Whether LXB Retail Properties will continue in its current form has been the subject of market speculation for weeks. Following a series of divestments by the firm, cashing out in a strong market appears to be an obvious choice.

Whether LXB Retail Properties will continue in its current form has been the subject of market speculation for weeks. Following a series of divestments by the firm, cashing out in a strong market appears to be an obvious choice.

But in its interim results, published last week, the LXB board called on its shareholders to vote for it to continue doing business.

When the company floated in 2009, its board and its chief executive Tim Walton said that once it had carried out its five-year business plan, a vote would take place on whether or not to liquidate.

But last week’s board recommendation came as a surprise.

Chairman Phil Wrigley said there was “unfinished business” for the company and “significant potential value to be gained” in the years ahead as he urged shareholders to vote for a continuation.

The recommendation runs counter to the history of LXB’s management and its propensity to sell out in the past.

Back-to-back sales

In 2005 Walton sold the company’s first incarnation, LXB Properties, along with its development portfolio, to Land Securities for £360m. The second, LxB, which grew rapidly from assets Walton had retained, was sold to Hammerson for £200m in 2006.

If shareholders vote to carry on, they will be backing the company’s activities in the retail park development market, where planning constraints are tightening. And many supermarket chains, which anchor almost all retail parks, are scaling back their expansion plans.

The company has nine UK sites under development, giving it a total portfolio valued at more than £255m, around £10m lower than its total market capitalisation.

Sources close to the company say that the fact the company has already marketed four of those properties as forward-funding opportunities makes the sale of the company as a whole more difficult.

Analysts are not so sure. The five remaining properties may not be the prime assets in the initial portfolio – the “jewel in the crown” Rushden Lakes project in Northamptonshire has already been sold to The Crown Estate – but they do have enough potential value to attract bidders, they believe.

A larger return

A piecemeal sale of assets is more likely to attract a more substantial return than the sale of the company as a whole, analysts added.

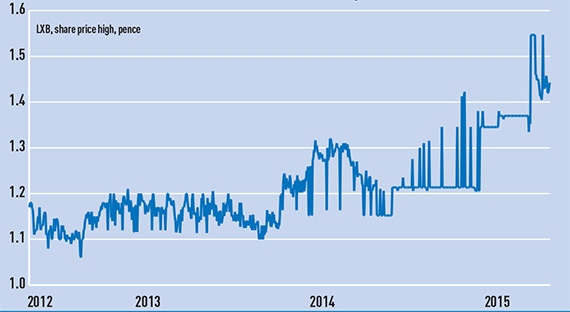

But there are indications that shareholders will vote to stay in business. For a company in a popular investment sector, its trading volume is low, rarely exceeding 1,300 trades a month, which is evidence enough for the City to believe that investors will remain loyal to the concept of LXB and vote to continue its activities.

If this does happen, what are the choices open to Walton and the board?

Alternative options

One option the company is understood to be looking at is floating as a REIT.

To do so, the company would have to transform its business model from development and disposal to one in which it retains the retail parks it develops in order to have an income stream.

With no new developments in the pipeline, the company would probably also have to either extend its debt profile or approach the stock market again for more capital to invest.

Without a comprehensive track record of managing complex retail park assets post development, however, the board may struggle to convince new investors to deliver the capital a REIT would need.

Another option, and the most likely one, according to analysts, is for the company to carry on as it is. With proven expertise in retail park development, and a steady demand for its schemes from institutional investors, the business may be able to continue for as long as the management sees a profitable future.

At present, the management does see such a future, and it hopes the company’s shareholders see the same vision.

LXB Retail Properties

Chief executive: Tim Walton

NAV: £256.8m

NAV per share: 139.87p

Pretax profit: £10.2m

Share price: 145.75p

Market cap: £266m

Key assets: Nine assets across the UK, including two in Staffordshire and two in Sutton, greater London. Its previous key asset, Rushden Lakes in Northamptonshire, has been sold to The Crown Estate, with a post-development value of £70m.