The $23bn (£15.7bn) sale by GE Capital of the majority of its real estate debt and assets to Blackstone and Wells Fargo last week is the largest global real estate transaction to have completed since the global financial crisis. It accelerates the varying business plans of the three US titans as they opt in and out of different areas of the sector. GE’s real estate equity business has been a potential target for the past three years, but its exit from lending was a surprise. Although some early-stage enquiries were thought to have been made, the deal itself took only a month. David Hatcher examines why each of the trio was so eager to get the deal completed

GE Capita: driving the deal

The origin of the deal can be linked back to the economic chaos of 2008. The US Fed insured $139bn of GE Capital’s debt as a result of financial instability in November 2008 but in return it had to undergo arduous supervision from government.

The origin of the deal can be linked back to the economic chaos of 2008. The US Fed insured $139bn of GE Capital’s debt as a result of financial instability in November 2008 but in return it had to undergo arduous supervision from government.

This bureaucratic factor, rather than an anti-real estate view from the GE management, has been the driver of the deal and is part of a much wider sell-off of the entire GE Capital business. GE is choosing to focus on its more industrial roots, where its management believe it can gain greater returns.

In 2012, GE began to reduce its exposure to direct real estate equity by focusing on lending to property. This was a directive from the highest level at the Thomas Edison-founded conglomerate that reflected the relative attractiveness and high returns that could be made from lending, given the lack of debt available globally at the time, in comparison to direct real estate.

It then owned €12.6bn (£9.1bn) of European assets but had until prior to the deal with Blackstone and Wells Fargo wound this down to €6bn, albeit having grown a senior lending business of the same size.

The deal with Blackstone and Wells Fargo accounts for the majority of GE’s real estate business but there are still notable and sought-after elements remaining that it is targeting an exit from before the end of the year.

In Asia, neither Blackstone nor Wells Fargo opted to buy GE’s Japanese real estate lending business. Blackstone bought its equity business in the country last November for $1.6bn.

In Europe, the German business remains and there is already a competitive process to buy this which is close to finalisation. Its French business also remains unsold; this process is considerably further behind owing to France’s stringent employment laws.

Elements of its loan portfolio that are not performing are also to be sold.

Decisions over the transfer of any GE employees to Wells Fargo and Blackstone have not yet been made, including the future of Ellen Brunsberg, president and chief executive of the GE real estate business in Europe.

Brunsberg was promoted to the position in March, having taken over from the retiring Lennart Sten.

Blackstone: allocating elements

For Blackstone the GE buy is the latest mega deal led by its global head of real estate Jon Gray, following on from its $26bn (£17.6bn) purchase of Hilton Hotels -Corporation and its $39bn deal for Sam Zell’s Equity Office Properties Trust, both in 2007.

For Blackstone the GE buy is the latest mega deal led by its global head of real estate Jon Gray, following on from its $26bn (£17.6bn) purchase of Hilton Hotels -Corporation and its $39bn deal for Sam Zell’s Equity Office Properties Trust, both in 2007.

The variety and amount of capital that the private equity fund manager has raised has allowed it to buy different elements of GE’s portfolio with different allocations.

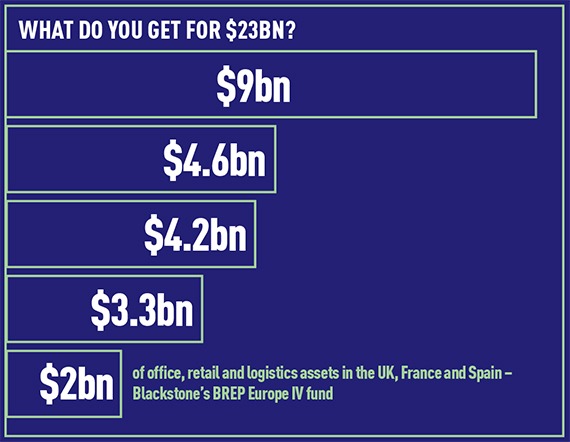

Its global BREP VIII fund bought the US office assets for $3.3bn; its BREP Europe IV fund bought the €1.9bn of European assets; its BREDS debt fund, which focuses on higher-yielding debt, bought the $4.2bn of Mexican and Australian loans; and its senior debt-focused listed mortgage REIT, BXMT, bought $4.6bn of US loans. Each vehicle as a result is making major leaps forward in deploying the billions of dollars of capital they hold.

