Glasgow and Edinburgh’s office markets don’t normally speak with one voice, but in a rare moment of unity, the message from both cities is the same: available grade-A stock is disappearing. Fast.

Glasgow and Edinburgh’s office markets don’t normally speak with one voice, but in a rare moment of unity, the message from both cities is the same: available grade-A stock is disappearing. Fast.

The situation is most acute in Edinburgh, where one of three schemes in the pipeline, Standard Life’s 108,000 sq ft 3-8 St Andrew Square, was unexpectedly taken out of the running just before Christmas when the Edinburgh-based insurer decided to occupy the building itself. That leaves just 220,000 sq ft in Moorfield’s Quartermile 4 and Interserve/Tiger’s The Haymarket 5 up for grabs. And the earliest completion is now April 2016 (at Quartermile).

In Glasgow, space is available in all three projects due to complete before this autumn, though both BAM and Clearbell have already signed up tenants at, respectively, 110 Queen Street and 1 West Regent Street. With Abstract’s St Vincent Plaza (pictured) making up the trio, only around 330,000 sq ft remains – in stark contrast to average annual take-up of 500,000 sq ft and, according to CBRE senior director Audrey Dobson, some 700,000 sq ft of large named requirements.

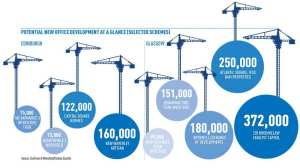

The potential supply shortage could see developers press the button earlier than expected on the next generation of speculatively developed buildings in both cities (see graphic) – possibly later this year. That may still not be soon enough for firms looking to make a move and cases of gazumping are starting to occur (see below).

The potential supply shortage could see developers press the button earlier than expected on the next generation of speculatively developed buildings in both cities (see graphic) – possibly later this year. That may still not be soon enough for firms looking to make a move and cases of gazumping are starting to occur (see below).

“As people see space under construction being let and realise the length of the gestation period for new-build, they are looking for space earlier than they’d like to,” says Dobson.

It’s a view echoed by Paul Curran, managing director of Quartermile. He says: “Occupiers are now getting worried. Those that would normally just be taking a look around the market have become more serious, especially those looking for 20,000 to 25,000 sq ft.”

Market commentators suggest that all three of the speculatively developed buildings in Glasgow and much of the same kind of space in Edinburgh could be let by the end of this year. Even if developers press ahead promptly, there is likely to be a hiatus of around two years in both cities when no new space will be readily available.

That time represents an opportunity for owners of existing stock. Savills director David Cobban says: “If I was a landlord I would want to capitalise on the two-year gap by renovating rather than redeveloping and ending up competing with other new builds.”

Yet, surprisingly, few large office refurbishment schemes are under way in either city, a situation not helped by a loss of offices to other uses (see box).

One of the few undergoing a makeover is IVG’s 40 Torphichen Street in Edinburgh, where 54,000 sq ft should be ready in the final quarter of this year.

Potential refurb candidates in Glasgow include the buildings to be vacated by tenants moving to the crop of new developments, including Lomond House, 9 George Square (ex-Deloitte space); and Central Exchange, 20 Waterloo Street (ex-Weir Group).

Even when it comes to rental prospects, there is broad consensus in both Edinburgh and Glasgow that, despite the predicted shortages, rents will not climb much over the £30 per sq ft mark (Edinburgh has a slight edge), but incentives will fall away sharply.

Gazumping arrives in town

A hazard in tight residential markets, gazumping appears to have arrived in Edinburgh’s office scene, and has taken many by surprise.

Nick White, director of CuthbertWhite, says: “I was acting for an occupier with a 6,000 sq ft requirement and we were gazumped not once, but twice. That’s never happened to me in 20 years.”

Other agents relate similar tales, and with no new stock due to be delivered for at least a year, competition for space looks set to hot up further. “I’m not complaining,” adds White, “as it’s reflective of an active marketplace. This kind of thing keeps everyone on the balls of their feet.”

The Next generation of new development

The unexpected scrabble for grade-A office space, combined with healthy demand owing to lease breaks and positive economic forecasts, means that developers are focusing keenly on bringing forward start dates of the next wave of new offices, which could be ready for occupation from 2018.

In Edinburgh the main contenders remain as they are now, with the final office phase at Quartermile and the next phase at The Haymarket tipped as the most likely to go forward (assuming occupiers come forward for at least some of the space under construction). However, other schemes waiting in the wings could steal the limelight.

Artisan Developments, which started on site earlier this year with the leisure element of its New Waverley mixed-use project, is looking at a speculative start on one of its two office buildings, next to Edinburgh city council’s offices. “It’s something we’ll consider at the end of this summer,” says Artisan project director Clive Wilding.

Some local commentators question whether the office space, a season ticket’s throw from Waverley Station, is on the wrong side of the railway tracks, but Wilding thinks not. He says: “We’re creating a new type of space here, so we’ll be open to a wide range of occupiers, not just suited professionals.”

Hermes is considering a start on its Capital Square project on Morrison Street, for which it submitted a planning application earlier this year. A decision is expected soon. Assuming consent is granted, it isn’t clear whether Hermes will fund the development itself or bring in a joint venture partner as it did with its Wellington Place scheme in Leeds.

Several new developments are also lining up in Glasgow for an early start. If BAM Properties lets the rest of 110 Queen Street, which completed last month, it is expected to consider moving on to Atlantic Square in the International Financial Services District.

Other players are also making moves. Last month HF Developments unveiled plans for Bothwell Exchange, which include a 10-storey block at 122 Waterloo Street. And at 20 Cadogan Street, Titan Investors is considering selling its New Exchange scheme so that it can focus on its larger Broadway Two project.

Conversions take their toll

Edinburgh isn’t the only UK city to have lost office space to other uses during the recession. But the city’s year-round appeal as a tourist destination means that in addition to residential and serviced apartment developers, hotel operators are also eagerly eyeing up offices with a view to converting them (see hotels feature, p104).

Taken individually, the numbers seem innocuous – for example 30,000 sq ft at Lismore House, George Street; 80,000 sq ft at Erskine House, Queen Street; and 22,000 sq ft at 24 Torphichen Street (all offices to hotel use) – but they soon add up. JLL director Cameron Stott says: “Over 700,000 sq ft has gone to other uses over the last two years.”

Most of it is grade-B space, some of which may never have let as offices again in its current state, but the pressure shows no sign of abating.

“To some degree Edinburgh is a victim of its own success,” says CuthbertWhite director Nick White. “People want to come here. And unlike other UK cities, there is huge demand for city centre living.”