Illustration: Gary Barker

Long leases to high-quality tenants equals lower cap rates and higher values. The longer the weighted average lease length, the lower the cap rate, the higher the value. There is a little more to it than that, of course, but generally speaking, the relationship between lease length and value is an axiom in the industry.

The bond maths is appropriate for an asset class prized for its predictable dividend income. The equation works for office buildings and industrial assets, where you can underwrite the covenant of the business you lease space to.

In other parts of the real estate world, the relationship between lease length, credit and yield is less useful.

In PRS, the simple bond maths starts to break down. Lease lengths are just one year and with an individual, not a business. That often means the short-term potential for market rent growth has a big impact on today’s yield, not the lease length or credit quality. Will renters a year from now be willing to pay more or less?

When it comes to arguing about what the next year or decade will look like, there is a fundamental difference in the analysis of these two groups. With offices and industrial assets the question is: what are businesses going to do? With residential the question is: what are consumers going to do?

This brings us to retail, which is in many ways the most difficult type of asset to value, because both those questions need to be answered. What are consumers going to do? And what are businesses going to do as a result?

When valuing retail, is it about long leases to good covenants? Or is it more about the consumer and service offered?

The answer is, a mix of both. Long leases to bulletproof covenants are great, but to focus on that alone is to ignore the question: what are consumers going to do?

Here’s how we at Appear Here think the value equation works for retail: value is a function of rent, rent is a function of audience and audience is a function of content.

Let me offer some definitions.

● Content: the brands, the products, the story. It needs to be interesting, fresh and give consumers a reason to travel to a place they have been before, or to take time to step into a store and explore.

● Audience: the consumer. The more targeted you can be, the better. Retailers want to know everything, not only how many people will pass by but how old are they, their occupation, purchasing power, habits and dwell time. The better access you can give retailers to their target audience, the more valuable your space becomes.

● Rent: the value of the space. This is the price a tenant is willing to pay to access an audience, which can mean different things to different tenants. Sometimes it is about selling stuff in the store, sometimes there is nothing for sale, as was the case with the Ant-Man store Appear Here helped place for a four-day opening at Old Street station to promote the release of the film.

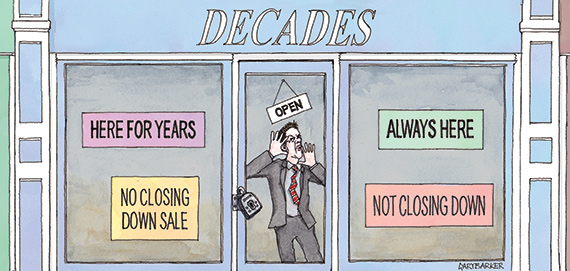

Using this calculation, the best way of adding value is not always about getting a retailer to sign up to longer leases. If we view asset value as a function of rent, rent as a function of audience and audience as a function of content, the maths becomes simple. Get the content wrong and you lose your audience. Lose your audience and the rents will follow.

Peter Lennon oversees landlord partnerships at Appear Here