Prologis is pushing north from its Northamptonshire heartland – travelling further up the M1 into Leicestershire.

It is not the only big shed developer and investor heading that way. With demand stronger than ever, and land supplies in the key Golden Triangle locations under pressure, everyone is looking for new sites. Leicestershire could be their destination.

According to research by Savills and MDS Transmodal, the East Midlands will need another 4,370 acres of extra logistics land by 2036. Leicestershire alone will need another 1,130 acres. They estimate that the region needs space for another 15m sq ft of big-box warehousing. Together with the replacement of increasingly dated standing stock, they estimate the East Midlands will need land for 78.5m sq ft of sheds within the next 21 years.

These are mind-bogglingly big numbers. Mike Hadfield, director at MDS Transmodal, explains that the East Midlands’ standing stock of 334 big-box warehouses – a total of 87m sq ft – is approaching a watershed.

“A lot of the 1980s sheds have reached or are reaching the end of their life. There is increasingly functional obsolescence in 1990s warehousing designed for pallet-in pallet-out operations, but which are not suitable for handling individual consignments, and retrofitting to make them suitable for e-commerce won’t work,” says Hadfield.

So where will the extra 4,037 acres come from? That is not as clear as it might be. Hadfield and his colleagues have warned Leicestershire’s local councils that the research report has to be a starting point, not an end point. They recommended councils set up a site selection task force.

“Without some work on site selection our report will just gather dust on a shelf. There are signs they will do what is needed. The land is there, but they have to face the political difficulty of building on green belt or greenfield sites,” he says. “Our view is that some of the older warehousing sites would be more suitable for housing, and so councils have an opportunity to tidy-up their zoning.”

Developers are watching with interest – and Prologis is watching more keenly than most. Robin Woodbridge is senior vice-president and the man responsible for the firm’s mighty Daventry rail freight terminal development, DIRFT (pictured).

“Our focus to date has been Northamptonshire, but we are now looking further north into Leicestershire, and there appears to be not quite so much land compared with Northamptonshire, where the local councils have been more aware of need because it has been the main logistics market for so long,” he says.

Woodbridge says Northamptonshire’s planners are making provision in the latest core strategies. Meanwhile, Prologis has made provision of its own. DIRFT III, Midway Park at junction 16 of the M1, Pineham, and more means it has 10m sq ft of consented development in the county already. “In the short-to-medium term, land supply is not an issue – we are not at the nightmare stage – but long-term it may be different,” he says.

“Councils are allocating sites, but we have got to be careful that plots are the right size and shape and in the right location – not just a load of sites that will not deliver the size and shape of buildings occupiers need. We have seen up the M1 motorway lots of tiny plots that just cannot take big sheds, although the message is now getting through that the key is bigger, regular-shaped plots, flat land, and access to transport.”

Prologis is not worried (yet) that land supply problems are being exacerbated by competition from residential developers. However, it is beginning to find residential developers bidding against it for mid-sized urban fringe sites and this is something the company is watching.

Peter Monks, associate director at Colliers International in Birmingham, says Leicestershire’s councils will need to make extra provision because developers are on the move.

“Leicestershire is the in-demand location, perhaps because of a lack of supply elsewhere, although it might also be because locations further up the M1 are more appropriate supply chain solutions these days. The county has a pipeline of development and we are now seeing developers going forward on sites they had been sitting on, because Leicestershire industrial rents had lagged behind Northamptonshire – perhaps £5.75-£5.95 per sq ft, compared with £6.25 per sq ft. So it is paying developers to take Leicestershire sites out of the deep-freeze because their appraisals now stack up.”

Geoff Gibson, head of the Leicester office at Lambert Smith Hampton, sees the same trend. “Demand is moving up the motorway into Leicestershire, but the supply of land here has always been limited, both for big logistics sites and local owner-occupiers. Land is like gold-dust – you just can’t get it. Some sites have been talked about for 25 years or more,” he says.

“In the present allocation we probably have enough land for the medium term, but beyond that, for 10-15 years that will mean looking at sites near the airport, such as Roxhill’s 6m sq ft East Midlands Gateway.”

With more demand heading north from Northamptonshire, the competition for sites is set to intensify.

M&G rolls into town

M&G Real Estate became the latest big name to invest in Leicestershire sheds when in January it announced funding for a 480,800 sq ft scheme at Wilson Bowden’s Optimus Park.

Two buildings of 276,100 sq ft and 204,700 sq ft will be built at Junction 21a of the M1 near Leicester. M&G Real Estate will acquire the 24.3-acre site.

Andrew Windle, associate director at M&G Real Estate, says: “There is a limited supply of logistics accommodation in core locations such as the M1 corridor.”

Strong interest and major enquiries are already in evidence, adds Wilson Bowden.

NRS acted for M&G Real Estate; Burbage Realty represented Wilson Bowden.

The Lincs link

Finding large flat sites is not a problem in Lincolnshire – a county of remarkable flatness.

Tim Downing, senior partner at Pygott & Crone, says: “There are difficulties finding sites in parts of the East Midlands, but we are lucky in Lincolnshire as we have the space to build on and an improving infrastructure to support this.

“There are national concerns that planning for housing will take priority over logistics and employment sites and will increase the values but, again, Lincolnshire has already addressed its housing needs and allocated land for this. So this will not be an issue in Lincolnshire.”

Notts untangled

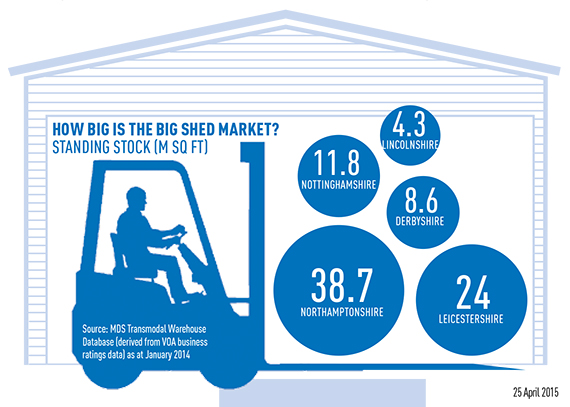

Could Nottinghamshire emerge as the next centre for transport and logistics? With demand already heading up the M1 to Leicestershire, hopes are high that neighbouring Nottinghamshire could grab some of the action. Today, at 11.8m sq ft of standing stock, its big-shed scene is barely half the size of Leicestershire’s.

New figures from Invest Ashfield & Mansfield show that Nottinghamshire’s transport and logistics sector is growing, thanks to preferential land values, site shortages further south, and the value of the M1-A38 crossroads.

In the past five years, logistics company Taylor’s Transport Group, based in Ashfield, has added 201,000 sq ft across eight sites to its warehousing portfolio, helping to push turnover up by 150%.

General manager Jean-Gil Abbate says: “Land here is a cost-effective investment and it is in good supply. We have been able to find the right facilities, on the right sites, at the right price.”