Yields in the private rented sector continued to strengthen in the first quarter of 2015 as low-cost funding and government guarantees made the sector more attractive to institutional investors.

The latest quarterly benchmark data from CBRE revealed that regional investments were the most popular in the first three months of the year, along with assets in outer London.

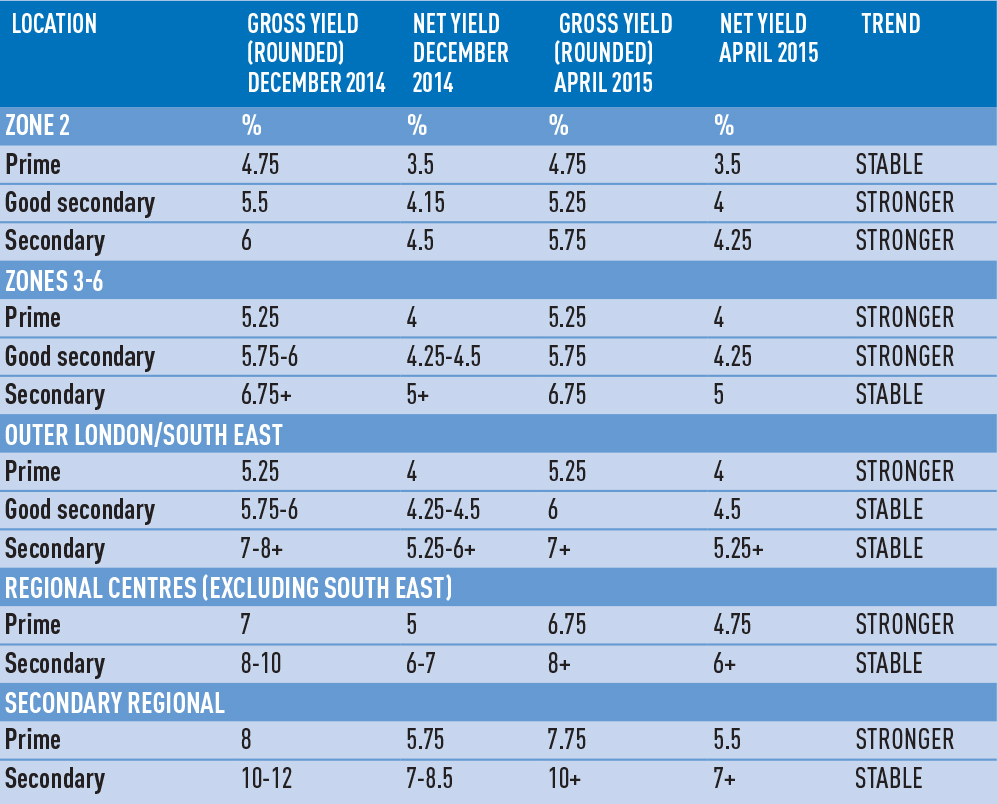

Regional cities outside of the South East saw yields tighten from 7% to 4.75%. In the regions yields fell from 8% to 5.5%.

In London, zones 3-6 improved the most over the quarter, with yields tightening by 125bps on prime stock and between 150 and 200bps on secondary stock. In particular, big deals by UK institutions helped to tighten average yields.

Legal & General Property’s 300-unit acquisition at Ferry Lane, Walthamstow, E17, marked the firm’s first investment as part of its strategy to invest £1bn in PRS over the coming years.

Aberdeen Asset Management’s £60m investment in 180 Stratford High Street, E15, also helped yields tighten in zones 3-6.

In London’s zone 2 it was the quality secondary investments that saw yields improve the most. Quality secondary improved by 150bps, with general secondary improving by 175bps.