On the back of the deal Blackstone shares rose by nearly 2.5% and shares in its mortgage trust rose by almost 8%. For the mortgage trust, its purchase of $4.4bn of loans, for which it paid $4.2bn, was sweetened with a $4bn loan from Wells Fargo.

The industrial element of the European portfolio adds 37 assets totalling 7.7m sq ft across France, Spain and the UK to Blackstone’s Logicor business. Logicor now totals around 80m sq ft across the Continent, having only been launched in 2012. The buy does not have any material impact on the timing of a potential sale or IPO, which is far from imminent.

The retail assets are to be incorporated into Blackstone’s Multi retail platform and comprise seven properties in Italy, Slovakia and the Czech Republic totalling 1.6m sq ft. Similarly, the deal is not expected to change Blackstone’s plan for exiting Multi.

Blackstone embarked on a strategy to buy core-plus office properties in Europe and the US early last year but none of the assets in the portfolio is suitable for that strategy.

Office buildings in the portfolio include 60,000 sq ft office development 98 New Fetter Lane, EC4; the 24,000 sq ft 10 Lloyds Avenue, EC3, and 94 Rue de Provence in Paris.

Parties have already approached Blackstone to buy parts of the European business it has inherited. It may sell off assets it considers less desirable.

Wells Fargo: increased contact

Wells Fargo is the largest originator of real estate loans in the US, according to research by the Mortgage Bankers Association, having originated $50.3bn of deals last year.

Wells Fargo is the largest originator of real estate loans in the US, according to research by the Mortgage Bankers Association, having originated $50.3bn of deals last year.

The $9bn performing loan book that it has purchased from GE will go predominantly towards adding even more clients to its contacts book on that side of the Atlantic – 79%, or $7.3bn, of the loans are held against US and Canadian real estate.

Buying the loan portfolio allows Wells Fargo to incorporate higher-yielding finance into its book. This is in the context of the current lending environment, where interest rates are low and margins are being squeezed owing to stiff competition.

This also applies to the UK market, where it has acquired $1.7bn of loans from GE. In the UK its lending business is considerably smaller – it holds a loan book of £4bn at present, albeit with an increasingly active presence. It entered the UK lending market in January 2013, relocating originators Cullen Powell and Robert Maddox to London, but its real boon was the purchase of Commerzbank’s £2.7bn UK performing property book in July 2013. The book was originated by Commerz’s Eurohypo property arm and allowed it to incorporate Max Sinclair as its head of office and Mike Acratopulo as managing director and head of origination.

GE bought Deutsche Postbank’s £1.4bn UK performing commercial loan book in October 2013 as the German lender made a similar move to Commerz. In acquiring the book Wells Fargo will have the chance to refinance the clients within it as well as form relationships that may lead to new lending. When purchased, the book included loans to Almacantar and Argent.

Since Wells Fargo’s purchase of the Commerz book, it has been one of the most active lenders in the UK on prime property as well as funding a number of non-performing loan portfolio deals for its highly acquisitive client, Lone Star.

In acquiring the book Wells Fargo will inherit only one loan used to fund an NPL purchase, which was extended to Blackstone to buy the €1.1bn Project Tower loans held against assets owned by Irish developer Michael O’Flynn last March.

With Blackstone now in full control of most assets, the loan-on-loan is to be converted into a standard loan.

GE’s book also includes loans held against Ares’ 10 Fleet Place, EC4, and Blackstone’s St Enoch Shopping centre in Glasgow.