A surge in loan-to-value ratios, the increased use of mezzanine finance and the dominance of non-bank lenders were all key themes in Savills’ 27th Finance Property Report, published this week.

A surge in loan-to-value ratios, the increased use of mezzanine finance and the dominance of non-bank lenders were all key themes in Savills’ 27th Finance Property Report, published this week.

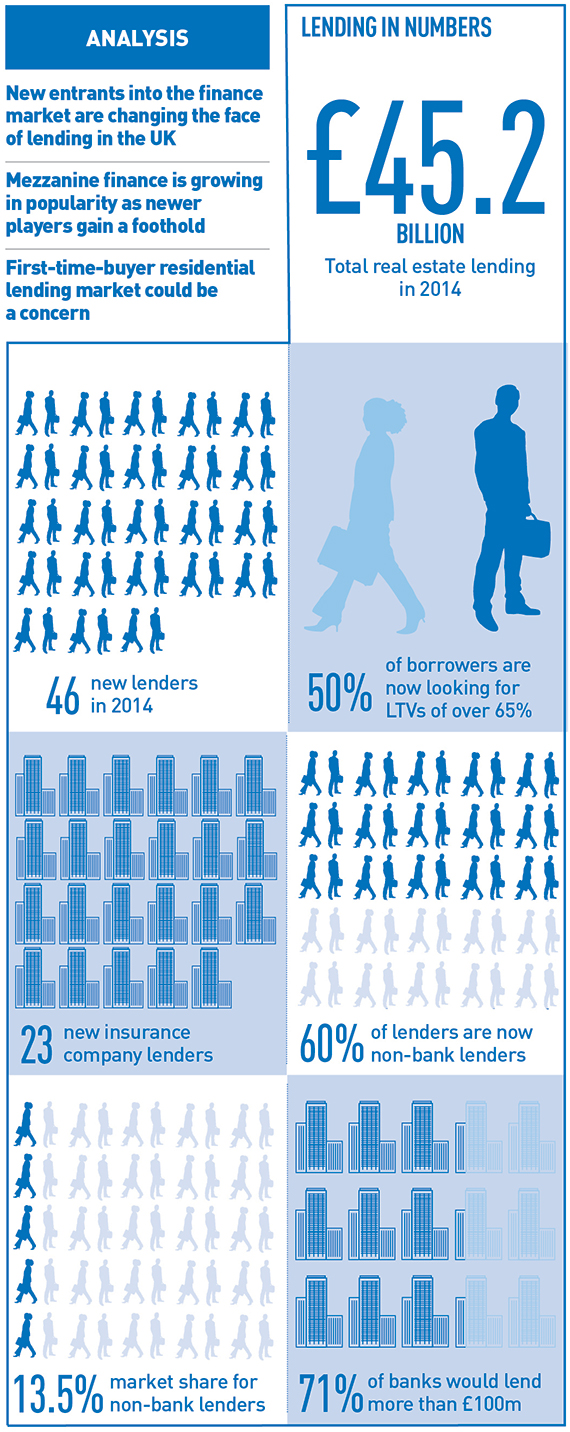

Head of valuations and the author of the report, William Newsom, highlighted 46 new lenders in addition to the 104 that entered the market over the previous two years, putting even more pressure on established lenders.

The new entrants have significantly changed the face of lending in the UK, according to Newsom, with 60% of the individual lenders in the market now “non-bank lenders”.

New names

Household names such as Hermes and Rothschild entered the market, as did Earlsfort, a business established by former Anglo Irish employees, and credit hedge fund Strategic Value Partners.

Morgan Stanley and National Australia Bank, which were both largely absent from property lending following the crisis of 2008, have made a return.

But for the traditional lenders that stayed in the market, including Lloyds and Royal Bank of Scotland, the impact has not been as significant as they may have feared.

Borrowers spoke to Newsom about a comfort factor with more established lenders that made them more likely to use them. A number added that familiarity and personal connections also ranked alongside confidence in their ability to deliver.

Pension power

Leading this charge have been the insurers and pension funds, which made up the bulk of the new entrants last year.

Only 13.5% of all lending in 2014 was conducted by the other non-bank lenders, despite their number. However, this is forecast to grow to 30% by 2020.

Chasing returns greater than bond and equities investments currently return, the 23 new players – including TIAA Henderson and Canada Life – typically play in the senior end of the market. The senior lending markets provide steadier returns than the mezzanine markets, which generally better suit debt funds’ risk appetites.

Mezzanine market

Where the newer players are making headway has been in the provision of mezzanine debt.

Newsom describes the growing market as “mature and well-respected”. The proportion of borrowers seeking LTV ratios in excess of 65% – typically the region for mezzanine loans – has increased from 20% to 50%.

Mezzanine funds now have their own surveyors on board and better understand the risks involved in lending to property, and are pricing it accordingly.

The assets they lend on have also been restricted to certain types, usually big-ticket, high-yielding assets and mostly in the secondary markets.

But the increased use of mezzanine has pushed up LTVs significantly. In one example highlighted by Savills, an overall LTV as high as 87% was achieved using a 62% senior loan with a 25% mezzanine loan on top.

Residential worries

According to Savills, the rise of mezzanine should not be taken as a sign of the imminent arrival of a downturn. There are some signs that senior debt LTVs remain low, and there is no creep towards higher-risk lending.

More importantly, the senior lending market has not reached the pre-crash “sky-high LTVs” and “rock-bottom” margins.

A more worrying market-lending sector for Savills is the residential first-time-buyer market, which has levelled off as mortgage market regulation dampens lending.

Lending levels plateaued in the nine months to the end of March 2015, as fewer people match the new criteria.