As TIAA Henderson prepares to explore the sale of a substantial stake in one of the country’s most eagerly anticipated developments, Edinburgh St James, appetite for shopping centre developments is increasing.

As TIAA Henderson prepares to explore the sale of a substantial stake in one of the country’s most eagerly anticipated developments, Edinburgh St James, appetite for shopping centre developments is increasing.

The brakes were put on most major developments following the downturn in 2008 in response to a slowdown in consumer spending and a lack of finance. Now, though, those factors are in reverse.

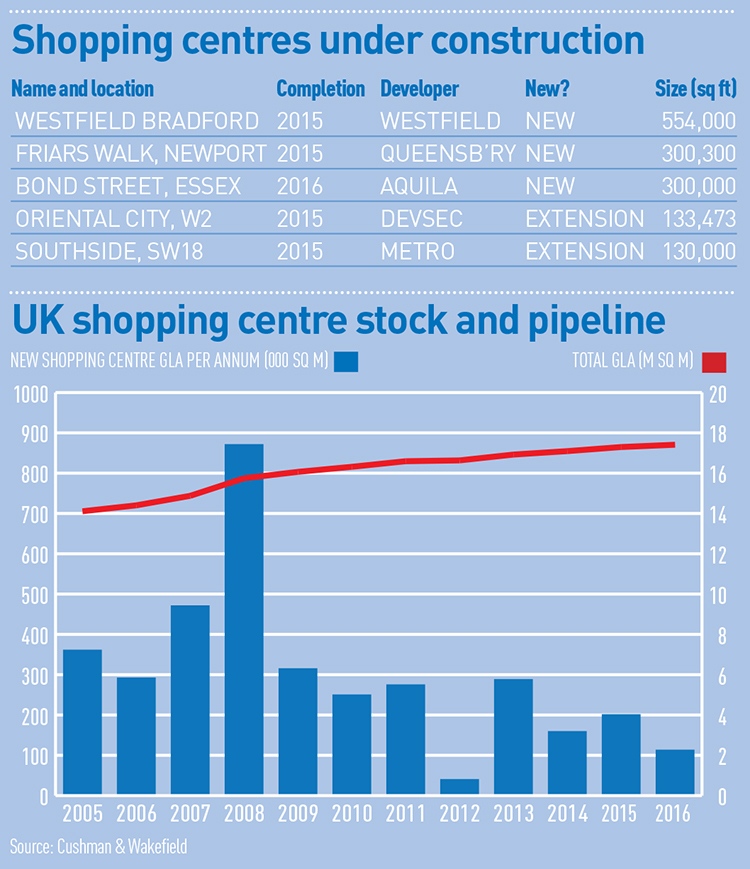

According to research by Cushman & Wakefield, 3.5m sq ft of projects are due to complete before the end of the year.

“Timing is everything,” says Chris Geaves, chief executive of Sovereign Land. And from an investment perspective, the timing is looking right.

The 2008 schemes that fell apart through lack of funding are becoming viable again, end values are increasing and there is renewed support from local authorities and the government for retail-led regeneration. Overall optimism has also produced more retailers, which means more names in the leasing market to fill the new space.

Paul Sargent, chief executive of Queensberry, says: “Those that failed in circa 2008 are coming back with government support, which unlocks viability and funding. This means that the investors can get on board early on.”

Of the 25 shopping centre projects under way, only nine are new-ground schemes, implying that redevelopments and extensions, such as Edinburgh St James, will be the most popular with potential investors.

“There will be more regeneration projects,” says Geaves. “Existing stock that is becoming aged and outdated needs to be rejuvenated.”

This makes sense, as redevelopment projects are easier, more viable, and more likely to gain government support.

“Ground-up development is much harder,” says Sargent, who is currently developing the new 390,000 sq ft Friars Walk centre on behalf of Newport city council.

“There is still a long way to go, and it will take a couple of schemes to get up and running to get more people involved.”

And although redevelopments do not take as long as ground-up projects, the nature of the changing retail market means that developments need to be on site for as short a time as possible.

Geaves says: “Unless you can get the retailers out, then developments rely on lease expiry. When looking at past examples we can see that some of these proposals never even happen. Either they are too ambitious, totally unviable, or there is not sufficient demand to underpin them.”

Co-operation and support from local authorities is a key component for making developments a reality.

Neil Crawford, retail development manager at Legal & General Property, says: “It is essential to have the local authorities with you and work together.”

Some plans have been seen as too ambitious, forcing developers to rework them to reduce the net increase in space.

Crawford says: “What we are experiencing on a large scale is a downsizing of initial plans to make them more viable.”

One factor limiting the longevity of these schemes is the requirement that they adapt to changing trends in shopping and supply what future customers will want.

Increasing the leisure aspects of centres, allowing for more dwell time, as well as integrating residential into retail schemes, are strong trends.

Geaves says: “We can expect to see the big fashion retailers take bigger stores, as well as seeing more food and beverage offers, which is what is needed to capture the customer and keep them in the centre.”