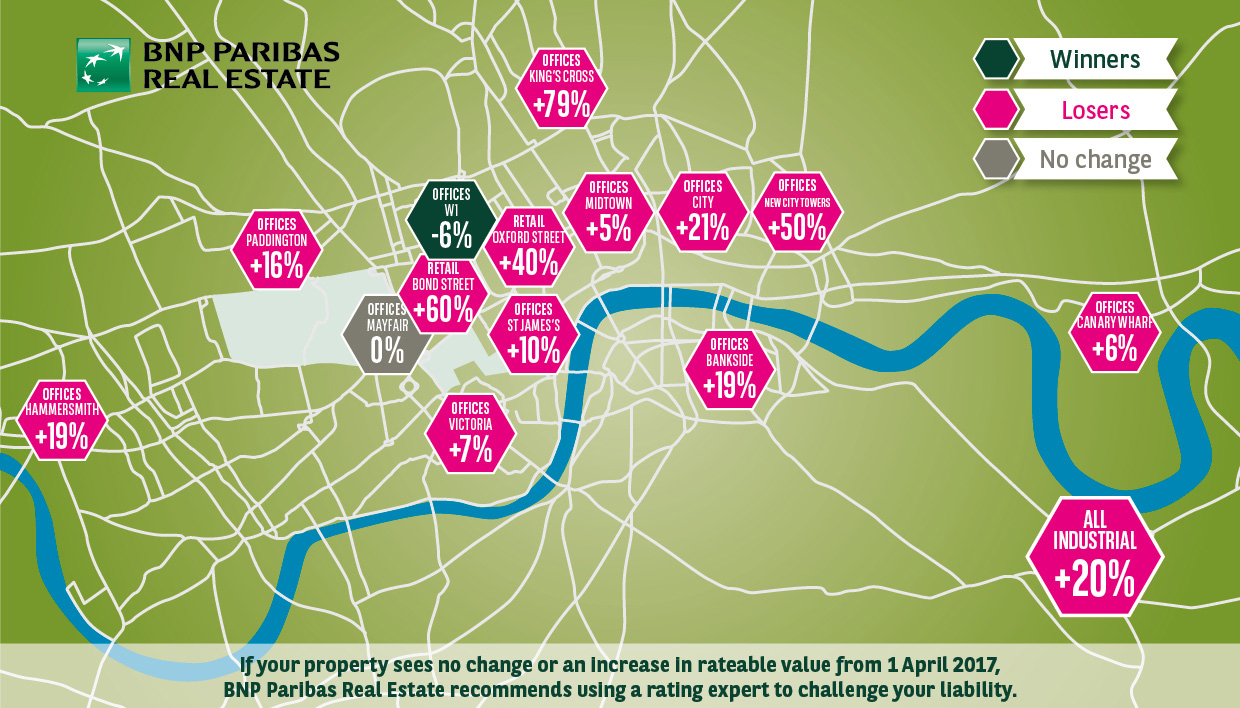

IN NUMBERS King’s Cross offices are facing a 79% hike in rates following tomorrow’s revaluation.

Government postponed the 2015 revaluation to 2017 forcing occupiers to pay rates on a further two years of rent rises.

New City and South Bank towers are forecast to see rates bills rise by 50%, with those based in markets only just emerging when rates where last set in 2008 facing the largest bills. In contrast, Mayfair and West End offices should remain static as rental values are unchanged on the 2008 peak, according to research by BNP Paribas Real Estate, with prime West End offices likely to see a 6% drop after huge rental increases in 2008.

The agent said the uniform business rate in England, the multiplier which is applied to calculate ratepayer’s bills, is likely to be set at 50p in the pound, the highest lever to date.

London rating director at BNP Paribas Real Estate, Ian Allison, said: “It is likely that those most affected will be large corporates with big portfolios heavily focused on London offices and/or retail or landlords/occupiers with one or just a few large properties in areas where rental values have increased significantly since April 2008, the valuation date of the last revaluation.”

Estates Gazette will be publishing an exclusive breakdown of forecast rates increases for the major UK cities in this Saturday’s magazine.

Could the rates revaluation cause a property crash in 2017? >>