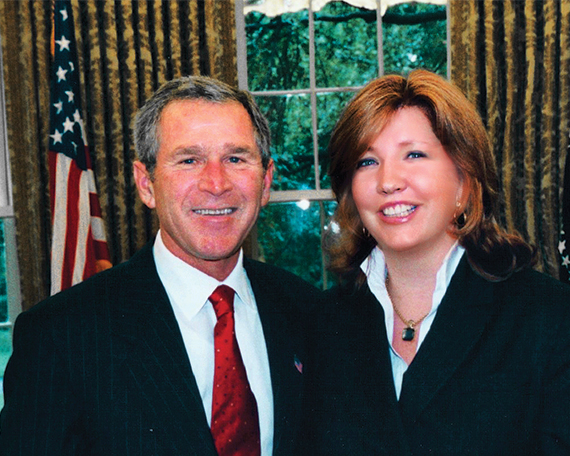

George W Bush’s former economic adviser tells EG why Washington is darker than anyone can imagine and warns that the current economic climate is starting to make people feel “sick to their stomach”

“Looking back, I realise the sacrifice I made as a woman to succeed in Washington. I completely turned off my femininity.”

As the former economic adviser to George W Bush, Pippa Malmgren is no stranger to controversy. But even she is aware of the potential fall-out from the statement she has just made. “I know people will be shocked by that,” she says in a slow DC drawl. “It is the sort of thing that no-one ever says. But I definitely had that thought process.”

She pauses, almost as if thinking her decision through again in real time. “I remember that I chose to turn it off until later in my career when my credentials were so solid that no one could challenge me. It is scary now I look back that I feel I wasn’t permitted to operate in feminine mode until I was so protected by my achievements that no one could throw a punch.

“But this was the White House – an environment where the pressure is so great that distraction of any kind is a problem. And female sensuality is a huge distraction. I am not saying women should not be empowered by it. I am saying you need to pick your moments.”

Now, as founder of her London-based company DRPM Group, the 53-year-old acts as an economic adviser to major players, from hedge funds to private individuals and pension to sovereign wealth funds. And the good news is that she is feeling particularly optimistic about UK property.

But first she addresses that age-old question: “Can an idiot make it to the White House?”

Political poker

The idiot in question is, of course, her former boss: president Bush. Malmgren broaches the subject unprompted and without a hint of fatigue. Impressive, considering it is probably the second most common thing she is asked about her time in the White House after “How similar is it to The West Wing?”

“Every US president is controversial but I worked for one who was exceptionally so,” she says as she manoeuvres from the other side of the table in the bar of the Four Seasons on Park Lane – “I’m going to come and sit closer, I am miles away over here.

“Everyone always asks, ‘What was he like?’ which is a polite way of asking, ‘Is he as dumb as we all think he is?’ The answer is no. He is smarter than most people who ask me the question, actually.”

She adds that the majority of people who ask are Europeans because of what she considers to be the “disconnect” between the way Americans speak to each other in the political arena and the way we expect them to.

“In the US, if you talk with a really heavy southern drawl this in no way precludes you from having a PhD from Harvard,” she says. “Over here the assumption when you hear it is ‘Wow, that guy is an idiot.’ I know there are the details of policy substance and arguments as to whether his choices were right or wrong. I am sure they will be judged harshly by history.

“But anyone who has worked in Washington, anyone who has seen the pace, the pressure, the stress and sheer volume of decisions that have to be made every day with insufficient time and insufficient data would know that the answer to the question, ‘Can an idiot make it to the White House?’ is absolutely not.

“It is a world-class game of poker. Your worst enemies are always on your own team and you need people who owe you. That’s how you get to the table and then that’s how you get stuff done. You make it with IOUs. And I don’t think there is anyone who has more IOUs in their back pocket than Hillary Clinton. She is very good at that game.”

Test of character

Malmgren’s first hint at a place at the table was back in 2000 when Bush was governor of Texas. “I was working in London and I got a call from his chief economic adviser, who said, ‘Pippa, the governor is thinking of running for president and you are one of the few people who can explain the global economy to him in plain English. Would you come to Austin to brief him?’”

It was, of course, a job interview and the governor swiftly asked Malmgren to be part of his team during the campaign and to join his presidential staff when he won.

It is easy to see why she was targeted for the job. She is an LSE and Harvard-trained economics specialist who had headed the global asset management business for Bankers Trust in Asia and the global investment strategy business at UBS Warburg in London. She became the only woman on Bush’s National Economic Council between 2001 and 2002 and now sits on the British Ministry of Defence Working Group and the Greater London Authority Infrastructure Advisory Board.

Qualifications aside, Malmgren says the first test for anyone new on the presidential staff is entering the Oval Office for the first time. “It’s a character test,” she says. “Will you feel overwhelmed and in awe to the point of losing yourself? One of the most difficult things for the president of the United States or the prime minister of the UK – or for any chief executive of a big company – is to get people to tell them the truth. Most people become so overwhelmed by the power that they start to say what the guy wants to hear to stay in the game.”

But Malmgren had something rare to offer – the dampener of familiarity. Born and bred in Washington, her father, Harald Malmgren, was a trade negotiator who served in the administrations of John F Kennedy, Lyndon Johnson, Richard Nixon and Gerald Ford and the relative normality of the world of US politics stood her in good stead. “I consider my background an immense blessing,” she says. “I grew up in that world, so it seemed neither heady nor glamourous to me when I came to work at the White House.”

But while she may have passed the Oval Office test, no amount of presidential family history could have prepared her for the job itself.

