The Minimum Energy Efficiency Standards are set to bite eventually on commercial property. Ed Glass and Nick Hogg explain why they should be at the forefront of buyers’ and sellers’ minds now

For any investor in commercial property, 1 April 2018 and 1 April 2023 are two significant dates. With regulations for Minimum Energy Efficiency Standards (“MEES”) now in place, there is a risk that from those dates, it will be unlawful to let commercial property that has a “sub-standard” energy performance certificate (“EPC”) rating of F or G. Those dates may still seem quite distant. However, the regulations already have the potential to impact on value and require careful consideration by sellers, buyers and funders at an early stage in any transaction now and moving forward.

The buyer’s perspective

Due diligence on EPCs

The requirement for a seller to provide an EPC to a prospective buyer is now well established. It is perhaps fair to say that for many investors, those certificates and the precise ratings (as well as their underlying preparation) may have received limited consideration. Typically, capital and rental values will reflect the nature of buildings that are acknowledged to be energy-inefficient, and in turn, transacting parties will factor this in to a commercial negotiation.

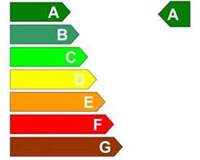

EPC rating

However, from a buyer’s perspective, with statutory restrictions on letting approaching, EPCs now demand closer attention. Those EPCs, depending on ratings, may present opportunities to “price chip” and/or seek concessions from a seller. For example, a buyer might argue for price reductions to account for the cost of capital expenditure required to bring a property up to a “safe” rating. A buyer may also look to negotiate on the basis that capital expenditure is required to improve the rating beyond the current minimum standard because the industry anticipates that the threshold will rise over time. A buyer should therefore look to scrutinise EPCs, and, if necessary, address the position as early as possible in a transaction.

EPC reliability

Where an EPC confirms that a property is “sub-standard”, inevitably a buyer will be concerned. However, even where a property is not currently recorded as sub-standard but as “at risk”, this should also merit further investigation. It is acknowledged that the reliability of existing EPCs may be variable, and a buyer may demand up-to-date EPCs at an early stage in negotiations to confirm the current rating (a step potentially all the more sensible where any existing EPC will expire before 2023). Alternatively, it may seek more information on how the EPC has been prepared (for example, assumptions used by the assessor), and whether it has been updated to reflect changes in the property since publication.

Another aspect to consider is that building regulations have been updated periodically. This could mean that, despite no changes having taken place in the property since publication, a different EPC rating may result. Where a buyer has concern, it may even insist on its own appointed assessor having the opportunity to prepare up-to-date certificates. This could have an impact on transaction timing, and is all the more reason for a buyer to address the position on EPCs as early as possible, particularly where portfolios form the subject of the transaction.

Due diligence on lease terms

The acquisition of commercial tenanted property always involves careful consideration of existing lease terms because of their impact on capital value and income stream. For example, where applicable, an investor might be concerned to note whether it can recover the cost of CRC energy efficiency compliance (see “Don’t get caught out”, EG, 24 May 2014, p86).

To the extent that a property is at risk from MEES, and improvement work is not undertaken by a seller pre-acquisition, a buyer should have due regard to the presence/absence of rights and obligations in a lease. For example, where a “sub-standard” property is currently let, how does/do the existing lease(s) allow a landlord to address the risk of unlawful letting in the future? Are there approaching voids, or landlord rights to undertake (and potentially recoup the cost of) necessary improvement work?

In addition, is there drafting to address the “MEES risk”, particularly in leases that have been granted recently or leases where the term will span the 2018 and 2023 dates? Are there provisions that prohibit a tenant from prejudicing the existing EPC rating (during the term/on reinstatement)? Furthermore, to the extent that a lease permits underletting, MEES has the potential to restrict a tenant’s ability to underlet. Is any rent review clause adequate to protect the landlord’s income with this new consideration?

Potential exemptions

The regulations make a number of exemptions available (see “A guide through the MEES minefield”, EG, 25 April 2015, p76). For example, a property is exempt where a landlord can demonstrate that the cost of recommended improvement measures will not be recovered in energy cost savings over a seven-year period. However, while exemptions apply to cost-effectiveness, none will be granted on the grounds of affordability, so landlords may need to consider significant amounts of capital expenditure.

