The global real estate market grew by 4% in 2014 to more than $13.6tn (£8.7tn), reaching a peak higher than the pre-downturn peak in 2007, with London attracting the highest levels of investment globally.

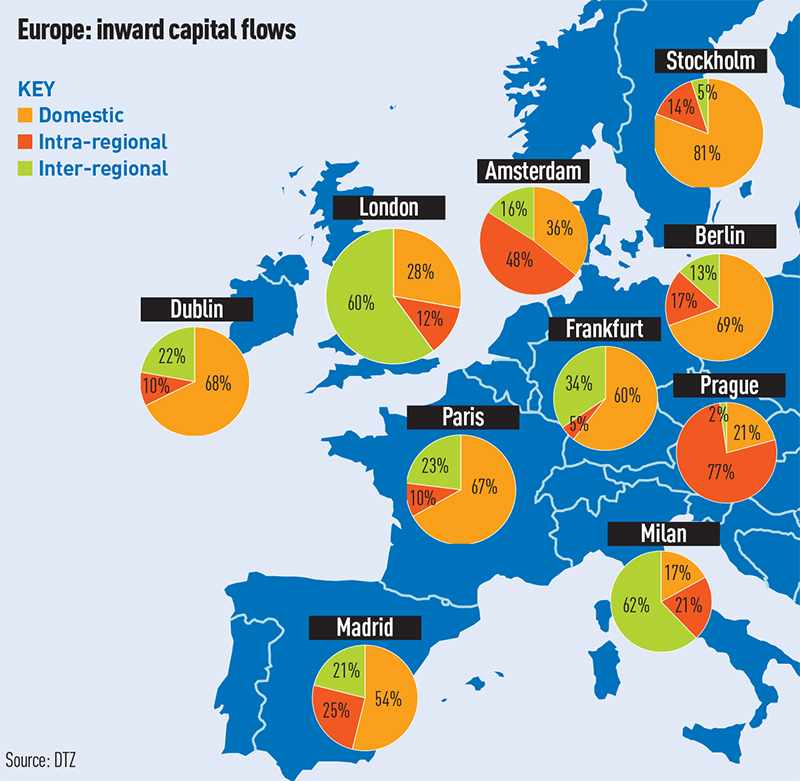

London in particular saw more deals of more than $20m than any other city, receiving $35bn of investment in 2014, with 60% or $21bn coming from overseas investors.

The proportion of non-domestic capital entering the market was the highest of any city in the world and double that of the next-largest major investment market, San Francisco.

The figures come from the annual DTZ Money into Property report, which looked at the real estate investment markets of 40 countries.

The report also found that despite fears of an overheating market caused by falling yields, equity continued to replace debt across the capital stack, with an 8% increase in the proportion of equity invested in 2014. Debt increased by just 2%.

Unlisted funds, a market that has traditionally been short-term and leverage-backed, led equity-driven investments. -Private equity grew its equity investment by 10% in 2014, with public listed companies increasing their investments by 2%.

DTZ believes private equity changed its model to one where lot sizes are smaller but with more transactions overall.

Global leverage rates have therefore shrunk from 56% in 2013 to 55% in 2014, with European ratios down from 55% to 53% over the same period.

Despite the strength of the UK, European investment volumes have begun to lag Asian markets in local currency terms as investors struggle to find core assets, the report said.

Investment activity continues to grow across global real estate in general, with DTZ estimating that annual investment levels will hit new highs in 2015.

The firm estimates that $429bn of new capital is poised to enter the market this year.