Agents pick most significant deals (six months to end of May)

Exertis, Burnley Bridge Business Park, Lancashire

Exertis, Burnley Bridge Business Park, Lancashire

Type of deal Purchase of design & build unit

Vendor Eshton

Purchaser Exertis

Size 543,620 sq ft

Terms Freehold

Value Undisclosed

Chosen by Michael Cavannagh, partner, Trevor Dawson

Technology distribution business Exertis searched the UK for a suitable site for a national logistics operation but will move just one junction along the M65 when construction of its new facility is completed at Burnley Bridge business park. The deal, thought to be the largest in the North West industrial sector this year, includes land for a 200,000 sq ft extension.

Attracting an occupier of this size is a remarkable achievement for a new industrial park which launched just last year. The deal follows a number of others which means there are just two to three speculative units and one six-acre D&B plot left on the 70-acre business park.

The Exertis deal further vindicates Eshton’s decision over the timing of the whole development – the really clever part being its strategy in acquiring a piece of land in an excellent location eight years ago, masterplanning it, improving the infrastructure, and then waiting for the right timing.

MediaCityUK, Salford Quays

MediaCityUK, Salford Quays

Type of deal 50:50 joint venture agreement

Parties The Peel Group and Legal & General Capital

Size 1.6m sq ft development on 37-acre site

Value £251.5m

Chosen by Oliver Foster, investment director, Savills

The Peel Group welcomed Legal & General Capital as a 50% JV partner in its landmark MediaCityUK scheme. As the largest purpose-built creative, digital and technology community in Europe, it has been instrumental in the rapid growth of these sectors in Greater Manchester.

I see L&G’s history of investing in the North West and its focus on regeneration as being well matched with the Peel Group’s approach to place making and long term value creation. The partnership will continue to drive the growth of MediaCityUK as a major business and residential destination.

With the BBC, ITV and many other businesses in situ, plus large amounts of consented development land available, its potential to deliver community benefits and prosperity for the area is immense. There was also significant international interest in this opportunity which I think highlights the global strength of the North West market.

Wharfside, Trafford Wharf Road, The Quays, Manchester

Wharfside, Trafford Wharf Road, The Quays, Manchester

Type of deal Freehold purchase

Vendor Benmore

Purchaser Missguided

Size 42,222 sq ft

Price £3.63m

Chosen by Gary Chapman, partner, WHR Property Consultants

The acquisition of Wharfside for online fashion brand Missguided has my vote for significant North West deal. When the company began searching for a quality, headquarters office building in Trafford Park, not an established office location, most of the options it faced were new build and, therefore, expensive.

Wharfside is an iconic, landmark building which gained a tarnished reputation, having been built pre-recession but never let. However, it suited Missguided’s exact requirements.

The company was determined to purchase a freehold property and despite owners Benmore having turned down several large offers in the past, it eventually agreed a freehold price of £3.63m – a substantially cheaper option than new build. The savings mean Missguided can now undertake an innovative refurbishment, including building a helipad and floating meeting rooms, to create a fun and inspirational workspace. This is not only unique to the region but it also reflects the ethos of the rapidly expanding company.

Double PRS boost

Double PRS boost

Manchester’s PRS housing market received double boost. L&G entered into a JV with Muse and the HCA to develop a £16m scheme in New Bailey. Meanwhile, German investor Patrizia made its entrance into the UK PRS market by buying Ask’s £500m First Street project.

Agency launches in Liverpool

Two agencies were launched in Liverpool. Mark Worthington, formerly of CBRE, and Andrew Owen, formerly of Mason Owen, set up Worthington Owen. Meanwhile, Llyr Emanuel and Dan Oliver left Legat Owen to launch Emanuel Oliver.

Blackpool EZ takes off

Blackpool’s newly reopened airport is to be the focal point of a new enterprise zone announced in the 2015 Budget.

GVA on grade-A hunt

GVA launched a search, thought to be for a government department, for up to 500,000 sq ft of grade-A office space in Manchester and Liverpool, the largest requirement in both for a decade.

Green light for Redrock

Stockport council secured full consent for the £45m retail and leisure scheme Redrock, where The Light Cinemas is the 40,000 sq ft anchor.

Office development cools

Office development cools

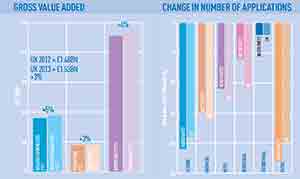

A cooling in Manchester’s office development emerged as EGi research revealed applications for business space down by 14% in 2014 on the previous year. Agents expected grade-A space to be absorbed in 2015, but overall take-up to fall – due, in part, to a lack of availability.

EG gauges the trials and tribulations of the North West property market