Some people may not see the huge sheds that power industry as the most exciting of real estate sectors, but for San Francisco- based Prologis, the big-box market is proving to be the right place to put its and, increasingly, other people’s money.

As at the end of December 2014 the group’s portfolio was valued at $45.6bn (£30.3bn), spread across the Americas, Europe and Asia, making the firm the world’s largest investor in industrial space.

And in the past week the company, with its partner Norges Bank, the sovereign wealth fund of Norway, has increased its portfolio with the $5.9bn purchase of KTR Capital in the US.

The deal comes on top of what has been a good quarter for Prologis. In the first three months of 2015, it boosted its global revenues by 6% year-on-year to nearly $463m.

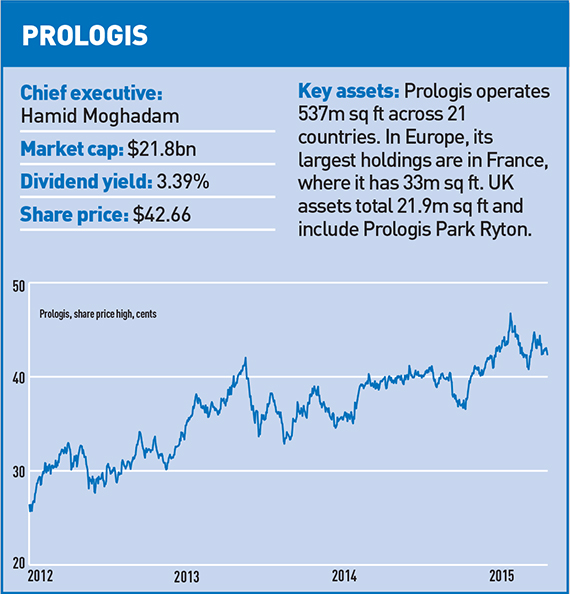

The company is headed by chairman and chief executive Hamid Moghadam, who founded AMB Property Corporation, with which Prologis merged in 2011.

It operates across the world in two segments: an operating company for its own investments and a fund management arm for partners and other investors.

In December 2014 the European operating business controlled more than 11m sq ft of property and had a $2.8bn development pipeline.

The European strategic capital business was responsible for another $11.8bn of properties on behalf of Prologis and its co-investors.

According to Philip Dunne, president of Prologis Europe, the Continent is an interesting and diverse market, and offers different challenges to the US.

Capital inflows and increased competition in the industrial sector, especially in the UK, have prompted the company to revise its M&A strategy.

“Now our focus is turning it down on third party acquisitions and ramping up our development machine,” says Dunne.

“We did just under a billion [€915m, or £652.8m] in acquisitions in Europe last year and I think we will do something significantly less than that this year,” he adds.

“We will buy buildings if they are priced sensibly and are accretive to our total returns and we will develop where we have the best land right across Europe,” he says.

Most of those “sensibly priced” opportunities will present themselves in southern and central Europe, says Dunne. In the first three months of the year Prologis Europe acquired €91m of buildings in Italy and Hungary.

What the company is not exploring in Europe is the corporate acquisition trail the US business has pursued with KTR.

Dunne says: “I don’t see anything out there that would make any sense for us in Europe, today at least.”

Pursuing this strategy through 2014 and up to the end of March 2015 has given the European business 163m sq ft of leased and development properties. Of the development opportunities, only 27% are speculative, with strong demand in the core territories of the UK, Poland and Belgium.

Demand for space is set to increase too as the European economy strengthens. This will drive up the 94.5% occupancy rate that Prologis already had at the end of March this year, and hopefully, says Dunne, its rental income stream across Europe.

He says Prologis has done well by getting into European industrials early in the cycle. It is now hoping that by moving deeper into development and southern Europe, it can continue that success into 2016.

As a result, Dunne is satisfied with the 25% contribution that Europe made to the group’s $463m of Q1 revenue.

The group’s overall first quarter earnings were more than 73 times its Q1 2014 earnings, and with the KTR acquisition, further growth is likely.

The consensus among 23 equity analysts has the company as a buy recommendation with an average target price of $47.97 – the current price is around $42.66. That price would give Prologis a market cap of $24.6bn, almost double that of British Land, one of those companies that some may label an owner of “more exciting” assets.