At acquisition, a buyer may consider the potential availability of such exemptions in the future. However, these exemptions are temporary, will not transfer on sale and need to be reviewed by a landlord every five years. Where improvement work is not undertaken pre-acquisition or there is no opportunity to improve the rating before the regulations “bite”, or where the nature of the building will require continuing application of exemptions, a buyer should consider whether the burden of such compliance should factor into negotiations on value.

Opportunity for profit

As the deadlines approach, it is easy to focus on the risk that MEES may present to buyers in the future. On the other hand, buyers may see opportunity in the purchase of buildings that are poorly-rated. For example, the future leasing cycle may present opportunities to improve energy efficiency or consider MEES in lease negotiation or renegotiation, and in turn, potentially enhance capital and

rental values.

Furthermore, in the context of cost-effectiveness, both buyers and sellers should consider the merits of improvements beyond the minimum threshold. Despite additional capital cost, there are potential benefits of reduced operational costs from improved energy efficiency. There would also be less disruption and associated costs of works than if additional works were later required due to rises in the minimum standard.

Funding

In terms of the provision of new funding on purchase, lenders will understandably be cautious about the extent that MEES might impact on the purchaser’s income stream (for example, the extent of capital expenditure required to bring properties up to appropriate standards and the value of the security should it need to enforce). The pricing of improvement works may become more binary in time and be factored into lending. However, there could be greater complexity attached to such considerations when valuing portfolios. As such, at an early stage in the acquisition process, buyers should also consider how the purchase of MEES-impacted property may influence the availability of finance.

The seller’s perspective

With MEES now in buyers’ thinking, sellers preparing to dispose of property should ensure they are fully prepared to minimise the risk to value. A seller may be well advised to ask the following questions:

- What are current EPC ratings on the assets being sold? Are the EPCs accurate? Is it sensible to commission up-to-date EPCs now?

- If required, can a seller “de-risk” now (eg, using voids or approaching existing tenants, as the likely beneficiaries of energy cost savings that may result from improvements, to undertake work)?

- Where a lease is subject to renewal or a new lease is under negotiation, how should a landlord look to preserve value with suitable drafting?

Transaction timelines may not enable a seller to take practical steps to address the risk that MEES may impact on negotiation. However, a seller prepared for MEES-related due diligence and negotiation will be better placed than one that sees MEES as a “buyer concern”.

Prepare now

With statutory restrictions on letting on the way, MEES present a new sphere of due diligence that buyers would be unwise to ignore on acquisition. On another level, a landlord without an immediate intention to sell should consider how it may need to prepare for the 2018/2023 dates and how the regulations may impact on the leasing cycle moving forward.

Landlords should consider energy “audits” and implementing “MEES strategies” now, well ahead of the key dates, anticipating and, as appropriate, addressing the impact that MEES may have. Otherwise, they may miss out on upcoming opportunities both to prevent the risk of unlawful letting and to preserve value on any future disposal.

All about MEES

Regulations for MEES are now in place that in the future will make it unlawful to let non-domestic property with a “sub-standard” EPC rating of F or G (unless one of a number of exemptions applies). Lettings of six months or less, or 99 years or more, fall outside the scope of the regulations. The regulations will apply to a property that requires an EPC under the existing regulations or one where an EPC already exists.

- From 1 April 2018, the prohibition will apply on the grant of new leases and, where an existing EPC is already in place, lease renewals/extensions.

- From 1 April 2023, the prohibition will apply to all leased buildings.

To the extent that a landlord considers that an exemption applies, the burden will lie with the landlord to record that exemption on a public register and, if challenged, demonstrate compliance. Failure to comply will risk financial penalties based on rateable value and the length of non-compliance, together with “naming and shaming” on a public register.

MEES acquisition checklist

Some possible questions for a buyer to consider pre-acquisition:

- Does the property need or have an existing EPC?

- What is the rating? Does it reflect the current state of the property?

- Where the certificate has a borderline rating, is it reliable? How and when was the EPC prepared?

- Where properties are at risk, how are existing leases drafted? Are voids approaching to enable improvement work? Are exemptions potentially available?

- Is there an impact on the availability of finance?

Ed Glass is a solicitor at Bristows LLP and Nick Hogg is a consultant on sustainability and commercial property