Thames Valley offices: On paper, the case for London occupiers to consider heading west is compelling. “There is a combination of both push and pull factors at play to facilitate decentralisation,” says Jonathan Manning, director of Thames Valley agency RARE.

Thames Valley offices: On paper, the case for London occupiers to consider heading west is compelling. “There is a combination of both push and pull factors at play to facilitate decentralisation,” says Jonathan Manning, director of Thames Valley agency RARE.

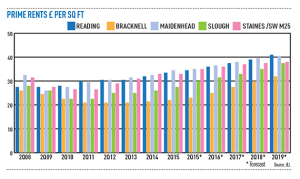

“Total occupancy costs per sq ft in the West End stand at £150 to £170 per sq ft, compared with £50 per sq ft in the Thames Valley. The region is becoming an ever more attractive alternative to the capital.”

That cost differential is set to increase with the arrival of the rates revaluation in 2017. The significant rental growth seen across the capital will have a knock-on effect on business rates.

According to Lambert Smith Hampton, rates liabilities on grade A office buildings are set to increase by in excess of 50% in 16 of the 18 central London submarkets. The agent predicts that occupiers in Tech City and Hammersmith will see a near doubling in rates liabilities, with South Bank and Clerkenwell not far behind.

Nick Coote, regional director at Lambert Smith Hampton, says: “Occupancy costs will rise a further 20% or 30% higher in London compared to the Thames Valley. When you then factor in the impact of infrastructure improvements, there is a compelling reason to relocate.”

Crossrail services will begin to run late in 2019, giving Reading a twice-hourly service direct into the West End and the City.

The region will also benefit from the electrification of the Great Western Railway, smart running of the M4 and Western Rail Access to Heathrow. Although not due for completion until 2021, WRATH will make it possible to travel from Slough to Heathrow Terminal 5 in just six minutes.

Yet, however strong the drivers for decentralisation, there has been little evidence so far of London occupiers relocating to the Thames Valley.

Apart from Maersk Line’s 40,000 sq ft relocation from central London to Maidenhead and Hammerson’s (much smaller) move from Mayfair to Reading, the floodgates are yet to open fully.

Indeed, there are more instances of occupiers abandoning the Thames Valley to find a home within the M25. Earlier this year, for instance, Amazon, based in Slough since 1998, completed the relocation of all its staff to London.

Indeed, there are more instances of occupiers abandoning the Thames Valley to find a home within the M25. Earlier this year, for instance, Amazon, based in Slough since 1998, completed the relocation of all its staff to London.

The Thames Valley office market is yet to see a spike in take-up. “We expected take-up figures to be far better last year than they were. The first half of 2015 has also been disappointing,” says JLL director Angus Currie.

He says: “All occupiers have different reasons for holding back and they don’t seem to have felt under any great pressure to make decisions. Yet we’re doing lots of reviews and analysis and we expect a lot more deals to be done over the next few months.”

Third-quarter figures are set to be boosted by deals such as the speculative letting to Scottish and Southern Energy of 190,000 sq ft at M&G Real Estate’s and Bell Hammer’s No 1 Forbury Place development in Reading. If confirmed the deal will become the Thames Valley’s largest office letting in a decade.

The letting may inspire other developers but the jury is out as to when and if it will be followed by any kind of exodus from central London.

Simon Knight, partner at Montagu Evans, says: “We are getting enquiries from occupiers in the likes of Victoria and Paddington that know they could halve their occupation costs by moving to the Thames Valley and we all feel we’re on the cusp of decentralisation, but then I would have said the same thing a year ago and procrastination still rules.”

Turning relocation feasibility studies into deals is a huge leap. The financial case for moving your office out of London may be robust, but as businesses strive to attract and retain the very best talent, cost is not the only factor at play.

“It can come down to a conflict of affordability versus credibility,” says Coote. “Moving to the Thames Valley might save you money, but are you prepared to upset staff who would prefer to be in London?”

If there is perceived danger that a move west would lead to a significant stand-off with the brightest and best among the workforce, many businesses may choose to stay put and take the hit.

Those occupiers with a young and creative workforce, such as those working in technology and media, may find it particularly hard to win the argument for moving out of the city.

The Thames Valley might appeal to those who prioritise good schools and more affordable family housing, but the younger demographic may not wish to sacrifice their London lifestyle.

Guy Douetil, head of EMEA corporate solutions at Colliers International, says: “The Thames Valley may in the past have done very well at attracting technology businesses, but they tended to choose business parks and out-of-town campuses. The younger generation are demanding a more dynamic environment and the lure of city living generally holds sway.”

