The true state of the real estate debt exposure held by 130 European banks was laid out this week in the European Central Bank’s stress test report.

The true state of the real estate debt exposure held by 130 European banks was laid out this week in the European Central Bank’s stress test report.

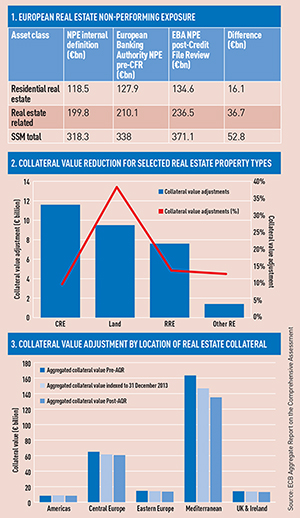

The 170-page paper, published on Sunday following the ECB’s year-long comprehensive assessment of the bank’s balance sheets, found that non-performing real estate loans totalled €371.1bn (£293bn) at the end of 2013.

This is a 17% hike on the €318.2m of soured real estate loans the banks had estimated they held prior to the review (table 1).

The €52.8bn difference was made apparent through the ECB’s application of a standardised definition of “non-performing exposure” to the institutions that had previously used varying internal definitions.

The €52.8bn of additional property NPEs comprised €16.1bn in residential real estate and €36.7bn in “real estate-related” loans. Both of these categories include investment and development loans.

While there were a number of reasons for such a large tranche of loans to be reclassified, one of the major factors was overvaluation of assets held on the bank’s balance sheets.

Some €29.5bn in overvalued real estate was identified by the ECB’s asset quality review. Most of this real estate writedown – €11.6bn – was linked to commercial real estate, followed by €9.5bn of land and €7bn of residential assets (table 2).

Geographically, banks were most exposed to Mediterranean real estate with a total of €135.2bn of property collateral in the region (table 3).

The result of the review is predicted to be an uptick in loan portfolio sales and, to a lesser extent asset sales, as banks

look to meet their capital shortfalls.

Some 25 banks emerged from the comprehensive assessment with a capital shortfall – although many of these failures were technical as money was raised from investors after the December 2013 cut-off.

The eight most severely affected banks – half of which were Italian – had a capital shortfall of €6.3bn.

Despite UK banks coming the through the assessment unscathed, the Bank of England warned this should not be interpreted as indicative of the 2014 UK stress testing exercise as there were a “number of significant methodological differences between the two”.

The BoE will publish the results of the UK variant stress test on 16 December.