An unexpected surge of delegates poured through the doors of Estates Gazette’s Aberdeen Question Time, hopeful that pundits would confirm that the impact on commercial property of the global oil crisis would be tempered by a strong 2014 in the Granite City.

An unexpected surge of delegates poured through the doors of Estates Gazette’s Aberdeen Question Time, hopeful that pundits would confirm that the impact on commercial property of the global oil crisis would be tempered by a strong 2014 in the Granite City.

How great a threat it is was the inevitable question, and the answers that followed were surprisingly positive. A drastic price drop could even be an investment boon to the city, the gathering heard.

Positive, however, until the debate turned to trams, desperately out-of-pace transport infrastructure and that dubious title of Scotland’s most dismal city.

A fall in oil prices could prompt an increase in investment

The debate did not just focus on the negative news surrounding recent headlines. Mark Fleming, director of investment at Savills, suggested that the fall in oil prices might not be such a bad thing after all and could even attract investment to Aberdeen.

“The last time we had a crash that peaked in 2008, there was a slump but then within one year it was back 50%, and within two years it was back 75%,” he reminded the audience.

He also put Aberdeen’s current situation against a global backdrop to highlight the opportunity.

“I believe that Aberdeen can manage it,” he said. “So much of this is geopolitical. It is not straightforward. The Saudis have got £900bn of reserves out there. If people start to turn off the taps a bit, that could cause an upswing when it does come back because the global economy is starting to improve.”

Nick Hayes, acquisition and development director at Unite Students, which is actively looking for development sites, revealed how the fall in oil price is increasing demand, which could in turn create more development opportunities.

He said: “The drop in oil price is affecting demand for prelet office space. This may lead to development opportunities that were previously best value for other uses now coming forward for development for alternative uses such as student accommodation.”

Oil and uncertainty – a path already travelled?

The debate kicked off with the most pressing question on everyone’s mind: just how bad is the impact of plunging oil prices going to be?

John Low, managing director at Stewart Milne Homes (North Scotland), stepped up to set the record straight, drawing attention to the fact that oil collapses come in cycles, and this is not the worst one Aberdeen has seen.

“The collapse in 1986 was the worst and we have been through three since then,” said Low. He went on to say that we could learn from the past, and that, most importantly, “there is an opportunity for the sector to recover”.

Parallels were also drawn between the current oil situation and the market sentiment that surrounded the Scottish referendum in 2014 – the strongest link tying the two concerns being that their impact would be short term, not long.

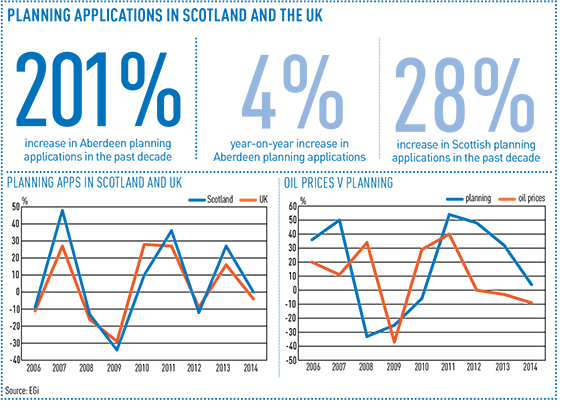

Comparing the impact of the drop in prices with the referendum, Andrew Creighton, head of segregated property mandates at Aberdeen Asset Management, said: “My immediate view is quite relaxed. Investment in Scotland as a whole in 2014 broke all records and was up by 40%, and the whole of the UK was only up by 18%, so did the referendum really have an impact? Short term, there was a bit of holding off, but over the year, not really.”

Creighton said that Aberdeen could expect to see a similar short-term effect from oil prices, and that some sectors would be hit harder than others.

“Across offices and industrial we are going to see an impact, we have seen it in the news headlines with job losses, but we shouldn’t forget the impact that it is also going to have on retail and residential. I don’t think it has started yet, but it will be only short term.”

The makings of a world-class city centre

The consensus on the panel was that Aberdeen needed some extra attention paid to its city centre, which has suffered over the years with the focus on Aberdeen’s main sectors on the outskirts.

“The city needs to have a heartbeat,” said Aberdeen Asset Management’s Andrew Creighton. “Residential, leisure and public realms in the city centre are crucial and it all has to come together.”

Aberdeen was named recently as Scotland’s most dismal town. One of the biggest challenges is the main high street, Union Street. As high streets across the country struggle, the main strip in Aberdeen lacks a strong leisure offering, with Burger King and Gregg’s being the current anchor tenants.

“It’s not the most friendly place on Saturday night,” said Fleming. “I think there is a lack of public realm.”

These issues have not gone unnoticed by Aberdeen city council. Council leader Jenny Laing said that she had a masterplan that would reshape the city centre. It is in draft form and will come to council in May. “We have award-winning buildings and a vibrant, dynamic city,” said Laing. “Are there things we can do better? Absolutely. Do I think we can do them? I do.”

A shift in focus

Aberdeen could benefit from additional opportunities by taking advantage of the recent limelight, as focus on the energy sector switches from a local to a national level.

Jenny Laing, leader of Aberdeen city council, believes the situationgives Aberdeen the impetus to push ministers to back a £2bn finance deal to support oil and gas firms as well as other businesses.

“It has shifted the focus, not just at a local level but at a national level, in the industry. From a local perspective this is good for the city’s economic growth as a whole,” Laing said.