If the number of commercial mortgage-backed securities issues of late from BNP Paribas, JP Morgan, Deutsche Bank, Goldman Sachs and others are any indication, confidence in the securitised bond – which took a hit having been blamed in part for the failure of the real estate market in 2008 – could be said to be returning.

A fully functioning CMBS market, as operates in the US, can be a crucial cog in a healthy real estate cycle – which at present does not exist in Europe.

But recent issues from Goldman Sachs, Royal Bank of Scotland and Deutsche Bank have not all been greeted with enthusiasm.

RBS’s Antares and Goldman Sachs’ REITALY were pulled at the last moment in April and June this year, and the recent double issue of Goldman Sachs’ Logistics UK and Deutsche’s Charlemagne DECO deal were met with a mixed response, with both issuers pushing their prices further out to ensure the deals were successful.

But Clive Bull, director in Deutsche Bank’s real estate finance team, does not believe this is due to a lack of appetite among investors.

He says: “All asset-backed securities markets were hit by the Greek crisis and CMBSs are no exception. I don’t see the market being generally ‘unaccepting’ of CMBS at all.”

In Bull’s opinion, the pricing of bonds became more unpredictable and difficult to manage following the Greek crisis and ahead of the summer lull in August.

As a result, pricing of AAA tranches in the Deutsche and Goldman Sachs deals were pushed out from an expected 100bps over Libor to 140bps over in both cases. This meant in the case of Deutsche a reduction in its profits and for Goldman Sachs a significant squeeze on the bottom line of the deal.

Perhaps perversely, Goldman’s logistics deal was also a victim of the high quality of the underlying assets, and the fact that it was issued in sterling.

“Compared with the pre-credit crunch market, there have been relatively few new CMBS deals with UK or German loans, but a relatively large number of Italian deals and deals from Ireland, Spain and the Netherlands,” says Conor Downey, partner at law firm Paul Hastings.

“Due to this and the requirements of investors, CMBS pricing is not always as aggressive as syndicated loan pricing in every market, and particularly in core markets for prime assets,” he adds.

But while this may explain the weak reception of these most recent CMBSs, it does not adequately explain the pulling of REITALY and Antares earlier in the year.

In these cases, initial failure has been put down to investors in CMBS being more discerning following the crash of 2008.

This has meant that assets which fail to match a combination of asset quality, pricing and risk have failed to attract the new wave of CMBS investors.

As Peter Hansell, head of real estate debt at Cairn Capital, says, “One of the big positives from the market shake-out is that the people who are now investing in CMBS are more experienced and perhaps more aware of the issues they need to address.”

But Bull expects that Antares and some other deals expected before the summer lull may come back to market in September and October with new pricing and possibly new structures.

Peter Cosmetatos, chief executive at the Commercial Real Estate Finance Council Europe, also believes the lack of investors in Europe is not helping. “The investor market remains quite thin, and building it up requires more issuance, which in turn needs more investors,” he says.

Whatever the reason for recent choppy markets, issuers in the CMBS sector are determined to make it grow. To be successful, it appears they simply have to work on their risk pricing to get deals away.

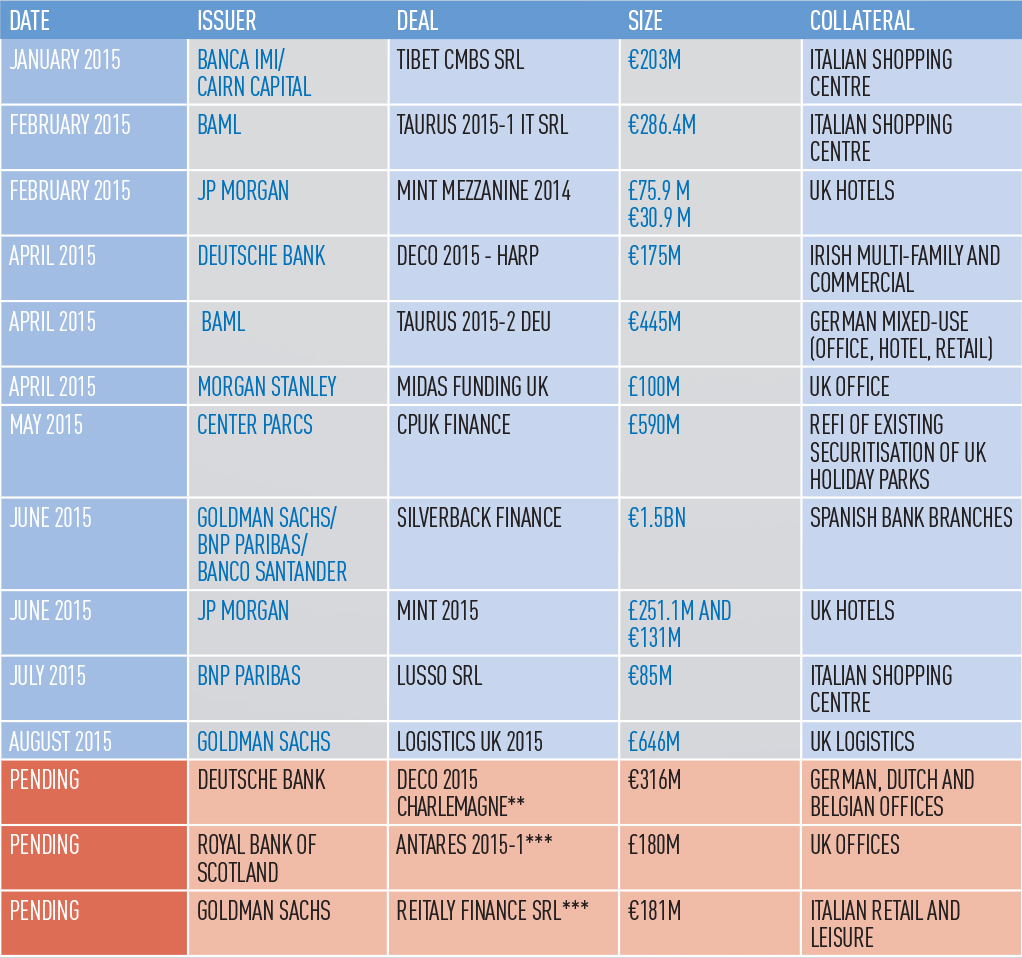

POST-CREDIT CRUNCH CMBS ISSUES*

* This excludes “re-remics (repackaging of legacy CMBS to improve ratings) and retained CMBS originated to ECB repo purposes. ** This deal is currently being marketed and has not yet closed. *** This deal has been pulled and it is not clear if or when it will be relaunched. Source: Paul Hastings