It has been a long old slog for Japan, but after 20 years of deflation the country is finally starting to see a turnaround.

Since 1991 when the asset bubble burst, what was the world’s second-largest economy has fallen into seemingly permanent decline. Between 1995 and 2007, Japan’s GDP fell from $5.33tn (£3.44tn) to $4.36tn, and since 1997 real wages have fallen by around 13%.

But, last year, the government announced that inflation was growing at its fastest pace in a generation. Prices rose by 3.2% following an increase in the sales tax rate, and the economy was entering a “virtuous circle”, it said.

The unemployment rate also fell to 3.3% – its lowest level since the late 1990s. Consumer prices are now up by 0.6% and, with the Tokyo 2020 Olympics fast approaching, the government is keen make it clear that Japan is open for business once more.

The country’s real estate market is attracting a great deal of interest, buoyed by access to cheap financing and steady rents. Most prices are still below those of the pre-2008 crash – hovering at an average of ¥5,299 (£27) per sq m per month for central Tokyo offices.

According to Real Capital Analytics, international investors are back in Japan in a very big way. “While traditionally a difficult market for cross-border investors, activity by overseas players was up by 49% on the last 12 months and 109% up on the first quarter of 2015 versus 2014,” its Global Trends Report concludes.

RCA figures show that in 2014 there was ¥915bn of investment from overseas in 2014, compared with inflows of ¥665bn in the previous year. This has been led by the Americas (¥376bn last year) and the rest of Asia Pacific (¥400bn). Global inflows into Japan hit a low of ¥198bn in 2009.

But investment growth does not mean Japan is an opportunistic market. Quite the reverse; most investors agree that the only way to hunt out the good deals is to put in the time and build relationships.

“In the US, you have a property, you put out the pitch, the whole world is invited and the best price wins,” says Douglas Smith, head of investment services at Colliers International. “Here, it is more relationship-driven, the information is not as transparent, so to access the market you need to have your own team here or good representation. Without that kind of assurance, sellers don’t want to take the closing risk.

“There is a lot of asymmetry that makes it difficult for newcomers to compete.”

The REIT market, which has existed for only around 15 years in Japan, is helping to make the market more transparent. The J-REIT market is now second only to the US in size, at approximately ¥13tn, with an attractive 2.7% spread between J-REIT dividend yields and 10-year government bonds.

The main challenge for investors is finding the right assets. Tokyo offices might top most investors’ wish lists, but in this conservative market property owners are not inclined towards sales.

“Across Asia – Singapore, Hong Kong – people have an almost pathological need to trade real estate. But the Japanese have a bizarrely emotional attachment to property,” says Chris Mancini, chief executive of Savills Japan. “There is an aversion to selling their real estate holdings, it is part of the culture and their history.”

And, as money flows in from abroad, so it is starting to trickle out to other markets. Japanese investors have traditionally preferred real estate investment within their domestic market, with many still burned from past experiences overseas. Investors who spent $78bn on US properties – including New York’s Rockefeller Center – between the late 1980s and 1995 took a hit when the US fell into recession.

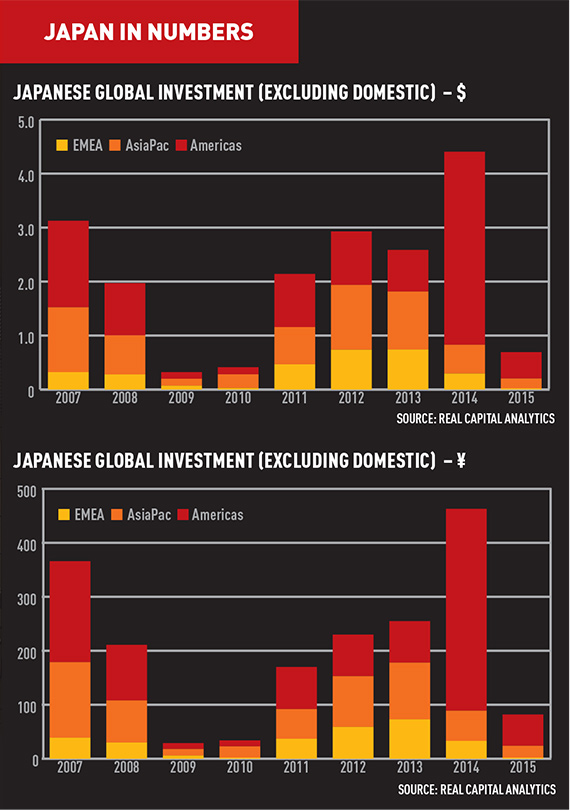

Increasingly though, real estate developers are daring to look beyond their domestic market again. Tracking exact levels is difficult, as most investment goes into listed companies or REITs rather than into the direct market. RCA says there has been a big increase in Japanese interest in the US, with $772.1m of investment in 2013 compared with $3.6bn in 2014.

In total, RCA records $2.6bn of outflowing capital from Japan in 2013 and $4.4bn in 2014.

Companies such as Japanese real estate giant Mitsui Fudosan are developing condominium projects in Bangkok, and will spend around $4.5bn in the next three years in Thailand, Singapore, Indonesia and Malaysia. Mitsui is one of a handful of Japanese developers also looking towards the US for deals, including buying existing office buildings and development sites – usually with a US partner on board.

“In Shinzo Abe’s government, part of it has been opening up the country and making Japan more of an internationally recognised location for business,” explains Chris Brooke, executive managing director for consulting, CBRE Asia Pacific. “Increasingly, Japanese companies are going abroad in a similar manner, particularly towards other parts of Asia.

“Many have found it hard to get into the domestic market in China, finding markets more open in South East Asia. But there are opportunities for outbound Japanese companies.”

Others are looking to European markets for their investments, particularly London.

“If money is going to the UK, it is going to go to London, because that new money is going to be pension funds, insurance fund money, and they want the liquidity, the transparency, and the track record of a market like that,” says Smith.

“They are not going to go to Manchester for the extra yield. The companies that will do that are the real estate companies who have been in the market themselves for a long time and can find a joint venture partner.

“The financial investors are going to go to London, and the same thing is true when investors come to our market here in Japan from outside. They want Tokyo,” he adds. “They understand they can get a slightly better yield in Osaka, but in Tokyo it is a large liquid market, and it is very hard for them to be induced out of that.”

While the overarching view of the Japanese real estate market is largely positive, there are a few concerns about the slow pace of movement.

“Staid and regulated are not pejoratives,” argues Mancini. “For a certain type of investor profile, these are ideal. If you are a European life insurance company, the absence of that precludes any investment activity in those markets.”

All in all, the pro-business approach of the Abe government seems to be having the desired impact on the Japanese economy. Exports are up, there was a ¥2tn-¥3tn increase in corporate profits and employee compensation last year, and tax revenue is set to increase to ¥54.5tn by the end of this year.

But to maintain this momentum, experts warn further reform is essential.

“You can do so much with inexpensive debt and quantitative easing,” says Megan Walters, head of research, Asia Pacific capital markets at JLL. “Fundamentally it is about change and boosting demand.

“The more people that can come to Japan and learn about Japanese culture, the more the office markets, retail markets and hotel markets will be helped, and they will provide a boost to Japan’s economy. Tourism could be a massive boost for Japan.”

For now, government measures to attract more investment are working – inbound investment rose by 181% to 1tn, its highest level since 2009, according to finance ministry data.

The government is well on the way to what it calls the “reinvigoration of the Japanese economy”. As long as it continues its path to liberalising the markets, it will continue to eye opportunities they might recently have shunned.