If you think it’s just UK regional office markets that are heading for a new-build supply hiatus over the next couple of years, think again.

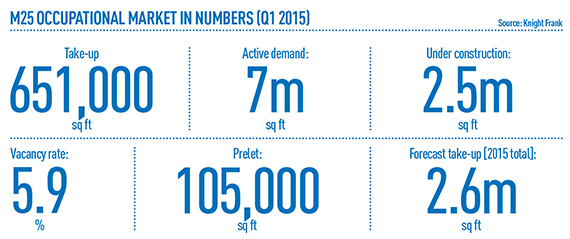

The M25 is heading the same way. The scale of the issue is highlighted in Knight Frank’s latest M25 offices report, which pitches 7m sq ft of active demand against just 2.5m sq ft under construction at the end of Q1 around the whole of the London orbital.

“That potential undersupply is prompting some true off-plan prelets,” says Cushman & Wakefield’s head of UK business space, Charles Dady. He reels off a list of seven that have been agreed this year, although only one – Gartner’s new 107,000 sq ft HQ at Egham, Surrey – is within the M25. The point, he emphasises, is that these rare beasts are likely to become more common this year. Particularly if, as in Gartner’s case, a purpose-built design is deemed more important than a generic layout.

“The company had a really good look around Reading and down the M3,” adds Dady, but it decided to stay put with its established workforce.

Not all demand is from indigenous occupiers, though. James Finnis, head of national offices at JLL, is keeping a watchful eye on what he describes as “strategic dispersal”. That may sound like a cleaning product, but what Finnis is actually talking about is the willingness of central London-based businesses to move parts of their business – not just back-office roles, but other functions, such as sales and marketing – further away from the capital, while retaining a West End or City HQ presence. “It’s human resources dynamite, so there are a whole bunch of unnamed requirements,” says Finnis, suggesting that overall demand for M25 offices could be even higher than anticipated.

Those occupiers with the largest requirements – four are currently looking for space of more than 80,000 sq ft – appear to be in no hurry to make a decision. When they do, however, property commentators expect a domino effect of smaller lettings around the M25, which could prompt landlords into refurbishing older buildings. Finnis explains: “Refurbs are likely because of their speed to market, they are more sustainable, town centre demolition is complicated and risky, and they are likely to have the benefit of historic car parking ratios.”

Opinion is divided on how refurbished space will be finished. Fit-out specialists suggest that a conventional business park-style look will be more commercially successful, but others, such as Cushman’s Dady, report more examples of occupiers willing to consider buildings with exposed services, the so-called “Shoreditch effect”. He says: “This isn’t just SMEs. Other companies are looking for a less corporate look.”

There is more consensus over the importance of transport links, with Crossrail and the proposed main line rail link from Reading to Heathrow (WRATH) likely to have most impact.

However, the Davies Commission report on runway capacity, which earlier this month recommended Heathrow for further expansion, is unlikely to make much difference to property decisions around the M25 in the medium term.

James Raven, development director at Goodman, which has 107,000 sq ft under construction at Uxbridge Business Park, says: “Anything that comes from the report will take at least 10 years to come to fruition and businesses need to make a decision now.”

Opportunity knocks – The fit-out specialist view

Opportunity knocks – The fit-out specialist view

With supply of new-build space in most parts of the M25 set to plummet, is now the time for landlords to nip in with a speedy refurb and, if so, what sort of spec are today’s occupiers looking for? Fit-out expert Colin Allan, managing director of Morgan Lovell Southern, believes he has the answers to both questions.

“We’ve seen a noticeable increase in refurbishment projects across the whole of the South East, but particularly the M25,” he says. “The type of stock coming to the market for this is now primarily late 1980s- and early 1990s-build that has become available after the end of the 25-year leases that were still common then.”

Allan shies away from putting a figure on how much space might be refurbished over the next couple of years, but agrees that it is substantial, with potentially hundreds of buildings around the M25 ready for an extensive makeover. He is similarly coy about exactly how much value is likely to be added by investing in what can be costly renovation works, pointing out instead that many of the candidates for refurbishment are currently empty. “Buildings become more valuable by being occupied by tenants,” he quips. “And the value added comes from ticking all the boxes that tenants are looking at.”

