A

t this time, perhaps more than ever, it is worth reminding ourselves that it is the big economic forces, not the decisions of politicians, that really make the difference.

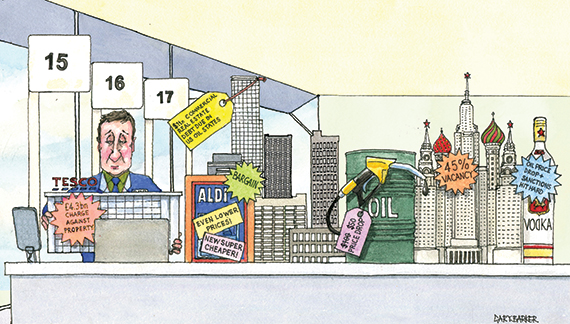

Let me take a couple of current examples. On 22 April Tesco announced a record loss for a British retailer of £6.4bn. For a business that not so long ago could do nothing wrong, this was an astonishing reversal.

Tesco announced impairment charges of £4.3bn on property, plant and equipment, as a result of a reassessment of fair values for its stores. This was not the first time the retail giant has taken a significant charge against its property assets; a few months ago it announced that it was cancelling the rollout of 49 planned new stores.

Tesco is not the only supermarket to be so affected – though its impairment charges stand out from the pack – and we probably have not seen the last of this in the sector. The point is that the forces that are affecting Tesco’s property portfolio, and probably driving the company’s head office move from Cheshunt to Welwyn Garden City, are both powerful and inherently unpredictable.

Who would have thought that, after years of regarding Aldi and Lidl as curiosities, the British public would suddenly have taken to them with enthusiasm? Who would have thought that shoppers would start to shun the big weekly shop at an out-of-town superstore in favour of smaller, more frequent shops? When these big economic shifts happen, it is often property that gets left high and dry.

Take another of those big shifts: the fall in oil prices. The halving of the oil price to less than $50 (£33) per barrel in the final six months of 2014 was one of those developments that everyone was apparently able to predict with hindsight.

The price has since recovered some ground, but this has been the equivalent of a tax cut for consumers and a big hit for producers.

There are reports that the fall in crude prices has made it difficult to refinance more than $1tn of commercial real estate debt in the US. Bloomberg, citing Green Street Advisors, reported that investors are adjusting their underwriting in states such as Texas and North Dakota, as they prepare for cutbacks at energy companies.

In Russia, the combination of a falling oil price and Western sanctions is having a big impact on property. A third of shopping centre projects in Moscow are said to have been halted in response to the economy’s sharp downturn. The Financial Times recently reported that vacancy rates in Moscow-City, the capital’s premier business district, are 45% and rental values have almost halved.

The big question is what effect the slump will have on the Middle East. The evidence so far is that the impact has been muted. Investors are still hungry for property investments around the globe.

But the fact that current talk is about the impact of lower oil prices, rather than spending the oil dividend, is a reminder of how quickly things can change. It really is the economy, stupid.

David Smith is economics editor at the Sunday Times