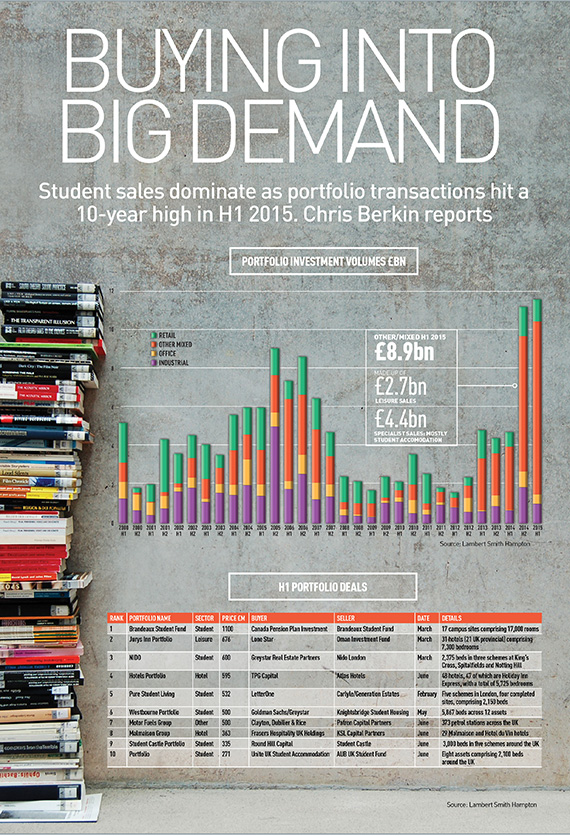

Student sales dominate as portfolio transactions hit a 10-year high in H1 2015. Chris Berkin reports

Portfolio transactions have hit their highest half-year level in a decade, with £11.5bn traded in the first half of the year.

That compares with £11.1bn in H2 2014, and a 10-year average of £4.8bn, according to figures from Lambert Smith Hampton.

However, these figures mask deep variations in performance, with the leisure and specialist markets – made up mostly of student accommodation – accounting for £7.1bn of transactions.

Strip that out and only £4.4bn of office, retail, industrial and mixed-use transactions remain – a £400m underperformance on the 10-year average.

The surge is driven by a perfect storm of student demand. Opportunistic private equity investors are calling the market and trading out of formerly distressed assets as long-term investors seek exposure in the sector after fears about the 2012 introduction of tuition fees proved unfounded.

Factors fuelling the build-up of the huge portfolios are the management-intensive nature of the sector and the high costs of organic expansion, both of which mean significant economies of scale for the package buyer.

Meanwhile, institutions and funds seeking large long-term investments were galvanised by the 2013 collapse of Opal and its subsequent sale, which gave them a first exercise in processing due diligence and compliance in the sector.

Unite managing director Richard Simpson points out that a combination of factors means that as much as 25% of the student asset base could be traded this year. “For the institutions to have any impact on total return the investment has to be of scale to justify the drain on human resources,” he says. “The catalyst was the break up of Opal – for a lot of private equity and pension funds that was the pilot project. It opened the floodgate.”

For now, the momentum is firmly in the student sector’s favour, but the good news for core vendors is that the market is not likely to stay so skewed for long. As the student market matures and low-hanging fruit are snapped up, short-term owners will sell out to long-term money and return to the mixed-use arena.