Those boxes include low running costs, low EPC ratings and, yes, plenty of car parking. Sustainability is also high on the agenda and refurbishment requires issues such as fabric insulation (surprisingly, many brick structures were built without cavity wall insulation), energy performance (many occupiers demand air conditioning) and lighting to be tackled. Despite the arrival of the “Shoreditch effect”, Allan believes that the most successful refurbishments will be those that are least radical.

“We don’t want to do a Marmite fit-out – we want something that’s as inoffensive to as many people as possible,” he says. But he concedes that while stock refurbished to today’s standards will compete incredibly well in performance terms with new-build, it may not always be as aesthetically pleasing on the outside.

Most important, from both a landlord and tenant perspective, is that refurbishments can be turned round relatively quickly, in many cases in well under a year.

“That timescale might be seen as aggressive,” says Allan, “but it’s certainly not unrealistic. The opportunity is there – landlords just need to pick the right window.”

Chain reaction – The investor view

The lack of new supply in the northern M25 may be a headache for occupiers, but for investors it means a more reliable income stream, as existing tenants are more likely to renew and prospective occupiers have limited choices. This dynamic was recognised by Columbia Threadneedle when it purchased the 70-acre Croxley Green Business Park near Watford for £85m at the end of 2013. Since then, the investor has notched up 30 lettings and bought a second Hertfordshire business park. It added Britvic’s HQ at the 322,000 sq ft Breakspear Park near Hemel Hempstead to the portfolio of £61m towards the end of last year.

Columbia Threadneedle senior asset manager Rob Flavelle says the focus is on letting space at Croxley Green, where 50,000 sq ft of refurbished grade-A offices has just been completed. He adds: “We understand that there is potential to refurbish space in other locations. Yet successful business occupiers want high-quality accommodation together with excellent communication links and extensive amenities. Their focus is to secure a committed workforce and that is what we offer. We’re confident about bringing forward this accommodation because we know that the supply chain for high-quality offices with a strong amenity offer is extremely limited.”

Croxley Green is expected to benefit from the rail link which will extend Transport for London’s Metropolitan Line over disused national rail tracks to Watford Junction railway station. A stop at Cassiobury, next to Croxley Green Business Park, will put the offices within 30 minutes of central London by Tube. Despite this huge fillip in communications, as well as the state of the M25 market in general, Columbia Threadneedle is surprisingly cautious about when and how it will bring forward new office stock. Flavelle confirms that both further refurb and new-build are under consideration, but that no decision is likely until this autumn.

Overall, the M25 investment market is likely to see further pressure on yields, which are hovering at 5% for prime assets. Figures from Knight Frank show £522m of deals were done in Q1 2015, equating to a mean lot size of £22m. Both figures are down on the Christmas spirit-fuelled final quarter of last year, but still significantly up on the 10-year average.

The agent tips US opportunity funds as key potential buyers of secondary stock around the M25, but notes that, as is the case for prime buildings, volumes are likely to be held back by a lack of assets coming to market.

Rental levels – The only way is up

Prime rents are rising in most established office locations around the M25, according to the latest research from Knight Frank. In some cases, like St Albans, where prime rents are £27.50 per sq ft, further growth is limited by a lack of supply. Points both north and south of the London orbital are achieving rents in the £20s per sq ft. Columbia Threadneedle asset manager Rob Flavelle confirms that rents have moved up by 15% at Watford’s Croxley Green Business Park, with further growth expected in the next year, moving quoting rents on from £23.75 per sq ft.

The rental cycle appears to be at the start rather than the end of its travel. Charles Dady, head of UK business space at Cushman & Wakefield, says: “Many locations have only just, or not yet, reached where they were previously. For example, Reading still hasn’t hit the £35 per sq ft seen during the dotcom boom 17 years ago.”

He also notes that incentives are reducing considerably, meaning net effective rental growth is likely to jump. “That is underpinning the values investors are looking for, which are driving the out-of-London market,” he adds.

As demand is likely to focus on the M25’s western quadrant (see main text), so rental growth is likely to be strongest around the M4. “We’re going to continue to see new record highs,” forecasts Savills’ head of South East office agency Jon Gardiner, “like the £35 per sq ft achieved recently in Maidenhead and £36 in Weybridge.”