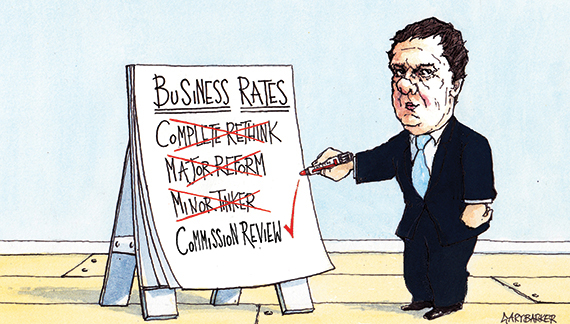

It seems to me paradoxically unjust that business rates – the very tax once designed to help businesses thrive by funding the necessary local services upon which they depend – are now weighing down upon business growth, and ultimately discouraging much-needed investment in our towns and cities.

It seems to me paradoxically unjust that business rates – the very tax once designed to help businesses thrive by funding the necessary local services upon which they depend – are now weighing down upon business growth, and ultimately discouraging much-needed investment in our towns and cities.

Moreover, business rates are a perpetrator of the increasing disparity between London and the rest of the UK, and have proven themselves, under existing arrangements, unable to adjust to economic cycle or geographical-based conditions. They are not fit for purpose.

While there seems to be broad-based political consensus that the sure-fire path to post-crisis growth is about attracting investment into critical infrastructure and property across the UK, the regime of having a five-year revaluation cycle is deterring vital investment into those locations and sectors of the economy that are struggling and so need it the most.

With many businesses still paying rates based on 2008 rental levels, areas of relative decline are paying over the odds, while those prospering gain from levels set too low. The situation has been further exacerbated by the government’s decision to postpone the next revaluation until 2017.

Taking inspiration from more efficient international models, such as those in Hong Kong and the Netherlands, the BPF’s latest report – Better rates for better business – makes it clear a key priority for the next government should be to move to an annually calculated system.

It also calls for the lag in the publication of the Rating List to be significantly reduced, moving from two years to one. Clearly, this is a tax where the burden is out of kilter with the prevailing economic environment. Creating a more responsive tax system that is fairer to ratepayers would have multiple cost saving advantages, including fewer ratepayers appealing bills.

A system that encourages more than a third of valuations to be appealed cannot be just or economically efficient. Perhaps, following a reform of the system, the need for the Transitional Relief (forecast to cost this parliament’s Exchequer more than £1.1bn), could be removed altogether.

With much thought now being given to devolution of political power, it may also be possible for councils to be given full freedom to set business rates to reflect their local areas rather than operating to a formula fixed in Whitehall. Local control over revenue may be accompanied by local decisions about where that revenue is spent.

One way to better align the original intention of the tax to its end result would be to remove the smallest properties out of business rates altogether, encouraging start-ups and SMEs to grow and thrive. Creating a business rates system that is fit for the 21st century is one of the central challenges facing the next Parliament.

Politicians of all parties must understand that re-balancing the north-south divide, allowing our regional cities to thrive as engines of local growth, and ensuring that our built environment receives the investment it desperately needs, depends on it.

Bill Hughes is BPF president and managing director of Legal & General Property