As the 2015 AGM season draws to a close, is there any evidence that shareholders are still frustrated by the level of boardroom pay?

In 2012, a minor revolution swept the City as shareholders took a stand against executive pay. The shareholder spring, as it was dubbed, contributed to the downfall of a string of high-profile executives. But is there any evidence that shareholders disapprove of the increasingly rich rewards being reaped by the bosses of listed propcos as the market booms and long-term incentives begin to kick in?

Prior to the shareholder spring in 2012, shareholder advisory group Pirc estimated that the average vote against a remuneration report in the FTSE all-share index was around 6%.

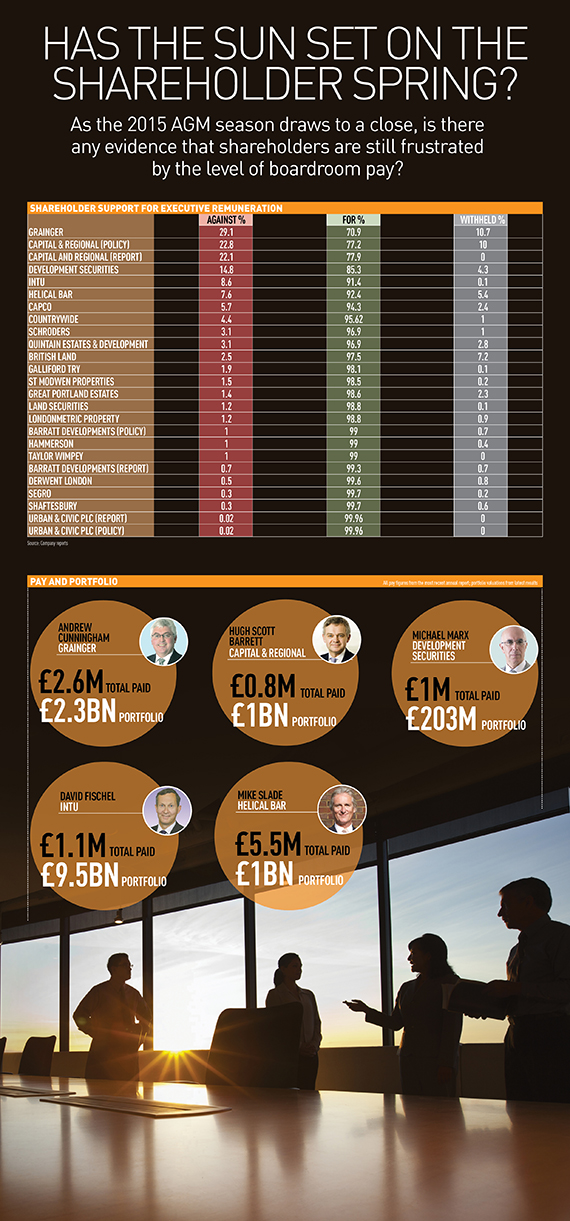

EG’s analysis of the shareholder votes on property company remuneration reports and policies this year found that on average 5.4% of shareholders voted against rewards, suggesting that the shareholder uprising has been short-lived. However, five listed propcos posted significantly above-average no votes from shareholders.

Grainger and Capital & Regional this year saw more than 20% of their shareholders vote against remuneration reports.

However, this does not necessarily mean that shareholders believe their executives are overpaid. Many institutional investors take their cues on how to vote from the recommendations of proxy research firms.

In Grainger’s case, some proxy firms recommended voters reject the report on the ground that it did not disclose enough information about bonus targets.

A Grainger spokesman said: “Grainger takes the views of its shareholders very seriously. After seeking their feedback following the AGM, we now understand that the level of remuneration was not the main concern but rather the level of disclosure in our annual report, particularly relating to bonus targets, and something we will certainly be addressing in the next report.”

For Capital & Regional, the proxy firms recommended a no vote on the ground that management was being solely judged by total shareholder returns.

A source said the company’s remuneration committee considered this appropriate, having consulted with a number of its largest shareholders and given the company’s recent restructuring and major de-gearing, which had affected its performance relative to its peers.