He adds: “I’ve got clients who have bought small niche IT companies and part of the package is an insistence they are not forced to move out of London.”

Investors and developers are spending significant sums in the region in the hope that the appeal of London quality space at Thames Valley rents will in the end prove irresistible.

There is a flurry of new office development underway in the area, designed both inside and out to tick as many boxes as possible for the ever-more discerning city occupier.

“If you want to persuade someone to relocate and tackle the concern of staff, you’ve got to offer a great working environment,” says Jon Gardiner, head of South East office agency at Savills.

“The building has to be as good, if not better, than the one they’re in and be surrounded by the type of amenities staff take for granted.”

The quality of Thames Valley stock has certainly moved up a gear as a consequence. Not only is more money and attention being spent on building design, but on the overall occupier experience. From ground floor coffee shops to cycle storage, developers are aware they cannot afford to compromise.

In Reading, the development pipeline is strong. Following the SSE deal, M&G and Bell Hammer may be keen to forge ahead with the second speculative 190,000 sq ft building at Forbury Place.

Meanwhile, Brockton Capital is refurbishing Thames Tower and demolition is underway to clear space for Stanhope’s and Benson Elliot’s £500m mixed-use scheme Station Hill, which could eventually provide 930,000 sq ft of offices.

Significant grade A office schemes are also planned for the likes of Slough, Uxbridge and Staines, as developers attempt to exploit perceived latent demand.

“We all predict that as the right space is delivered, significant relocations out of London will follow,” says RARE’s Manning.

Yet caution will prevail and Manning admits that decentralisation is likely to manifest itself as a trickle rather than a flood.

He says: “Many of those who do come across to the Thames Valley won’t do so entirely. They may have a small West End Jacuzzi office where all the bubbly people sit and press flesh, while they take space in the Thames Valley for back office operations.”

Occupiers are thinking more strategically about how they locate their property portfolio. They want a greater range of options, depending on requirements for different groups of staff.

DTZ’s Jamie Renison says: “Clients are starting to question whether they really need all their staff in central London and as the Thames Valley becomes better connected with considerably cheaper occupation costs, we’ll see a lot more movement.”

Will the first move happen pre-Crossrail? “We’re likely to see a lot more activity in the coming three to four years,” says Renison.

“We’ve recorded more than 700,000 sq ft of central London demand looking at options to move out and I predict there will be a much bigger wave behind that.”

Heading west

Heading west

Reducing its London floorplate by moving staff west has helped developer Hammerson get to grips with its cost base.

In 2013 Hammerson set a target to cut its cost:income ratio from 25% to 21%. It sold its offices portfolio and looked more strategically at property to improve its dividend yield.

“We decided to move our HQ from Mayfair to King’s Cross and took 8,000 sq ft at Reading’s Aquis House to reduce the amount of floorspace we would need in London,” explains Simon Betty, Hammerson’s corporate development director.

Hammerson was already in Reading owing to its long-term ownership of the town’s Oracle shopping centre. It took the opportunity to relocate staff to more modern space at Aquis House and transfer 25 London staff from IT, finance and purchase ledger.

“There was a mixed reaction from staff and we lost some people who didn’t want to leave London,” says Betty. “Yet we’ve achieved a saving of roughly 50% on rent and we feel it was the right thing to do.”

Banking on success

Banking on success

A swarm of investors have been drawn to the Thames Valley in the belief that values will surge in the wake of major relocations.

In November 2014 Clearbell Capital announced the launch of its £100m Chalk portfolio to be invested in South East locations set to benefit from occupier decentralisation. Clearbell has targeted unloved buildings ripe for asset management, including 95,000 sq ft at Atlantic & Pacific House in Reading, Churchill Court in Crawley and One Thames Valley in Bracknell.

“The Thames Valley is changing dramatically and improved transport links will give London occupiers looking to relocate the opportunity to halve their occupancy costs,” says Clearbell’s Duncan Jarvis.

Brockton Capital is also focusing much of its investment activity on well-located Thames Valley assets, such as the 147,000 sq ft Thames Tower block next to Reading station.

“We have acquired around 750,000 sq ft of office space in Hammersmith, Slough, Uxbridge and Reading with an end value of more than £500m,” says partner Tony Edgley.

He adds: “If the central London market is around 225m sq ft and just 5% of occupiers are proactive about decentralisation, then that represents 11.3m sq ft of latent demand, which is roughly the size of the total Reading market. So it doesn’t take much movement to make a big impact.”