Tough times

Enron hit first, just months after Malmgren took on her role. “The US saw seven out of the nine biggest bankruptcies in its history in just one year,” she says. “We had no idea that was going to happen and I got a call at 5am the day of the collapse telling me I needed to brief the president as the press were already gathering on the White House lawn.”

Then came 9/11. Malmgren was working in the White House that morning back when, staggeringly, there was no evacuation plan for presidential staff.

“We all went back to our offices after the second plane hit, though our phone lines had all been disabled. Then, I could faintly hear the sound of the Secret Service banging on heavy oak doors, getting closer and closer to mine, shouting ‘run don’t walk for the next exit’.

“The next day we all came in to work to deal with aftermath and I had to brief the president on the impact of having so much of our stock and bond markets wiped out. I remember thinking ‘Oh my god. They didn’t teach me this at the London School of Economics.’

“How do you tell the president of the United States that three-quarters of the US’s trading capabilities have been destroyed?”

In the end, it all came down to logistics and the physical implications of the attack on the world economy. The power station for the entire Lower Manhattan area – and the one that powered the New York Stock Exchange – was under the World Trade Center buildings. It had been destroyed and no one could turn the NYSE on to forward the data. The markets had closed but no one knew whether they were up or down. Malmgren and her team eventually contacted someone in the US military based in Maryland who was able to help them commandeer a power generator and get it up to New York to power the exchange. “You can study as much economic theory as you like but sometimes it comes down to practical decisions,” she shrugs.

The sub-prime story

On the subject of the sub-prime mortgage crisis, Malmgren’s pace noticeably slows. Even though she is a skilled orator and economic policy expert, she takes her time answering questions on who was to blame for the disaster – one that tipped the world into a global economic meltdown.

“It is a fair question,” she says gently. “I think the problem was linear thinking. Borrowers who believed their incomes would only rise, lenders who believed the economy would only get stronger, politicians promising more to citizens [ie spending on the fiscal side[, the belief growth would continue and citizens asking for expenditure based on that same linear growth projection.”

Is that fair? Did the US citizens really understand the implications of their demands? “Some did, some didn’t,” comes the pared-back answer. “But there were a million signals that something wasn’t right. Who was responsible is one part of the question. Why they couldn’t see it is another. But that’s not about financial markets. It is about humans. We don’t listen to what anyone tells us about love. We have to get hurt to learn. It is the same when it comes to a generation of people losing their savings. We can’t see it until we have been through it.”

Inflation protection

So how soon should we prepare to go through it again?

“We have some artificial groundswell caused by central banks throwing record amounts of cash into their economies, which is potentially dangerous,” says Malmgren. “You know, when everyone feels slightly sick to their stomach.

“When central banks want to create inflation they usually succeed. And we are witnessing inflation here in the UK, in the US, in most emerging markets. Biflation maybe. One the one hand, we are seeing inflation in the stock market, in property, asset values, art, diamonds. They have risen to extraordinary heights and continue to go up. Then you have inflation of whatever is critical to live – transport fares, school fees, healthcare costs.

“But technically, banks don’t count asset prices so they are able to say there is no inflation. In fact we have just hit pretty much a zero inflation rate in the UK. So it is almost like two different economies. Mark Carney has told businesses they should think about a world in which business costs are higher in two years’ time than they are now. In other words, he expects his effort to create inflation will work.”

She adds that this could prove good news for the UK property sector as her clients are looking to invest in inflation-protected assets. “Sovereign and pension funds will continue to buy property in the UK but the types of property have changed,” she says. “They are less interested in trophy assets and more in those with genuine, unimpaired cash flows – useful properties, like sheds near Manchester airport.”

So, she advised the US president. But what would Malmgren say to the UK party leaders, given a chance?

“In the run-up to the general election, I would say this: the UK leadership goes round in circles on budget and spending for things such as high-speed rail and infrastructure. I keep thinking, “Why do you have to spend any money on that?’ Every foreign investor in the world is dying to spend their money on it. You have to permit the foreigners to come on in and deploy the capital here.”

As the interview draws to a close, Malmgren’s final message revisits the issue of women in positions of power.

“I did turn it back on, you know. My femininity. Now I feel a responsibility to fully embrace being a woman and to give others permission to dress how they like and be themselves. But I took part in a debate on stage recently with some powerful men and the write-up said that I had won but also that I was wearing a leather skirt. That wouldn’t have happened if I were a man.

“Women can be powerful and feminine but I stand by what I said. Sometimes that comes at a price.”

Malmgren’s musings

Barack Obama “I have been a critic of president Obama, but it is not partisan. It is not about him being a Democrat. He is one of the few presidents we have had who had never operated the machinery before he took on the job. We like to elect governors. If you have managed a budget of that size, you can manage Washington. Obama hadn’t done that before and I think he was overwhelmed and when he arrived the Democrats took one look at him and said: ‘Look kid, you are lucky you even got here at all. You don’t have a clue what you’re doing and you don’t have any chips in your pocket so shut up, sit down and we’ll tell you what to do and which cards to play when.’”

House of Cards “I met the author recently. A marvellous guy. And I said to him ‘I think that when you write you’re holding back because you know if you said what actually happens it is so dark that no one would believe it’ and he replied: ‘You must be from Washington’. It is not quite as dark as reality, which I know is terrifying. Claire Underwood is a real person. There are so many political wives like that and she is the reincarnation of Lady Macbeth.”

The West Wing “Again, it is very similar. The White House is the same. Just as fast if not faster.”

Air Force One “A lot of people can get overwhelmed by the Oval Office and, of course, the toys that go with it – including Air Force One. I have been on it and yes, it is amazing. There is one room that looks like a meeting room with two seats in it but it converts almost instantly into an operating theatre equipped to do everything, including open-heart surgery.”