Birmingham’s retail landscape will be transformed in 2015. In the spring, upmarket shopping mall the Mailbox will open for business after a £50m revamp – Harvey Nichols is almost doubling the size of its store. Then, in September, the spotlight will fall on John Lewis when it opens its doors as the 250,000 sq ft anchor of the city’s new 500,000 sq ft shopping centre, Grand Central, atop the £650m redeveloped New Street station.

Birmingham’s retail landscape will be transformed in 2015. In the spring, upmarket shopping mall the Mailbox will open for business after a £50m revamp – Harvey Nichols is almost doubling the size of its store. Then, in September, the spotlight will fall on John Lewis when it opens its doors as the 250,000 sq ft anchor of the city’s new 500,000 sq ft shopping centre, Grand Central, atop the £650m redeveloped New Street station.

These investments have bolstered Birmingham’s pulling power, and the extension of the Midland Metro to New Street station will doubtless attract extra shoppers from outside the city. As Birmingham prepares for its retail spree, attention is turning to other regional centres to see who can up their game.

The smart money is on Solihull. The town, home to the region’s only other John Lewis store, may appear vulnerable to the added allure of its neighbour (see Public Sector Focus, p72). Yet, with an affluent and loyal shopping catchment, it consistently punches above its weight.

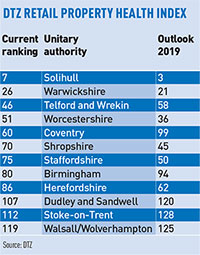

Last year, uSwitch’s Quality of Life Index crowned Solihull the best place to live in the UK. A few months later, DTZ research predicted that in five years the town will be the UK’s third-healthiest retail destination. The Property Health Index took into account factors such as household income, population growth and vacancy rates (see table).

DTZ associate director Jonathan Rumsey says: “Solihull has a very strong demographic of healthy, wealthy and confident consumers.”

There may be enough affluent shoppers for two John Lewis stores, but Solihull can’t afford to rest on its laurels.

Touchwood owner Lend Lease is drawing up plans to extend its 650,000 sq ft shopping centre; IM Properties is working with the council on proposals to redevelop Mell Square.

Rob Alston, partner, retail, at Cushman & Wakefield, says: “Solihull provides the best shopping environment in the West Midlands and the two development proposals will be complementary.”

Alston says the Touchwood extension is likely to feature more fashion-focused shopping and an increased leisure offer, whereas Mell Square will provide additional restaurants and the potential for more value-oriented retail.

While Solihull looks to consolidate its lofty retail ranking, less-affluent centres in the region are struggling to get proposals off the ground.

For example, DTZ forecasts Stoke-on-Trent to be the least-healthy West Midlands retail destination in 2019, citing 22.5% vacancy rates in an area that has consistently haemorrhaged retail spend.

For example, DTZ forecasts Stoke-on-Trent to be the least-healthy West Midlands retail destination in 2019, citing 22.5% vacancy rates in an area that has consistently haemorrhaged retail spend.

Before the recession hit, Stoke’s hopes rested on Realis Estates’ proposals for Hanley. The 640,000 sq ft City Sentral scheme got planning permission in 2011 for a Marks & Spencer anchor store, hotel, restaurants and a Vue cinema.

Eight months after permission expired, no announcements have been made, although Realis is believed to have bought back the debt from Oaktree Capital and hopes to bring a downsized scheme forward.

A spokesman for the developer said: “We are working up plans for a revised scheme more suited to the new, post-recession economic reality. We hope to bring these into the public domain soon.”

But some question whether City Sentral will ever see the light of day. M&S has begun building a new store in nearby Wolstanton and another cinema is due next year as part of the extension of Intu Potteries shopping centre (right).

Intu’s 60,000 sq ft leisure extension, due to open in August 2015, is now fully let, with tenants including Cineworld, Nando’s and Pizza Express.

When asked about Realis’s proposals, Martin Breeden, regional director at Intu, told EG: “I don’t think they’re competition because they haven’t got a project with any prospect of going ahead.”

Meanwhile, transforming ambitious plans into deliverable schemes is a challenge elsewhere in the region.

Wolverhampton already loses out to the pull of central Birmingham and, from next year, Black Country shoppers will be able to travel by tram right to the entrance of Grand Central.

Delancey Estates has secured planning permission for a £30m redevelopment of Wolverhampton’s Mander Centre, to be anchored by a 90,000 sq ft Debenhams. However, Delancey is about to sell the scheme to Benson Elliott Capital Management and only time will tell what ambitions the new owner will have.

“Investment in Wolverhampton is long overdue,” says Alastair Robertson Dunn, director, Midlands retail, at GVA. “With a huge catchment, there is clearly development potential.”

The same can be said for Coventry, a city that has under-delivered, largely because city centre retail development has repeatedly fallen through. But alongside the development of Coventry’s 3.2m sq ft Friargate business district, long-awaited plans to redevelop the city centre retail area could finally go ahead.

The same can be said for Coventry, a city that has under-delivered, largely because city centre retail development has repeatedly fallen through. But alongside the development of Coventry’s 3.2m sq ft Friargate business district, long-awaited plans to redevelop the city centre retail area could finally go ahead.

Queensberry Real Estate’s City Centre South (right) promises to deliver 560,000 sq ft of retail-led development, incorporating large, modern retail units, an anchor store and up to 25% of leisure. It is hoped that construction could start in two years’ time, to be completed in 2018.

Queensberry partner Paul Sargent says: “There is a huge amount of investment going into Coventry, which has been in the shadow of Birmingham for too long. There are key retailers who are not yet in the city and occupiers who don’t have the space they require.”

In time, Coventry may turn the corner, but many of its tertiary retail centres will struggle to attract high-street names.

BWD director Guy Webber says: “Retailers that once needed 350 stores now want 100 larger units instead. Unless you are in the top 150 locations, it becomes a real challenge.”

Many developments are now focusing on leisure, which is attracting strong demand across the board.

Sovereign Land, for example, is focusing on new restaurants and cafés for the first phase of its redevelopment of Telford Shopping Centre, while Kidderminster has attracted leisure-oriented development proposals from both TIAA Henderson Real Estate and Exchange Street Properties.