The price of performing commercial real estate loan portfolios is expected to increase even further in 2015, while price expectations for non-performing loans have dropped off, according to new research from PwC.

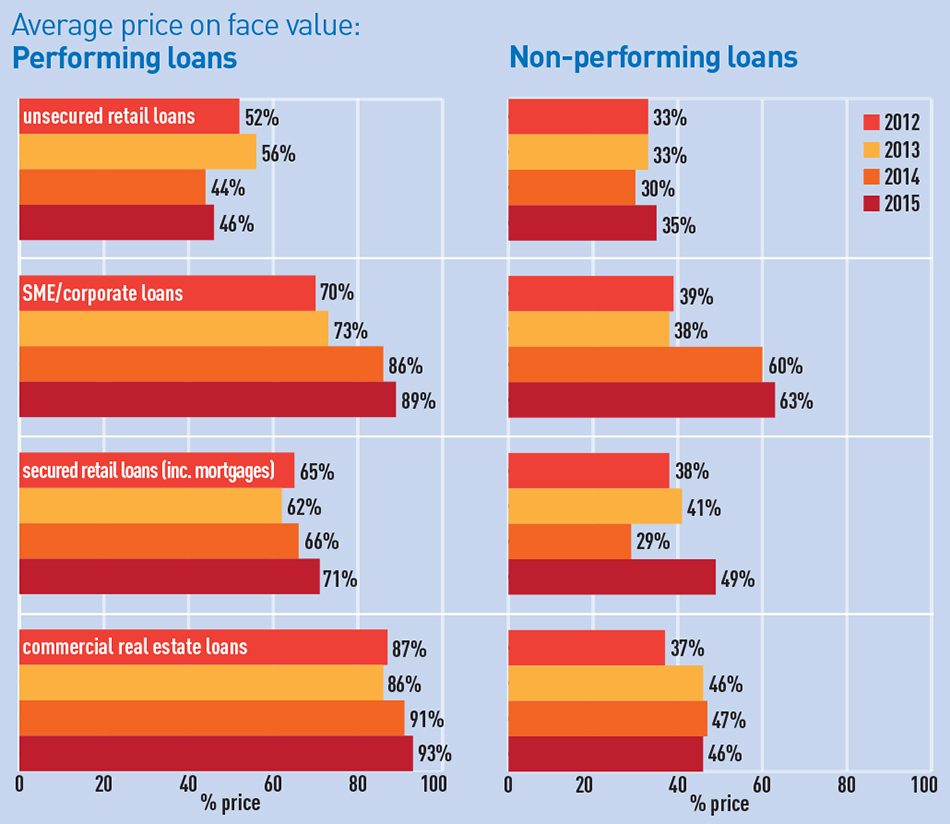

The latest Market Survey, produced by PwC’s portfolio advisory group, shows that the average price the consultancy firm’s clients expect to pay for performing loans has jumped to 93% of the face value of loans, compared with 91% paid last year.

JP Morgan was the most active buyer of performing loans in Europe in 2014, acquiring the performing €2.2bn (£1.6bn) half of Project Octopus, which was made up of loans held against Spanish real estate issued by Eurohypo and £2.7bn of UK mortgages from the government issued initially by Northern Rock and Bradford & Bingley.

Meanwhile, PwC expects that prices paid for non-performing loans will dip this year, down to 46% from 47%, as the quality of portfolios coming to market is expected to worsen and increase in granularity.

Expected returns from the real estate loan market this year have remained steady, despite the increased competition. For performing loans, investors expect an unleveraged return of 5%, while for non-performing loans 20% returns are expected – the same figures as in 2014.

Investors are expected to increase their use of leverage this year. According to PwC, the number of investors expecting to use no leverage to buy loans dropped by 21% and those looking to leverage at the most aggressive level of above 75% of the price being paid for loans increased by 5%.