FINANCE: A new index aimed at providing the growing number of institutions targeting the private rented residential sector with investment-grade performance benchmarks has been launched.

FINANCE: A new index aimed at providing the growing number of institutions targeting the private rented residential sector with investment-grade performance benchmarks has been launched.

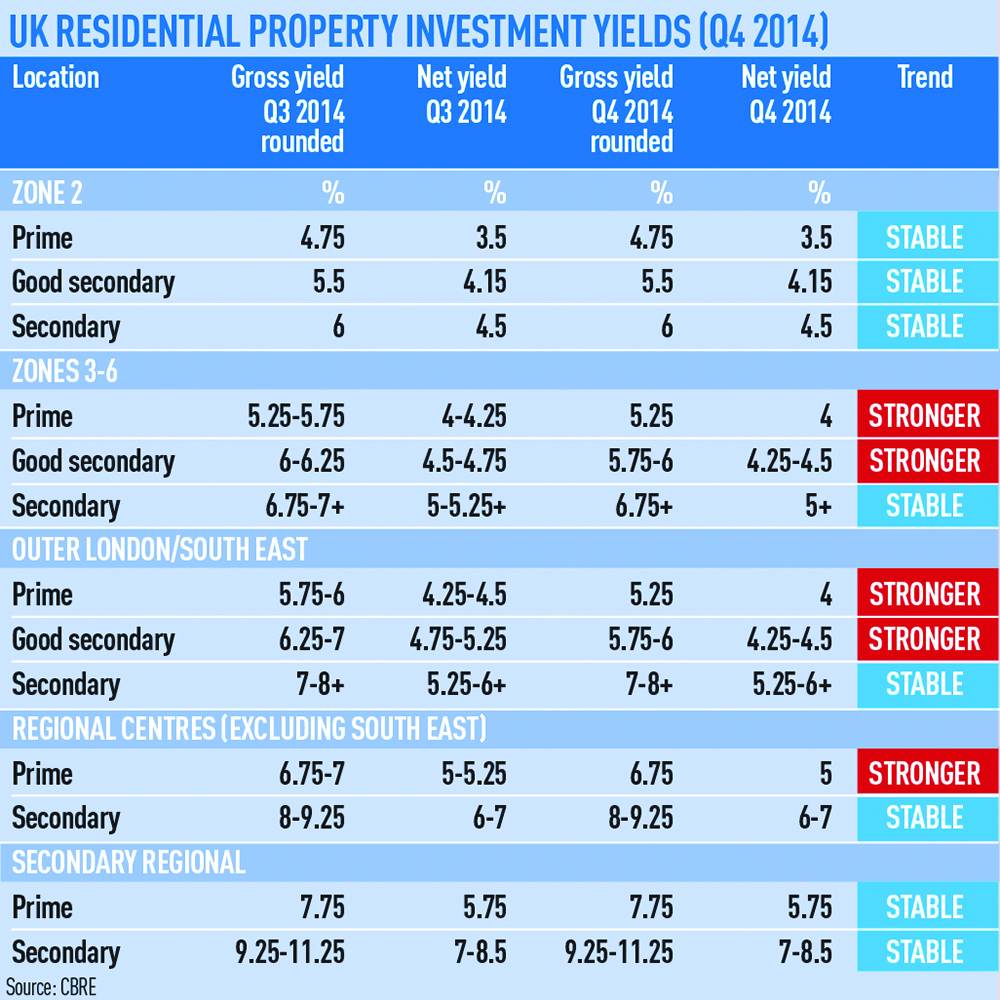

The UK residential property investment yields data set from CBRE will be published on a quarterly basis to provide a barometer of market sentiment.

The first index reveals a strengthening PRS market in zones 3-6 in London, plus the outer boroughs and South East, with yields on prime and strong secondary assets moving in by around 25 basis points in each region (see table).

Jason Hardman, senior director in CBRE’s residential valuation and advisory division, said: “There has been a lot of activity in what we call the donut, zones 3-6, particularly at Crossrail-related sites. Investors are willing to buy into funding opportunities or standing investments with lower overall returns. It is a very similar theme in the South East.”

He added that investors were continuing to focus on forward funding and build-to-rent opportunities because of the dwindling stock of constructed and let assets.

The new index aims to provide a clearer way for institutional investors to value the PRS sector. Historically the approach to valuing housing stock has been based on sale prices, but for PRS investors are much more focused on net income, says Hardman.

The RICS last autumn released an information paper offering guidelines on valuing residential property purpose-built for renting.

Hardman said he hoped the CBRE index provided a benchmark that puts PRS investment on the same terms as commercial, allowing institutional investors to compare like with like.