Despite the TV onslaught of adverts with annoying jingles urging consumers to design cards using pictures of themselves circa 1970s, the greetings card market is still very much a bricks and mortar business.

Just over 97% of people buying cards do so by personally browsing shelves bedecked with images of fluffy kittens, cuddly puppies and various jokes, while picking up increasingly small gifts to go with them.

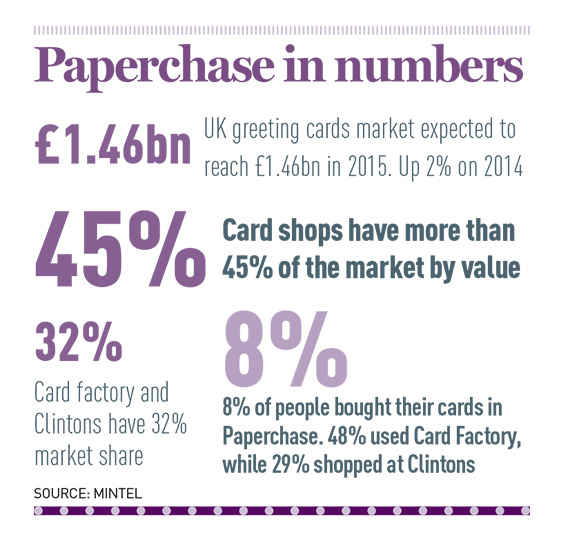

So much has the market grown that consumer spend this year, according to Mintel, is expected to reach £1.46bn, up 2% on last year. And carving out a niche among the card giants that are Card Factory and Clintons, which have 32% of the UK market, is Paperchase.

While Paperchase does indeed sell cards – 8% of those who bought greetings cards last year used the chain says Mintel – it is so much more than a card seller. Indeed, it is in fact a fashion brand. “We are a fashion retailer. We just don’t sell clothing,” says the company’s chief executive Timothy Melgund, who was born Timothy Elliot-Murray-Kynynmound, 7th Earl of Minto.

Given its fashionable status Paperchase, like all style-conscious retailers, wants its surroundings to be as on trend as the shops are. “Adjacencies are extremely important to us, location on pitch is extremely important to us, and size and character of building is extremely important as well,” says Melgund.

“We are seen as a fast fashion business, and I think customers shop by brand nowadays, they don’t shop by category. Nobody goes out to buy a pair of shoes, they go out to visit a certain number of brands, during which time they might purchase a pair of shoes.”

The demographical make-up of its customers certainly gives credence to this fashionable stance. “Paperchase attracts a young audience (younger millennials) and has a strong performance in the London area. Its shoppers have an upscale bias,” says Jane Westgarth, senior retail analyst at Mintel.

Store growth

Store growth

It is this group which is pushing the success of the chain. Currently it has 117 standalone UK stores, plus 40 concessions and is on the hunt for 15 to 20 sites a year. The optimum number of sites is, says Melgund “somewhere between 200 and 250”.

“[But the number] changes,” he says, adding “retail is dynamic, and if you are too fixed in your views, then you can get caught out… [but] it is important to grow at the speed that the business can cope with comfortably.”

Specific fast fashion retail neighbours may be high on Paperchase’s agenda, but required retail sites are flexible. These range from 200 sq ft at Cannon Street Station, EC4, to the company’s Tottenham Court Road, W1, flagship at 22,500 sq ft. All are leasehold – definitely leasehold, says Melgund: “Retailers should not tie up their capital in freehold property.”

And the chain, which works mainly with CBRE, is well liked in the market. One senior retail agent says: “Paperchase is still very much a landlord’s target tenant on schemes and high streets. It is still seen as the retailer they would like, and it is a good shop fit. Paperchase hits the spot because it is not too aspirational for landlords like, say Michael Kors, and it is better than getting a mass market retailer.”

Hitting the spot is, as Mintel’s Westgarth says, down to Paperchases’s merchandise, which is design-led. “This sets it apart from other rivals. We estimate that its share of cards and wrap is some 1.2% in the UK but the company also generates strong sales and profits from its stationery and gift ranges and is extending its reach overseas.”

The company has been international for many years, through a succession of owners and investors, including WHSmith, and Borders, which bought the company in 2004, before Borders collapsed in 2009. Paperchase is now backed by private equity firm Primary Capital.

Outlets in the US are through a wholesale relationship with retailers, while other outlets are in the Middle East, Denmark, The Netherlands, France and Germany. Many are operated by direct concession. “It is important to keep control. We don’t wholesale, and franchising is not something we considered for Europe.”

Online

While bricks and mortar do still carry weight, Paperchase’s online presence is strong, and getting stronger every year.

Its UK website continues to grow at about 30% per annum, accounting for 3% of the business. “The website is very successful, and I am sure it will continue to be so,” says Melgund. He adds: “We have a euro and a dollar website, and we are just about to go into local language websites as well where we currently trade. Customers now expect a certain brand presence.”

But, Melgund’s overriding message is that the door is open to any suggestions of where to open a Paperchase store.

“We are continuing to expand across the UK, and we have got a very active expansion programme. From our shop fit perspective, we do very unusual shop fits. So, they are not in any way cookie cutter. Each one is different.

“And we are not shy to spend money where it’s needed.”