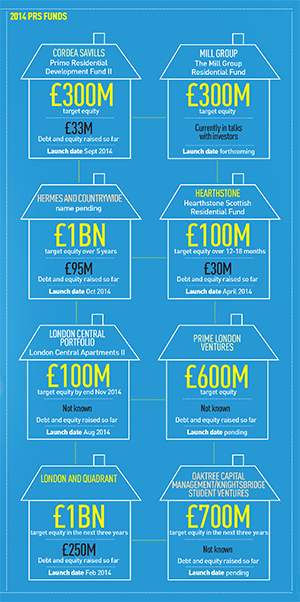

A crop of new funds targeting the UK private rented sector have either launched or begun marketing in the past two months alone – and could channel an additional £1.6bn of capital into the sector.

Last week, Hermes announced that it had teamed up with Countrywide to launch a UK housing fund seeded with £95m of equity, which could grow to £1bn gross asset value over five years. This follows Cordea Savills and Mill Group, which both announced plans in September to raise PRS funds of around £300m each.

These, combined with five new funds that have either launched or begun talks with investors this year, could take the total of new capital entering the UK market to £4.1bn in the next five years.

This is a long-awaited development for the UK PRS sector, where pundits have predicted a wave of fund launches by major institutions since the Montague Report was published in mid-2012.

Adam Challis, head of residential research at JLL, said: “The rhetoric is translating into reality.” However, he warned that the weight of money coming into the sector via funds may be a hindrance, rather than a help, to the market. “There simply isn’t enough stock in the pipeline to invest in,” said Challis.

The UK private rented sector is valued at around £837bn, according to LaSalle Investment Management. However, institutions currently allocate just 4% of their overall property investment – or around £18bn – to the sector.

Funds launched in 2013

A number of major PRS funds hit the market last year, most prominently M&G Investments’ UK Residential Property Fund, an open-ended vehicle that has invested about £150m to date. Dutch pensions giant APG teamed up with Grainger, the UK’s largest listed residential landlord, to create a £350m residential fund in January 2013. APG invested about £158m in the five-year fund, while Grainger put forward £59m.