The Granite City boasts the UK’s highest concentration of millionaires outside central London, as well as Britain’s worst traffic jams. But, since the 1970s, it is oil that has made Aberdeen famous.

The Granite City boasts the UK’s highest concentration of millionaires outside central London, as well as Britain’s worst traffic jams. But, since the 1970s, it is oil that has made Aberdeen famous.

In economic terms, the oil industry has allowed Aberdeen to become a counter-cyclical anomaly, bucking downward trends on the back of a five-year, uninterrupted price spike for the bubblin’ crude. Likewise with property. The dynamics of this small Scottish city – population 212,000 – have borne more resemblance to prime London than to any other regional centre.

But that could soon be over.

The steep and sudden decline in the barrel price for crude has hit the oil capital of Europe hard. For five years the price had been spiking, easily topping $100 per barrel. But over the second half of 2014 prices halved.

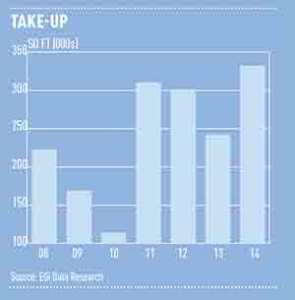

The oil price high coincided with a period of investment in Aberdeen, culminating in a year of record take-up, with just over 1m sq ft let in 2014, including two of the biggest UK lettings. One – Norwegian drilling contractor Aker Solutions taking 400,000 sq ft on a 20-year lease at Abstract Securities’ Aberdeen International Business Park – was Scotland’s biggest single letting so far.

The energy sector is responsible for the lion’s share of this take-up. Since 2009, according to figures from CBRE, it has accounted for 67% of take-up in the city. In 2014 that reached 84%.

However, Aberdeen’s oil-related industries are forecast to shed 23,000 jobs over the next five years, according to a recent report by the Oil and Gas UK trade body and the Department of Business, Innovation and Skills.

But the bulk of job losses are a result not of the oil price drop, but of structural changes in the industry – 35,000 jobs are going, but 12,000 are being created.

This is all part of Aberdeen’s transition from North Sea oil town to global energy city. “And that transition will be a great help in reducing the impact of a low oil price,” says Derren McRae, CBRE’s Aberdeen managing director.

Oil production in the North Sea has been declining for a decade, but the energy industry in Aberdeen has grown. It was this that led to a surge in demand for office space and an increase in prime rents (see graph, below).

Oil production in the North Sea has been declining for a decade, but the energy industry in Aberdeen has grown. It was this that led to a surge in demand for office space and an increase in prime rents (see graph, below).

“Aberdeen is an eastern hemisphere HQ for the vast majority of international energy companies,” says Ewen White, director of investment for Lambert Smith Hampton in Scotland.

This has led to a widening of Aberdeen’s skills base, which has allowed its oil sector to diversify beyond the North Sea, with teams based in Aberdeen working on projects as far afield as West Africa and Central Asia.

“This should cushion it from some of the short-term impacts of a low oil price,” adds McRae.

White says that the new skills set means that even if the oil price tumbles again – which is unlikely, for now – Aberdeen’s workforce would still be in high demand. “The expertise is transferable to other sectors, such as renewables.”

And people are still taking space, McRae says: “Oil companies are continuing to invest. Some are taking leases for 15 to 20 years, even after the oil price dropped.”

Indeed, there is an undersupply of offices, which is continuing to drive capital and rental values. The city had just over 540,000 sq ft of offices available at the end of 2014. Of that, just 27,000 sq ft, or 5%, is grade-A space.

There is, for the first time in some years, spec development in the centre, notably Dandara’s 80,000 sq ft The Point and Knight Property Group’s 74,000 sq ft The Capitol. Site clearance has also begun on Titan Investors’ Silver Fin Building (132,000 sq ft) and Muse’s Marischal Square (173,000 sq ft).

However, structural issues continue to act as a drag on the city. “Occupier activity, specifically in the office sector, will slow down,” says White. “While that is due partly to the price of oil, it is more because the majority of occupiers have spent the past four to five years sorting their long-term occupational needs.”

For the moment, interest in the market is pausing. “The whole industry is considering where it is and what space it wants,” says Abstract Securities managing director Mark Glatman. “And that is fine, as it gives a chance for the infrastructure to catch up.”

More demand, McRae adds, will be driven by a wave of mergers and acquisitions predicted by industry watchers.

“We could see a scenario where these developments don’t just secure top rents,” McRae says, “but offer a platform from which current prime Aberdeen office rents could actually increase.”

But despite the positive noises being made in the market, Glatman is sanguine. “It will put pressure on rents, so there will be less profit in development, and thus less money to throw into the pot,” he says. “The city won’t be able to keep underinvesting in infrastructure, and expect developers to keep picking up the bill.”

While Abstract plans to stay and dig in deeper, Glatman feels others may be put off by the boom town’s return to reality. “People who are less committed to this market will simply not come,” he says. “If you were thinking of buying a bit of land and doing a spec office, you’d run a mile now.”

Aberdeen’s trend-bucking, counter-cyclical characteristics may be coming to an end. The past four years have witnessed take-up of 1m sq ft a year.

This year it is likely to be 600,000 sq ft, making Aberdeen comparable with Leeds or Edinburgh.

Next year, perhaps take-up will drop even further to 400,000 sq ft.

Rents

Rents

The correlation between Aberdeen office rents and the oil price is so close as to be spooky. So could we be looking at a rental crunch? Prime rents at the end of last year stood at £32 per sq ft, and had been hovering above £30 since 2011. Indeed, rents have been rising solidly for the past two decades, with only falls in 2008 and 2010.