Forget vacancies on the high street, retail is still hot property for much of the real estate investment market, with transactions topping £5bn over the past 12 months.

According to new data from EGi Research, 73 shopping centres were traded between June 2014 and May 2015 for a total of £5.1bn – higher than any of the previous three equivalent periods. The investment is on a level with 2010/11, when trading figures were skewed by the £1.6bn acquisition of Manchester’s Trafford Centre by intu – the largest shopping centre deal recorded by EGi.

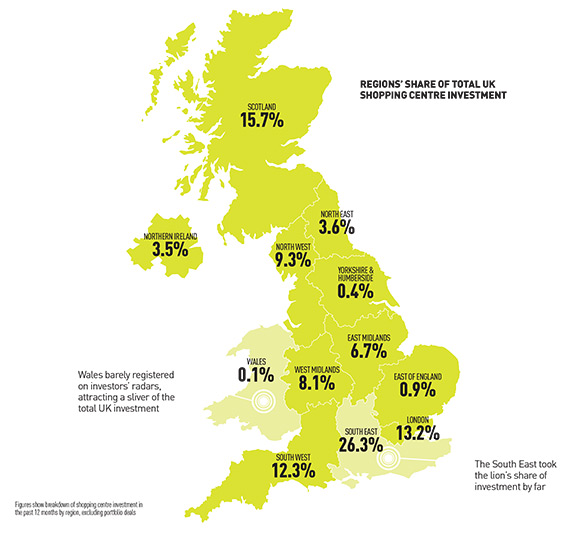

UK investors were the driving force behind the latest surge in shopping centre acquisitions, accounting for 82% of the overall spend. Land Securities’ £656m acquisition of a 30% stake in Bluewater in Kent was the largest acquisition last year.

Top deals in UK shopping centres |

|---|

| June 2010 – May 2011 |

| Trafford Centre, Manchester |

£1.6BN |

| June 2011 – May 2012 |

| Royal Victoria Place, Tunbridge Wells, Kent |

£159M |

| June 2012 – May 2013 |

| Meadowhall (50% stake), Sheffield |

£762.5M |

| June 2013 – May 2014 |

| Joint purchase of intu Merry Hill in Dudley, West Midlands, and intu Derby |

£798M |

| June 14 – May 15 |

| Bluewater (30% stake), Kent |

£656M |