London may be at a familiar point in the market cycle, but that does not mean that the capital’s office market today is familiar territory. Compared to the previous post-recession recovery there are three outstanding differences, leading to talk of a prelet boom.

London may be at a familiar point in the market cycle, but that does not mean that the capital’s office market today is familiar territory. Compared to the previous post-recession recovery there are three outstanding differences, leading to talk of a prelet boom.

The first is a simple supply equation. During the dot.com downturn, central London office availability soared from around 5.4m sq ft in mid-2000 to 28m sq ft in 2003, according to DTZ. The abundance of supply meant prelets were almost unheard of as the market recovered.

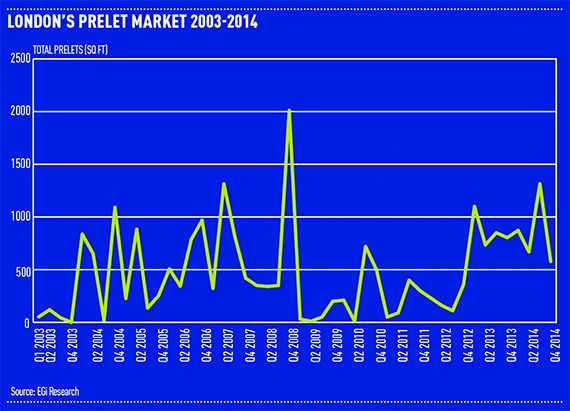

In 2003, just 215,387 sq ft of space was prelet across central London. That total built steadily towards the 2007 and 2008 peaks of around 3m sq ft (see graph). Naturally the figure dropped again after the banking collapse.

Little development during the recession has been exacerbated by recent office-to-resi legislation and means the current supply picture is the tightest in living memory, according to agents. Availability has been in decline since 2009, leaving a supply of 12.9m sq ft and a vacancy rate of 5.6%, according to Knight Frank. The long-term average is 8.9%. And there are signs it is going to get worse.

All this means occupiers with looming requirements are beginning to sweat.

Rents are forecast to rise steeply in the coming years, up 17% across central London this year, according to BNP Paribas Real Estate.

As CBRE head of central London development, Peter Burns, puts it: “There are some very large traditional occupier lease expiries coming up between 2016 and 2018, far more space than is being constructed, and that’s really piling the pressure on. [Occupiers] know what’s happening and they know they’ve got to commit early.”

Back in fashion

Faced with few oven-ready options, prelets are back in vogue – as seen in the take-up figures.

The prelet market was stagnant before rocketing up to 860,000 sq ft in 2012. In 2013 the figure soared to 3.5m sq ft and held steady at 3.4m sq ft in 2014. That means the past two years have seen more prelet activity than the previous five years.

All this comes at a time when London has more established office locations and more emerging markets so that prelets aren’t just the preserve of the City.

The City core does remain the dominant location in attracting prelets – some 2.2m sq ft of deals were signed in 2013-14 – but now there are the likes of Victoria, Paddington, South Bank and King’s Cross.

It means occupiers are having to shop around rather than wed themselves to a particular postcode. CBRE City agency director, Chris Vydra, says: “Occupiers today are far more footloose than they ever were, and are more likely than in the past to seriously consider the emerging new central business districts, such as Spitalfields, Shoreditch, Clerkenwell and South Bank. More locations are deemed core now than in any previous cycle.”

Unchartered waters

As if all this didn’t make the picture difficult enough to predict, the occupier profile has evolved too. According to Cushman & Wakefield the prelet market was traditionally dominated by major financial services requirements, but has emerged from the downturn with new occupiers. Media and technology firms make up as much as 70% of prelets in 2013 – well above the long-term average of 15%.

This is a trend Colliers head of West End agency, Paul Smith, thinks will continue. “The sector most likely to have expansion in the next year is the tech sector,” he says. “The lack of opportunities has driven them to look two to three years ahead, and they are generally footloose across all of London.”

It is uncharted waters for the London prelet market, particularly in the untested sub-markets. But the emergence of these new challengers, the new interest in preletting from media companies, and an abnormally acute supply crunch all point to a prelet boom for the London market – so long as the city’s developers can bring forward suitable opportunities.

Prelets are all around

During the last 15 years London’s office market has evolved.

The West End has spread north of Oxford Street, Victoria is having a renaissance, the South Bank is an established office location and Midtown is not just the preserve of lawyers and those looking for cheaper space with access to the City and West End.

The market now offers the most diverse prelet opportunities in its history.

In Midtown, for example, out of a total 3.4m sq ft prelet since 2003, some 2m sq ft was in the past two years.