lending having played a major role in the current change in sentiment.

“We are seeing ample liquidity, with the debt market conditions strengthening even further, so it’s hard to see any correlation between the softening of sentiment and conditions in the debt market,” he says.

He also draws a distinction between the present market and the build-up to the 2008 bust. “At that point in time – 2006 and 2007 – highly leveraged structures were the norm and as often as not the key players in the market were financial engineers rather than real estate people. They were coming up with more convoluted structures and means to arbitrage valuations, so to speak. What we have now is much less leverage in the market. We have banks generally sticking to their knitting in senior debt and the enthusiasm has been driven more on the equity side.”

Referendum lessons

Lloyds’ and the IPF’s SME regional breakdown demonstrated that waning optimism could be seen across the country. As the poll was taken in the run up to the Scottish referendum, one could have expected a greater dip in confidence there than in other regions. However, the CPCM found that overall confidence in Scotland dipped in line with the fall seen in most regions, dropping from 67 in February to 51 in August.

The muted response on paper and late rush of contingency planning as the potential outcome of the historic vote looked more uncertain is telling, according to Feeney. He thinks the market is treading the same line in relation to potentially disruptive upcoming events such as the general election and interest rate rise.

“The prospect of interest rate rises in the not-too-distant future is the biggest threat on the horizon right now,” says Feeney.

“We are in a market that has got used to very cheap money and when that changes I suspect that will be quite a shock to many people in the market.”

“Certainly our view is that [a rates rise] will happen earlier next year than the market consensus suggests, and while it will probably be quite a gentle set of rises it is still going to have quite a big impact, I suspect, particularly for assets that have very low yields where there is not that much cash flow to service debt.”

In the previous CPCM survey carried out in March, respondents were adamant that rising interest rates would not curb their investment intentions but, based on the referendum response, Feeney believes that in practice things might be a little different.

“We got a pretty optimistic response last time. Frankly I am very sceptical about that. I think it’s one of those things everyone says isn’t going affect their investment decisions until it actually happens and I suspect people will actually respond in a much larger way than they suggest in the survey.”

Overseas enthusiasm

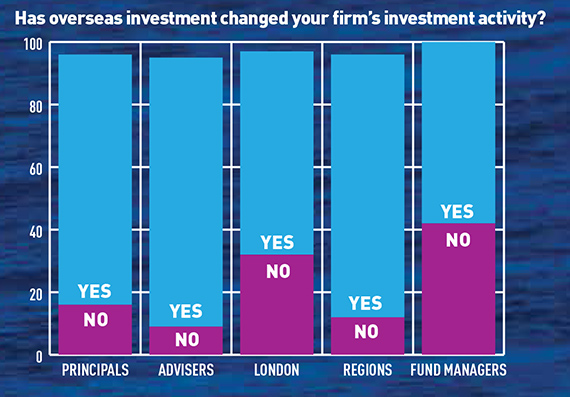

The effect of overseas investment on business activity was polled for the first time in the August CPCM, with some surprising results.

On the whole, most businesses see the influx as having a positive effect on the UK CRE market. This was stronger for commercial property SMEs than their residential peers, where a quarter thought it didn’t have any effect despite the wave of overseas cash often linked to rising values in the UK housing market.

While the majority of respondents also said the influx had made no change to their investment activity, there were pockets where a change in policy was evident. Some 42% of fund managers, 32% of medium to large businesses in London, and 30% of major businesses acknowledged a shift.

Lloyds and the IPF said the responses largely pointed to addressing the requirements and risks of the overseas investors and shifting focus from areas where UK investors are no longer competing on price.

bridget.oconnell@estatesgazette.com