It is getting increasingly tricky for the publicity-shy Charles Street Buildings Group to continue its modus operandi of flying under the radar, as it has done successfully for more than 50 years. However, after securing the largest office deals in both Nottingham and Leicester last year, being named the region’s wealthiest property company in EG’s 2014 Rich List and with a large-scale urban regeneration project in the offing, the Leicester-based, family-run property company is destined to spend more time in the spotlight.

So it is perhaps no surprise that Leicester’s biggest private landlord has eschewed a glitzy city centre glass and steel HQ in favour of a pseudo-Swiss chalet located in the centre of a part-residential, part-industrial area in the unassuming suburb of Thurmaston. It is over the threshold of this recently self-built, 10,000 sq ft building, after a tour of its local sites, that Estates Gazette exclusively steps for the first-ever interview with director and group solicitor Joseph Murphy.

A former property litigation solicitor with Pinsent Mason, Murphy cuts a corporate City image in his hand-stitched pinstripe suit. But with property in the blood he is animated and passionate about the business, the day-to-day running of which he shares with his father (hands-on chairman Hugh) and fellow board directors, who include his mother, brother and sister. He says: “We are not generally on the radar. The portfolio is valuable, but we just don’t shout about it.”

A former property litigation solicitor with Pinsent Mason, Murphy cuts a corporate City image in his hand-stitched pinstripe suit. But with property in the blood he is animated and passionate about the business, the day-to-day running of which he shares with his father (hands-on chairman Hugh) and fellow board directors, who include his mother, brother and sister. He says: “We are not generally on the radar. The portfolio is valuable, but we just don’t shout about it.”

Over several decades, the firm has quietly bought up offices, industrial and retail space. Industrial and warehouse space is the company’s bread and butter and boasts virtually zero voids, reflecting the proactive approach the company takes when dealing with tenants. Now, though, CSB is turning its attention to a much more high-profile proposition: the regeneration of an eight-acre site it owns in Leicester’s Waterside area – a natural extension to Hammerson’s successful Highcross retail and leisure scheme.

Known internally as Project Medius, and as Waterside to locals, the site includes the now-demolished Stibbe building on Vaughan Way, fronting the inner ring road and facing Hammerson’s Highcross, and the Leicester Central railway station on Great Central Street, which closed in 1969. What is now a largely derelict landscape may in future turn into a vibrant extension of the city centre, linking it to the River Soar.

At the heart of CSB’s plans is transforming the run-down Leicester Central Station into a 100-bedroom boutique hotel, while removing part of the viaduct to create independent cafés and restaurants in the remaining arches, as well as public open spaces. Meanwhile, around 110,000 sq ft of new space – comprising 90,000 sq ft of offices and 20,000 sq ft of ground-floor A3 space – could be provided in two buildings on the neighbouring one-acre Stibbe site as the first phase of development. The second phase could see a further 450,000-500,000 sq ft of mixed-use development on a site that houses redundant industrial stock.

Murphy says: “Malmaison has looked at the site. It is a natural extension to Highcross but we haven’t talked to Hammerson about our plans as yet. We have met with Leicester city council on a number of occasions. Our consultants are working with LCC to resolve highway constraints. We can’t move forward on potential occupiers until we know if the highways issue can be resolved.”

Murphy says the scheme can go ahead only if the council agrees to calm or reroute the busy A50 that runs through the site so the area can be pedestrianised to encourage footfall from Highcross. “That’s the only way this development can work,” he adds. If negotiations are successful, the firm intends to submit a planning application later this year.

In the meantime, Charles Street continues to keep a weather eye on suitable investment purchases. As a cash buyer, the firm is in a strong position when it finds a target property to add to the portfolio. Although acquisitions are few, the firm rarely sells. Its largest investment to date is the £45m purchase in 2007 of the 51,500 sq ft 1 Bessborough Gardens, SW1.

The group prefers to invest in fully prelet schemes, says Murphy, which are let to single occupiers and in a good location. He cites as an example the E.on building in Nottingham, where CSBG struck a deal with Miller Birch in 2011 to pre-fund and acquire the 105,000 sq ft bespoke office block. Murphy says: “This was attractive because of the green nature of the building and the

covenant strength of E.on. It ticked all the boxes.”

Family history

Family history looms large at the group. During the 1930s, six Murphy brothers relocated from South Armagh, Northern Ireland, to Leicester. In 1945, Joseph’s great-grandfather Hughie and uncle Paddy founded Murphy Bros and the original business involved buying and selling vehicles and a contractors plant. Fast-forward to 1954, and Murphy Bros had expanded and built itself a new depot on a large site in Thurmaston. Around 25 acres of land was surplus to requirements: it became the catalyst for speculative design-and-build projects.

In 1956, a site at 74-82 Charles Street in Leicester was acquired and a new office block was built. In 1961 Charles Street Buildings (Leicester) was incorporated and became the principal property company within Murphy Bros.

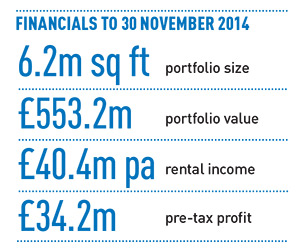

CSB is ranked as the richest East Midlands’ property company in EG’s 2014 Rich List.

Helen Donnellan, head of inward investment at Leicester city council, describes the firm as an “asset” to the city. “CSB is always looking to provide the best possible results for its clients, which is great for Leicester,” she adds.

If the Waterside development comes to fruition, the next 10 years could see Charles Street dedicate increasing attention to regeneration projects. “There’s also the possibility of massive redevelopment of our existing industrial and warehouse stock,” says Murphy.

As for the future, he adds: “I’d love my kids to be involved in the business. My dad always says the first generation makes it, the second generation consolidates and builds and the third generation messes things up. Well, we’re now coming into the third generation, so we don’t want to be responsible for that.”

Key deals

Charles Street Buildings Group hit the headlines earlier this month for striking a pre-sale deal with Opus Land for a 52,000 sq ft Waitrose store in Worcester. The £20m pre-funding and purchase will see a new store open in spring next year. Prelet to Waitrose at a rent of more than £940,000 pa, a 20-year lease has been agreed.

Last October, the group netted the largest city centre office deal in Nottingham for four years: pharmaceutical giant Parexel International came back into the city centre to consolidate its operation into CSBG’s entire 62,000 sq ft building at 2 Castle Wharf on Maid Marion Way. A comprehensive refurbishment of the building ensued and practical completion was reached last week. Parexel agreed a 15-year lease with a 10-year break at a rent of £930,000 pa (£15 per sq ft).

In Leicester, the group negotiated a re-gear of HSBC’s lease at its 61,000 sq ft De Montfort Street operation for £866,400 pa, securing the bank’s future in the city for another five to 10 years.