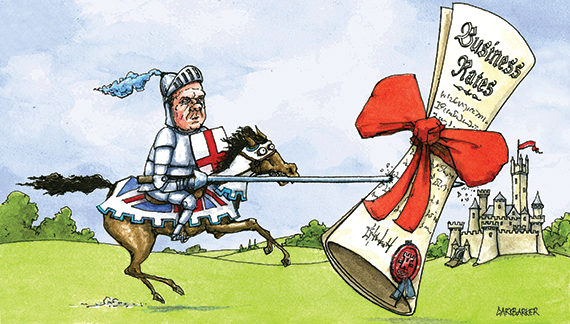

There is growing discontent among those who pay business rates. Many feel that the tax, first introduced in the 16th century, has lost touch with economic reality and become an almost unbearable burden on businesses.

This general disaffection with the system is something that the government appears to have recognised in its review of business rates, which closed this week. Along with many others, the BPF welcomed this review as a vital step forward and urged the government to seize the opportunity to make significant improvements.

The terms of the consultation, however, suggest that we might not see the breadth and depth of reform that we would like. The fact that any changes must be “fiscally neutral” is a warning sign, as is the government’s intention to make decisions before the 2016 Budget. A real root-and-branch review would demand both more time and fiscal flexibility.

An administratively difficult task, but one that would transform the rates system’s responsiveness, would be to gradually move to a system of annual revaluations. This would ensure that businesses are paying rates on up-to-date rental values. Currently, until 2017 they will be paying on the basis of valuations calculated in 2008, thanks to the government postponing the last revaluation.

A fixed business rates multiplier would ensure that rates better reflect economic conditions and rental growth. Currently, rates are calculated according to RPI. IPD figures suggest that overall commercial property rents have increased by 8% since 1990, compared with a 107% increase in the RPI over the same period. It does not take an expert to identify a disconnect here.

And what about the removal of empty property rates relief in 2008? Empty units are punishing enough for landlords, but asking those who are unable to find a tenant to foot the rates bill is effectively imposing a tax on failure. It also deters redevelopment, as property owners must often pay empty rates as they gradually vacate the buildings they are looking to improve.

To reinforce the importance of reform, we must consider the impact of the business rates system on wider UK growth. Economic theory suggests that at least some of the burden of business rates ultimately falls on property owners, which in turn reduces the attractiveness of real estate as an investment.

Investment is the lifeblood of development, and lower levels of development will have a negative impact on economic growth, job creation, and the regeneration of towns and cities.

It is time for government to be brave. Although deep-seated reform would remove the certainty the Treasury currently has about the tax take – and may even result in a short-term fall in revenue – this would soon be recompensed by businesses being able to invest in expansion and creating new jobs, which would reduce social welfare and increase tax revenue through other streams.

The prospect of a referendum on the UK’s membership of the EU means that – at least for the time being – the UK risks looking less attractive as an investment location. Government should be doing all that it can to ensure that we maintain our competitiveness, and a radical review of business rates would be a good place to start.

Melanie Leech is chief executive of the British Property Federation