It is hard not to feel sympathy for residential development professionals in the likes of Norwich, Ipswich and Peterborough. Irrespective of the merits of those locations and their schemes, the East of England’s regional landscape is utterly dominated by Cambridge.

It is hard not to feel sympathy for residential development professionals in the likes of Norwich, Ipswich and Peterborough. Irrespective of the merits of those locations and their schemes, the East of England’s regional landscape is utterly dominated by Cambridge.

Whether it is house prices (up 10.9% in a year, according to Hometrack), or its private rental market size (28% of households and growing, says Savills), or completed new homes (1,299 in 2013/14, according to the latest data available from the NHBC), activity in Cambridge significantly outshines the rest of the region – and often the rest of the UK.

The city combines a range of factors, any one of which would boost a market, but when operating concurrently turn this area into one of the country’s busiest for development.

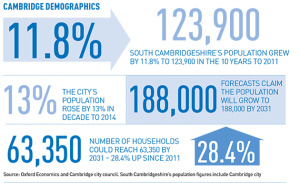

First, its permanent population rose by 13.8% in the decade to 2014, according to Oxford Economics, and is set to rise by almost 30% in the next 15 years (see below).

Second, its transport links are good and improving. For example, some trains take just 48 minutes to reach King’s Cross – home to Google and other tech firms – and a new Fen Line station for regional commuters into Cambridge opens in the north of the city next year.

Third, Cambridge’s private rental market – already strong thanks to some 30,000 students – now attracts large numbers of investment buyers typically favouring new-build purchases. Savills says 30% of its 2014 prime purchasers were investors, but in the new-build market the total was 70%, with over one-fifth of its sales to overseas buyers.

But it is the fourth factor – Cambridge’s transformed employment profile – that has been the biggest catalyst for residential development growth. A mix of science-based businesses and a fiercely entrepreneurial university have created a Cambridge reborn.

Savills has calculated that there are more than 1,500 technology firms based in the East of England, with most on Cambridge science parks and many connected to the Cambridge Bio-Medical Campus. This includes Addenbrookes hospital, where new operating theatres are under construction, plus a new Papworth hospital, which is due to open in 2018. But it does not end there.

Savills has calculated that there are more than 1,500 technology firms based in the East of England, with most on Cambridge science parks and many connected to the Cambridge Bio-Medical Campus. This includes Addenbrookes hospital, where new operating theatres are under construction, plus a new Papworth hospital, which is due to open in 2018. But it does not end there.

“AstraZeneca is moving its headquarters there along with 2,000 employees, which has resulted in great demand and an increase in housing reservations on the southern fringe of the city,” says Alex Cox of Bidwells’ residential development division.

Meanwhile, Cambridge University, with 9,500 employees, also remains a key player in the residential sector with its £1bn North West Cambridge Development project, regarded as a formal extension to the city itself. The university has just appointed Hill Residential and Countrywide to build phase one of the scheme – 404 of what will eventually be 1,500 private homes, plus accommodation for postgraduate students, a hotel and a school.

Yet the university’s historically strong influence means that, aside from this scheme, opportunities for building are relatively scarce. “Colleges own and control much [city centre] development land and building stock,” says Toby Greenbow, Savills’ head of residential in the city. “Unlike other cities where redundant brownfield sites are readily available, the university recycles land for its own need. Supply is unpredictable.”

Therefore, to meet Cambridge’s and South Cambridgeshire’s housing needs – 46,000 new homes by 2031 – planners and developers alike are looking beyond the city to locations with more space and, crucially, lower land prices, which allow more affordable homes to be built.

Eight miles north-west at Northstowe, 9,500 homes are planned in the UK’s largest new settlement for 50 years. In phase one, the first of 1,500 homes are being built by Gallagher Estates, working with the Homes and Communities Agency, alongside an existing guided-busway route linking Huntington, St Ives and Trumpington, and will complete in September 2016. The HCA is aiming to make units here cost less than in the

city of Cambridge.

At Waterbeach, six miles north of Cambridge, regeneration specialist Urban & Civic and landowner RLW Estates are working on plans to deliver 8,500 homes, with a possible planning application for phase one being submitted next year.

Bourn Airfield, eight miles west of Cambridge, is allocated for 3,500 homes, while Cambourne, a new settlement between Cambridge and St Neots, is now the subject of a planning application for 2,350 homes by MCA Developments – despite the site being earmarked for only 1,200 homes in South Cambridgeshire’s draft local plan.

Barratt homes are being built and sold on a new scheme at Trumpington Meadows, while Countryside is delivering a 2,250-unit estate at Great Kneighton (pictured above). “Our developments in the area are now reserving into 2016,” says Andrew Loveday, sales director at Countryside.

And yet even more homes are needed.

“A number of planning applications for residential developments have been made on speculative greenfield sites not allocated in the local plan,” says Bidwells’ Cox.

Three applications turned down by South Cambridgeshire council look set to go to appeal – and pundits predict they will succeed, replicating the decision of an earlier appeal when the inspector deemed the council had failed to identify a five-year supply of development land.

So while Cambridge and its environs have development levels the envy of most locations outside London, there is more to come. Watch this space: it may be built upon soon.

Cambridge student housing

There is a clash of thinking on student housing, according to David Henry of Savills’ Cambridge planning team. “Historic colleges, of course, prefer sites within, or close to, their location as this is the hub of their students’ experience,” he says. “Commercial providers, on the other hand, are more flexible, with the main arterial routes and edge-of-centre locations being favoured.”

In addition to the university’s North West Cambridge scheme, planning permission has been granted for 316 student beds at Cheddars Lane in the city – easily the biggest of six student housing schemes approved in Cambridge in the past 18 months.

Colin Summers, head of student accommodation at Bidwells, says: “Other schemes that could potentially come forward are the former Wests Renault on Newmarket Road, Castle Court and the former Co-op site on Mill Road.”

Rest of the region

South Cambridgeshire and Cambridge developments hog the headlines, but the wider region is also a hotbed of building.

There are major strategic expansions of Norwich, Ipswich, King’s Lynn and Ely, as well as a major housing site on Huntingdonshire’s RAF Wyton. In Peterborough, the Norfolk development firm FW Properties is completing a £4m conversion of a former HMRC block into 33 apartments called Hereward Tower.

North of Thetford there is a 5,000-unit development called KingsFleet, from the Crown Estate and investment management firm Pigeon, which is expected to gain consent this autumn.