Agents pick most significant deals to end of January

44 Peter Street, Manchester

44 Peter Street, Manchester

Type of deal: Investment

Vendor: Magnus

Purchaser: Credit Suisse

Size: 24,500 sq ft

Price: £7.425m

Yield: 6.53%

Chosen by: Matthew Stretton, partner, Manchester Capital Markets, Cushman & Wakefield

I am choosing Credit Suisse’s purchase of 44 Peter Street because I believe it further consolidates this area. It is a part of Manchester city centre that has benefited hugely from the development of Spinningfields – widely regarded as the premier office location and, arguably, upmarket leisure pitch.

While Spinningfields is one book-end for Peter Street, the opposite end meets with St Peter’s Square, now undergoing a huge transformation to create a new business quarter.

This property in Peter Street offers tenants an established business location, with the amenities that modern occupiers demand. It’s also accessible – being close to the proposed new transport interchange at St Peter’s Square – so it is likely to see strong demand and rental growth over the next five years.

Credit Suisse has since made two further office acquisitions in Manchester city centre, which I believe serves to highlight the continued strength of investor confidence here.

2 St Peter’s Square, Manchester

2 St Peter’s Square, Manchester

Type of deal: Leasing

Developer: Mosley Street Ventures

Tenant: EY

Size: 49,900 sq ft

Terms: 15-year lease at a rent of £31.50 per sq ft

Chosen by: Kirsty Littleford, associate director, office agency, CBRE

In the first letting at the building, EY recently committed to just under 50,000 sq ft at 2 St Peter’s Square – making this a significant deal for Manchester city centre.

The firm is one of the several occupiers at Barbirolli Square with lease events coming up in 2017 looking at other offices here – as opposed to staying within their existing buildings. This deal demonstrates the way companies are now striving to provide their workforce with better-quality accommodation in order to retain and attract the best staff. I believe it will, therefore, encourage additional professionals to consider a move to enhanced, quality accommodation.

With an increased amount of inward investment coming into the city centre – owing to, among other factors, infrastructure and amenities – new accommodation at 2 St Peter’s Square, 101 The Embankment, New Bailey Street and The Cotton Building is well timed and supported by demand.

Peter House, Peter Street, Manchester

Peter House, Peter Street, Manchester

Type of deal: Investment

Vendor: Mayer Real Estate

Purchaser: Rockspring Property Investment Managers

Size: 94,650 sq ft

Price: £23.7m

Yield: Sub 6%

Chosen by: Dan Crossley, partner, WHR Property Consultants

Peter House would get my vote as the deal of 2014. Not only was a very good price achieved, it also provided a potted history of how much the capital market has recovered in just three years.

Peter House is an iconic building that is multilet, with ground-floor retail/leisure and upper floors let wholly to Regus as a business

centre.

When the recent vendor purchased the property in 2011 the market was at a particular low point and there was slim interest from purchasers. Mayer Investments was looking for opportunities to add value that were well positioned within Manchester’s central business district.

Peter House fitted the bill as Mayer recognised that St Peter’s Square was going to undergo a complete transformation over the coming years – as is now clearly evident.

As proof, from the original purchase in 2011 to the exit in 2014 the property increased in value by about £9m.

Click to enlarge

Office rents and yields rise

Office rents and yields rise

Two buoyant indicators emerged for Manchester’s office market. Colliers International forecast rental growth of 8% to £35 per sq ft by 2018 – much of it driven by a supply-demand imbalance. Previously, at the end of 2014, Orchard Street also set a new record yield – at 4.95% – with its £31m purchase of 4 Hardman Square.

Build to Rent helps PRS

The region’s private rental housing market received a boost with a £55m contribution from the government’s Build to Rent scheme – helping to fund Renaker’s plans for 779 new homes in Manchester and Salford.

Partners needed At Piccadilly

A consortium of London & Continental Railways, Manchester city council and Transport for Greater Manchester launches its search for finance and development partners for its £750m plans for Manchester’s Piccadilly. The first phase, comprising offices, hotel, housing and park space, is being worked up over the next 12 months.

Capital grows in Manchester

Manchester’s capital values are set to grow by 22.2% over the next three years, according to property investment firm IP Global.

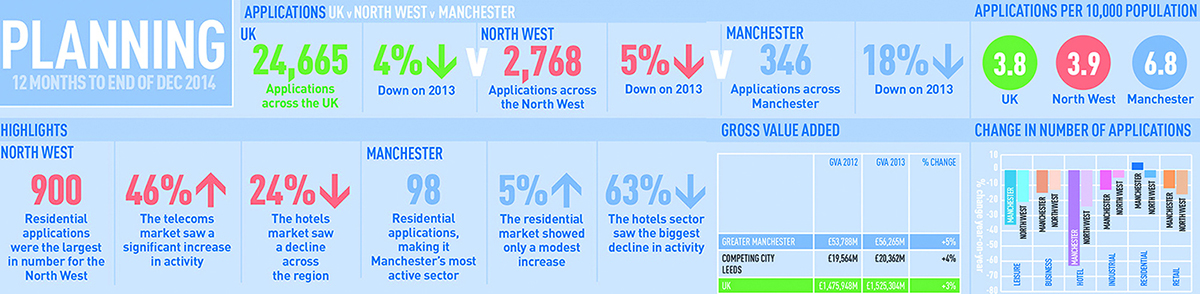

Planning slows down

Planning slows down

EGi data revealed an 18% decline in the city’s planning applications to the end of November 2014.

Building society review

The organisations that saved Manchester Building Society in 2013 have hired investment bank Rothschild to review its finances.