Players rushing into the rental sector off the back of a promise of large rental rises might be disappointed.

Data commissioned by EG from Hometrack shows that despite fluctuations in market rent the relationship between average rents and average earnings has remained consistent for the past decade, refusing to budge from the 33% mark. But it may be a good thing.

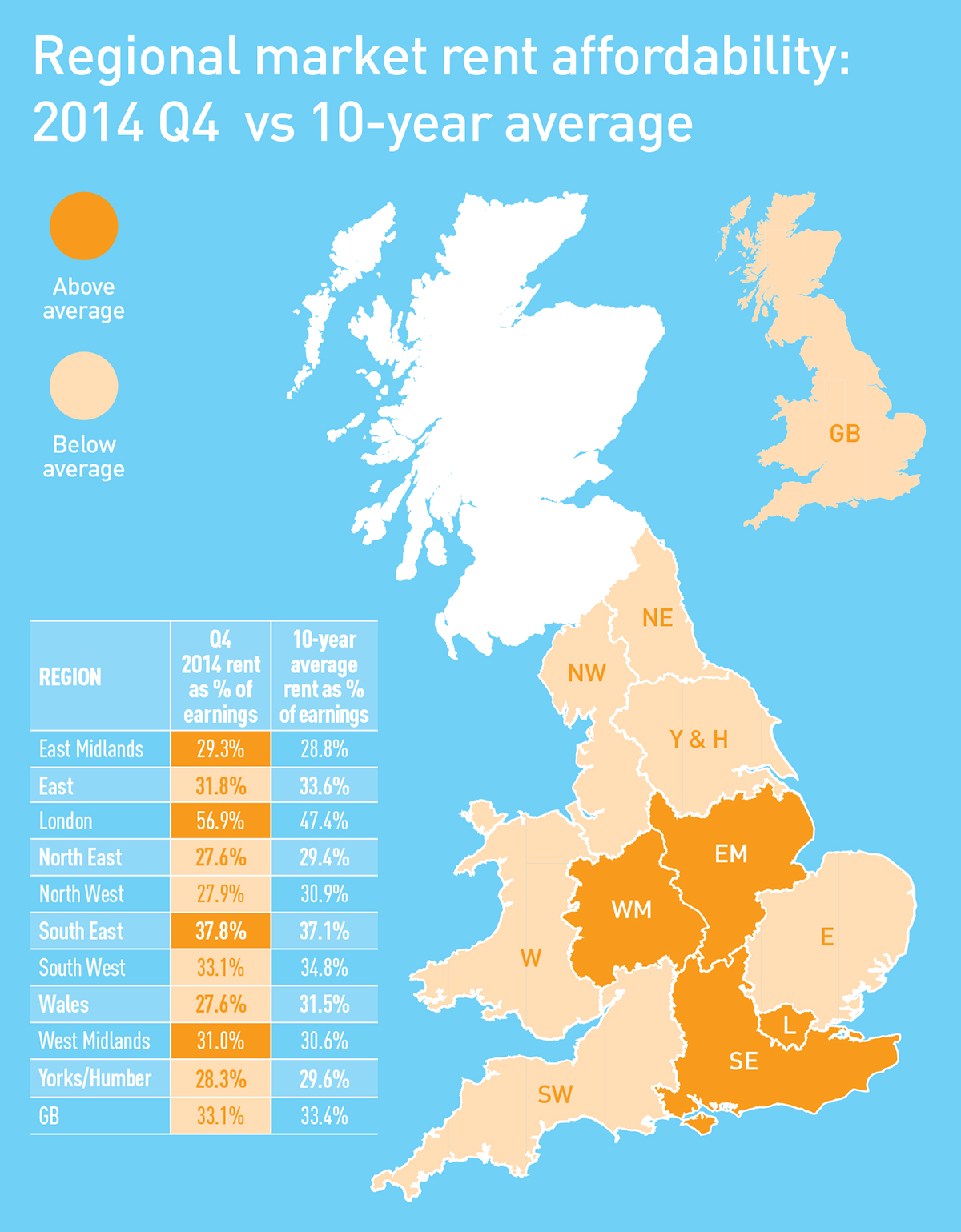

Hometrack’s figures show that outside of London rents as a proportion of earnings are below the long-run average, although rising in the South East and East. Looking at market rents by region, there are two, possibly three distinct rental markets, says Hometrack’s research and insight director, Richard Donnell.

But the flat, featureless unchanging correlation between rents and earnings could be a good thing ultimately for investors, says Donnell. “It should provide great comfort to investors looking to invest in assets with an underlying performance linked to earnings,” he says.

“Historically, investing in residential has been about capital gains and trading but for the new money entering the market it is the commercial-style attributes of residential that are most attractive, not least the rental streams and the relationship to earnings growth despite short-term fluctuations in rental levels.”