Lone Star Funds’ proposed £700m takeover of Quintain Estates and Development Company points to a new strategy for yield-hungry private equity buyers as distressed loan sales dry up.

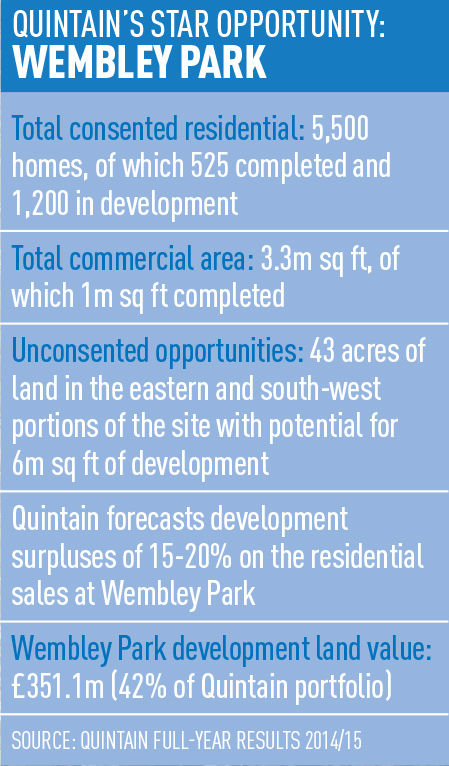

The Texas-based fund manager is betting that Quintain’s 5,500-home Wembley Park project will deliver for investors in its $5.8bn (£3.7bn) Real Estate Fund IV, which held a first and final close in April this year.

While the 131p per share offer for the company, recommended by Quintain’s board this week, reflects a 22.4% premium to the share price and a 7.4% premium to NAV, Lone Star believes there is substantial growth to come for the stripped-back developer – Quintain has been transformed by its new management in the past three years (see box).

Wembley represents just over 80% of Quintain’s portfolio and the opportunity is the central attraction for Lone Star.

Quintain has already delivered 500 homes at the park and is under way with a further 1,200 to be built by 2019, in a joint venture with Keystone.

Early sales indications are strong, but these have not yet been realised in Quintain’s accounts.

By giving the company substantial firepower – and ratcheting up its LTV from its present 32% – Lone Star plans to accelerate development at the park. Quintain had been tackling Wembley gradually as it sought to shore up its balance sheet after being pushed to the brink by the global financial crisis.

To date, Lone Star’s exposure to hard asset development, particularly in London, has been limited. It controls the Two Fifty One residential tower in Elephant and Castle, SE1, and it is backing a large residential development site in Corby, Northamptonshire.

Instead, its 38-strong European team has been predominantly focused on non-performing real estate loan portfolios, which typically include regional assets.

Last year it was the second largest buyer of European NPLs, investing more than €16bn (£11.2bn) in 10 transactions.

But the recent reduction in the number of non-performing loan portfolios on the market – and the increasing competition for them – has prompted the group to pursue alternative opportunistic strategies.

What next for Quintain?

Chief executive Max James joined Quintain in June 2012, at a time when the company’s gearing was at 87%. His three priorities on joining were to dispose, de-lever and deliver.

Pushing ahead with the company’s pipeline of development opportunities was impossible without a more disciplined balance sheet and James accelerated a sale of the company’s non-core assets.

The sale of almost everything bar Wembley has clearly paid off, attracting Lone Star’s affections and resulting in a premium bid which “crystallises value for shareholders at an early stage”, according to James.

Lone Star says it plans to stick with Quintain’s management if its bid proves successful, but the company will be held in a separate entity within Lone Star’s acquiring funds meaning they will not be used on other projects.

At Wembley, around 10% of the homes to be built are due to be retained for private rental, which could give Lone Star the start of a scalable PRS platform in the UK.

Other parts of the scheme – such as the completed designer outlet – would be highly sought after by trophy retail investors, while the majority of the residential element will be sold privately.

Unless new projects are taken on it seems unlikely Lone Star will maintain the company’s existing structure and could instead seek piecemeal exits as value is realised from the development pipeline.

Either way, management have voted with their feet and chosen to recommend the 131p/share offer.

Quintain director shareholdings |

||

|---|---|---|

| Shares | Value | |

| Maxwell James | 45,241 | £59,265 |

| William Rucker | 478,725 | £627,129 |

| Nigel Kempner | 1,020,668 | £1.3m |

jack.sidders@estatesgazette.com

• Lone Star agrees £700m Quintain takeover