A deluge of money has had Birmingham’s agents rubbing their hands with glee. They say there is more investment to come, but what is driving it? David Thame reports

A deluge of money has had Birmingham’s agents rubbing their hands with glee. They say there is more investment to come, but what is driving it? David Thame reports

Sometimes it must have felt like money was fluttering down on Birmingham from the skies, so sudden and so overwhelming was the summer and autumn shower of investment mega-deals.

You couldn’t quite scoop up fistfuls of fivers in Brindleyplace, but agents confess deals did seem to be dropping into their laps. “In May, June and July it felt like anything would sell,” one investment specialist recalls.

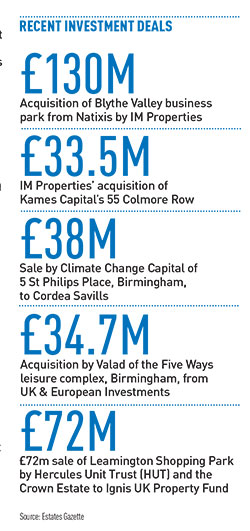

M&G Real Estate’s £140m acquisition of Hines’s 319,000 sq ft Two Snowhill is the largest of a long list of deals (see panel, page 73).

In the meantime, city centre office yields have plunged, dropping in the course of a year from a keen 6% to a keener 5.25%. Yields of 5% are expected imminently – and the first sub-5% yield can’t be far off.

With more hush-hush off-market deals soon to be completed, investment specialists say they expect the last weeks of 2014 to contain many pleasant surprises.

So what is the explanation? Is the run of mega-deals just a series of happy coincidences, or is it inspired by fiercely competitive new buyers taking a stake in the West Midlands? Could it be that the excitement of the HS2 train line is delivering an early bonus? Or are vendors off-loading assets, guessing that this is the top of the pre-general election market? Or is it simply that a rising economic tide suddenly floated Birmingham’s boat?

Benson Elliot ought to know the answer. This summer it missed out on a rumoured £30m bid to buy a share of the mothballed Martineau Galleries retail scheme in Birmingham from a joint venture between Land Securities, Hammerson and Ignis Asset Management. In the end, Hammerson snatched the prize. However, Benson Elliot had already secured 11 Brindleyplace earlier this year in a £30m deal with Argent. The 108,000 sq ft award-winning block – the largest single phase at Brindleyplace – is also something of a prize. Tenants include Colliers International and Argent.

James Jakeman, principal at Benson Elliot, explains: “Birmingham has been a key target for our UK regional investment and development strategy, which has seen us invest more than £1bn into towns and cities outside London over the past four years, through careful stock picking.

“With little new stock being delivered in the short term, we were excited by the opportunity that 11 Brindleyplace offered. We have recently relaunched the building back into the occupational market. Against a market backdrop of limited good-quality space and improving business sentiment, we expect the response to the building to be favourable.”

In other words, a slice of the Birmingham office market was worth having – and when the opportunity arose, they snatched it.

Valad has also been buying for its European Diversified Fund. It paid £34.7m, a net initial yield of 8.1%, for the 199,702 sq ft Five Ways leisure complex, anchored by Grosvenor Casinos. The vendor was UK & European Investments, on behalf of Blue Coast Commercial Investments.

David Kirkby, managing director at Valad Europe, says: “The timing of the purchase was based on a combination of the fundamentals of the asset being right and the availability of capital to invest. The UK’s strong regional cities, such as Birmingham, are investment markets that we will continue to target for income and value opportunities.”

Timing was also influenced by the funding regime for the new fund. Once the fund’s pot was filled, it could go out and spend – but not before.

Both Valad and Benson Elliot suggest buyer motivations are uncomplicated – and haven’t changed in any fundamental way. But how about vendors? Could their expectations have changed, and could this be the explanation for the run of West Midlands mega-deals?

Damian Lloyd, director at GVA, thinks vendor expectations could be the key. “Last year and early this year a lot of activity seemed to be bypassing Birmingham and going to Manchester. We were seeing lots of interest but no deals. Then the market snapped, and deals began to happen. Suddenly we have a surge of investment deals.”

Lloyd adds: “Of course, some of those deals just took a long time to complete – Blythe Valley, for instance – but I think what changed is that vendors took a while to catch up with the market. Now their expectations and the market’s expectations have caught up with each other. The result is that the supply of stock has loosened. Things that were on the market and not shifting, like the Five Ways leisure scheme: all of a sudden, vendor expectations were met.”

According to Lloyd, something similar happened at 11 Brindleyplace. “It was an off-market transaction, and Argent had approaches before Benson Elliot but had not sold,” he says. “Then, this summer, the buyer offers just enough to make it worth Argent’s while.

“We are at that nice point in the West Midlands where buyer and vendor expectations meet and click and the market works.”

Lloyd thinks the new mood of equilibrium will continue for some time to come.

Andrew Bull, director at Savills in Birmingham, shares Lloyd’s analysis. He says: “No doubt something changed. Last year we might have got three or four serious bids for something; today it’s a dozen. But it’s not overseas money driving the market – we’ve not seen an awful lot of overseas money in Birmingham.

“It’s the same old faces – the Germans are always looking, for instance – but it’s the UK retail funds that are driving the market, targeting the higher returns they can find in the UK regions, compared with London and the South East. Every one of the UK institutions has a regional prime office requirement today – last year it was just one or two of them.”

The next stop for the West Midlands investment scene? It’s going to be forward funding, the market-makers say.

“Forward funding is on the agenda because it’s a way for the funds to buy into a market they couldn’t otherwise get into,” says Bull. “Expect something soon in the £25m-£75m bracket, certainly no larger than that because it would begin to raise liquidity issues for the funds.”

The consensus is that by this time next year one or two forward-funding deals will have been agreed – but no more than that. “There will soon be a feeling that we’ve had enough of that for now,” one agent confided to EG.

The spate of big deals is not over yet. Tritax is expected to sell its Brindleyplace blocks – numbers 7, 8 and 10 – for around £130m, a yield of 5.75%, while the Great Charles Street island site, next to Paradise Circus, is likely to sell for north of £20m.

Is the West Midlands heading for a hectic winter season of deal-making? It begins to look highly probable.

Elsewhere in the region

Outside the Birmingham conurbation, the main focus of investment activity is the logistics sector. In September Los Angeles-based Karlin Real Estate paid £6.1m for the 101,573 sq ft Simmons Transport warehouse at Telford in a deal with Barlows, which brought the first major US investment to Shropshire. Competition for the best assets is keen.

Not too warm, and not too cold, but just right.

Goldilocks knew how she liked her porridge – and investors appreciate just the same virtues in the West Midlands investment scene.

According to DTZ’s Fair Value analysis, Birmingham is just nicely warm in all investment sectors.

DTZ says that prices are increasing, backed by rental growth over the period 2014-18 (2.4% pa for offices, 1.6% for retail and 2.5% for industrial in Birmingham). James Bladon, associate director at DTZ, says: “We had seen a mismatch in vendor and purchaser expectations. Now purchasers are prepared to pay even beyond what vendors expect. Valuations are lagging behind the market. Investors want to get their money into property quickly – they don’t want to wait.”

Bladon takes a cooler view of office yields than some rivals. “We could move out from 5.75% today to 5.5%,” he predicts.