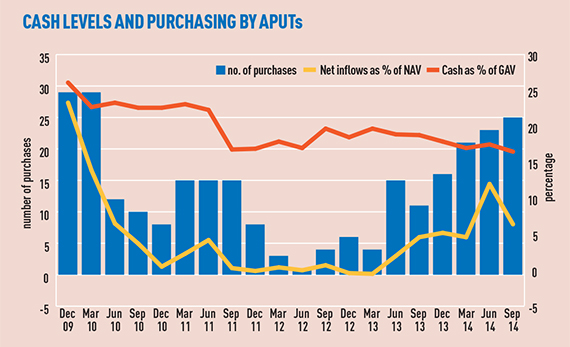

Fund managers have been largely successful in spending the record levels of cash they received in 2014, according to exclusive data from IPD.

UK authorised property unit trusts saw net inflows of £2.7bn in the first three quarters of 2014, compared with £550.5m for the corresponding period in 2013 – levels not seen since 2010.

But the amount of surplus cash held by APUT funds has fallen, indicating that managers are finding deals despite a hot market.

APUTs held an average of 16.5% of gross asset value in cash at the end of the third quarter compared with 18.8% for the corresponding period last year.

“UK institutions have been extremely active this year. The definition of risk has changed and investors have been more willing to buy in the regions,” said Mat Oakley, director of European commercial research at Savills.

Non-authorised funds in the IPD index held an average of 6% of GAV in cash, compared with 6.8% in Q3 last year. Debt levels are also declining, and stood at an average of 10.6% compared to their 30% peak in 2009.

IPD has seven APUTs in its sample with a combined GAV of £13.7bn.