Birmingham was once, literally, a race track. The Birmingham Superprix, an FIA Formula 3000 event, saw some of the world’s fastest cars speed down city streets over August bank holiday weekends.

Birmingham was once, literally, a race track. The Birmingham Superprix, an FIA Formula 3000 event, saw some of the world’s fastest cars speed down city streets over August bank holiday weekends.

Hopes of reviving the annual event, last run in 1990, have never quite died. But today, those who miss the smell of burning rubber have something else to occupy them. Bcause a new, expensive, fast-moving, sport is fuelling the city: the Birmingham office investment scene.

The latest deals to buzz past include Legal & General, with its foot on the clutch for an £87m buy of 1 Colmore Square, with a dry-as-dust yield close to 4%. Meanwhile 7, 8 & 10 Brindleyplace were sold to CBRE Global Investors for £130m at a yield of 5.77%.

But this is not a Superprix – normal rules of the road still apply. And the biggest constraint on the Birmingham city investment scene is supply.

Damian Lewis, senior director at Bilfinger GVA, says: “There’s a lot of money chasing very limited stock, which is why yields are hardening so rapidly, in some cases by 1.25%-1.5% in 24 months. This is a decent trading profit for those who flip.”

Andrew Bull, Savills’ head of investment in Birmingham, adds: “The expectation is that regional offices will outperform industrial investment this year, and some buyers’ appetite for risk has really moved on.”

Ed Gamble, head of investment at CBRE, says: “The keenest yield we have spotted so far is 5.25%, but if the best building came up, we could go below 5%, although I expect that is the lowest we will go this cycle.”

Surely that means even the most reluctant vendor could be confronted with offers too good to refuse. Is it true that any – and every – Birmingham office building is for sale, if the price is right?

Craig Satchwell, head of central London office agency at Colliers International, agrees that pricing is the real issue. With about £1bn chasing a home in Birmingham office property, Asian buyers are among those bidding up prices: “Asian investors like the infrastructure investment going into Birmingham. Clean buys, with some low-risk management potential, are attracting a lot of interest.”

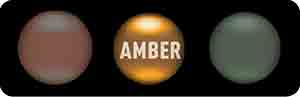

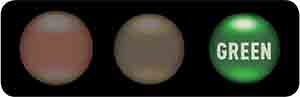

So what’s green for go, amber for persuadable, and red for no chance in the Birmingham investment road race? EG asked the experts.

How the deals and potential deals are shaping up

5 St Philips Place

The 77,000 sq ft block is owned by Cordea Savills. Climate Change Capital sold it in 2014 for £38m, a 5.8% yield, having flirted with a sale in 2011 and 2013. Climate Change paid around £36m for it in 2009.

There has probably not been enough yield shift since early 2014 to make a trade worthwhile.

Nurton Developments acquired the 204,000 sq ft block in 2004, paying £43.3m, and sat out the recession. Law firm Shoosmiths signed a 15-year lease in 2013, paying around £25 per sq ft.

With No 1 next door close to achieving a 4% yield in an £88m sale to Legal & General, can Nurton resist testing the market? It would find it hard to reinvest elsewhere to such advantage.

The 62,000 sq ft block, owned by SEB, last changed hands in 2010 for £29m, a yield of 5.85%.

The play here would be based on the shrinking yield differential between long-term and shorter-term income. In other words, it wouldn’t necessarily pay SEB very much more to extend and re-gear the (soon to expire) lease.

Israeli insurance giant CLAL paid £32.2m in 2012 for the 80,000 sq ft block, which has eight years of Eversheds lease left.

CLAL bought at the bottom of the market. A 6.5% yield in 2012 has turned into a potential 5.25% yield today, so it’s worth testing.

Epic UK owns the 143,000 sq ft block where around 32,000 sq ft is available, having paid around £61m for it in 2008.

Regarded as a long-term holding, though if the price were right, anything is possible.

3, 4, 5, 6 and 9 Brindleyplace

3, 4, 5, 6 and 9 Brindleyplace

As exclusively revealed in Estates Gazette in April, Lone Star and Hines are offloading the prime buildings for an asking price of nearly £300m – just under a 6% yield. The duo has now appointed Colliers International and CBRE to handle the sale.

Widely regarded as one of the largest regional sales this year, Lone Star and Hines aim to capitalise on Birmingham’s hot investment market.

Deutsche Bank has taken a 15-year lease with a break at year 10, prompting some interesting offers to British Airways Pension Fund, owner of the 68,500 sq ft block.

Potential buyers were salivating – so it is no surprise it has apparently found a buyer quickly, off market. Believed to be under offer at £38m, but the sale has a complicated tax back story.

US private equity house Carlyle is teeing up a sale with a £140m price tag. The last trade for the building was in 2006 when it sold for £150m. Around 106,000 sq ft of the 307,000 sq ft floorspace is unlet. Cushman & Wakefield is advising along with Eastdil Secured.

Not the first time Carlyle has considered a sale – but the timing is perfect. The vacant space is not the liability it might have seemed, but is instead a great opportunity to ride a rising rental market.